Domestic demand growth rate of non-ferrous metals is expected to remain healthy at about 9% for the next two financial years and the domestic demand growth is likely to outpace the expected rate of global demand growth, according to rating agency ICRA. Therefore, the rating agency has maintained a ‘Stable’ outlook on the non-ferrous metal sector.

While metal prices witnessed a marginal recovery at the beginning of the calendar year 2023, the positive momentum was short-lived and the metal prices steadily declined since April 2023. The rating agency further said that prices are expected to remain range-bound for the rest of FY2024.

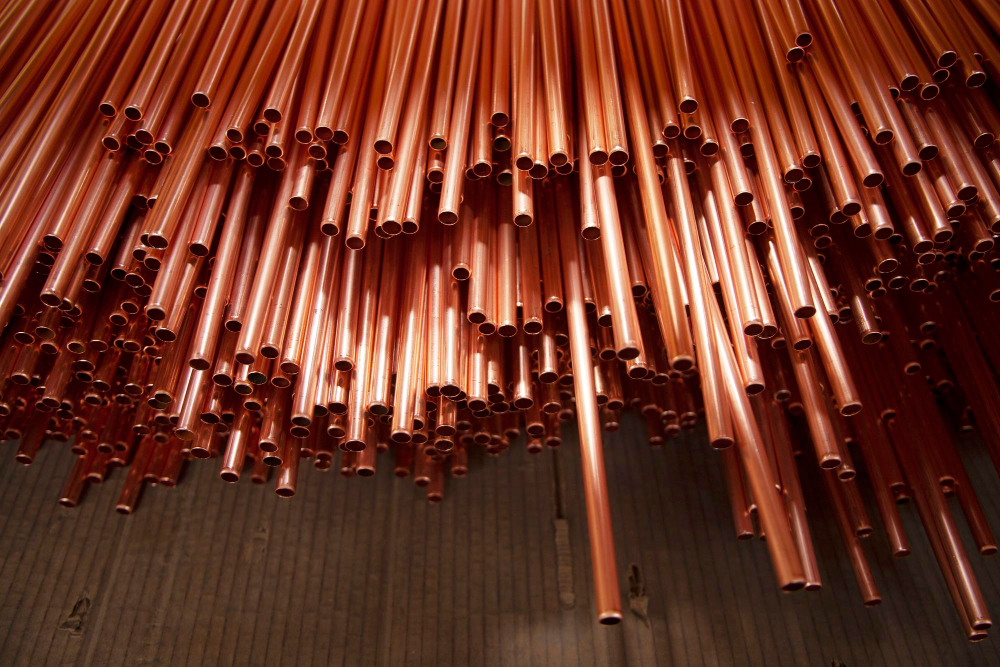

The international prices of three non-ferrous metals – aluminium, copper, and zinc – have declined and have been trading near their two-year lows for the last two quarters, due to global macroeconomic uncertainties, according to ICRA rating agency. ICRA stated that the regional premia across markets continue to be tepid due to negative macroeconomic sentiments.

“Global consumption of non-ferrous metals decelerated during the current calendar year due to sluggish demand conditions, primarily in the developed nations,” said Jayanta Roy, Senior Vice-President and Group Head, Corporate Sector Ratings, ICRA.

Roy added that though there has been a partial demand recovery in China compared to the weak performance in the previous calendar year, uncertainty exists over the strength of China’s recovery.

The rating agency said that there are signs of increase on the supply side, particularly in China, that is expected to result in surplus metal inventories for CY2023 and subsequently, the metal prices are most likely to be subdued in the near term.

Lower input costs to alleviate margin pressure

Metal prices have corrected in the recent past and the earnings of the domestic companies would remain under pressure in H2 FY2024, after a subdued performance estimated in the first half. However, lower input costs is expected to slightly ease the margin pressure.

ICRA noted that the domestic e-auction premia on coal, which is primarily used in power generation for aluminium and zinc manufacturing, have eased in recent months to approximately 58% in July 2023 from the very high levels of more than 300% seen in the same period of the preceding year.

Also, prices of other raw material used in primary aluminium manufacturing like caustic soda and calcined pet coke have declined in the current fiscal. Additionally, the rake availability for transportation of materials is significantly better compared to the previous year, thus supporting the cost structure.

Credit profile

ICRA said that operating profitability of domestic companies are projected at about 17% in FY2024 and FY2025, which is a contraction of almost 150 bps compared to FY2023 level.

Moreover, moderation in earnings, combined with the committed expansion plans of the companies in the sector, are expected to increase the industry’s leverage i.e. total debt/operating profits to 2.5x-3x in FY2024 and FY2025 from 1.8x reported in FY2023, according to ICRA. However, the debt coverage indicators are estimated to remain adequate in the base case scenario, with interest coverage at 5-5.5 times in FY2024 and FY2025 compared to 6.2 times in FY2023.

The rating agency also cautioned that any further weakening in the earnings profile due to worsening global macroeconomic conditions could severely impact the debt protection metrics of the domestic entities.

Stock to watch

Some of the top listed companies in non-ferrous metal industry are Hindustan Zinc, Hindalco Industries, National Aluminium (Nalco), Hindustan Copper, Gravita India, and Tinplate Company.