Syrma SGS Technology, a prominent player in the Electronic System Design & Manufacturing sector, experienced a significant milestone as its stock hit the 20% upper circuit on January 29, 2025. This surge was propelled by the company’s impressive Q3 performance, particularly in the IT and Railways segments, which saw revenue growth of 23% quarter-over-quarter (QoQ) and 37% year-over-year (YoY).

Share Price Movement of Syrma SGS on January 29, 2025:

On January 29, 2025, Syrma SGS’s stock opened at ₹529.50, reflecting a 0.54% decrease from the previous close of ₹540.10. However, buoyed by the strong Q3 results, the stock quickly gained momentum, reaching the 20% upper circuit limit. This surge underscores investor confidence in the company’s growth trajectory and strategic initiatives.

Syrma SGS Q3 Results:

In the quarter ending September 2024, Syrma SGS reported a consolidated net profit of ₹36.24 crore, marking a 27.83% increase from ₹28.35 crore in the same period the previous year. Net sales rose by 17% to ₹832.74 crore, up from ₹711.73 crore in the corresponding quarter of the prior year. The operating profit margin improved to 8.52%, compared to 6.88% in the previous year, indicating enhanced operational efficiency.

Managing Director Jasbir Singh Gujral expressed confidence in achieving the company’s ambitious targets for FY25, projecting a 40-45% revenue growth to approximately ₹4,500 crore and an EBITDA margin of around 7%. He highlighted the company’s strategic focus on high-margin sectors such as healthcare, medtech, exports, design engineering, industrial, and automotive, all of which have shown significant growth.

Shareholding Pattern of Syrma SGS:

As of December 31, 2024, the shareholding pattern of Syrma SGS was as follows:

- Promoters: 46.58%

- Domestic Institutional Investors: 7.44%

- Foreign Institutional Investors: 8.49%

- Other Investors: 37.49%

Notably, promoter holding decreased from 46.89% in March 2024 to 46.58% in December 2024, while domestic institutional investors increased their stake from 5.8% to 7.44% during the same period.

About Syrma SGS Technology:

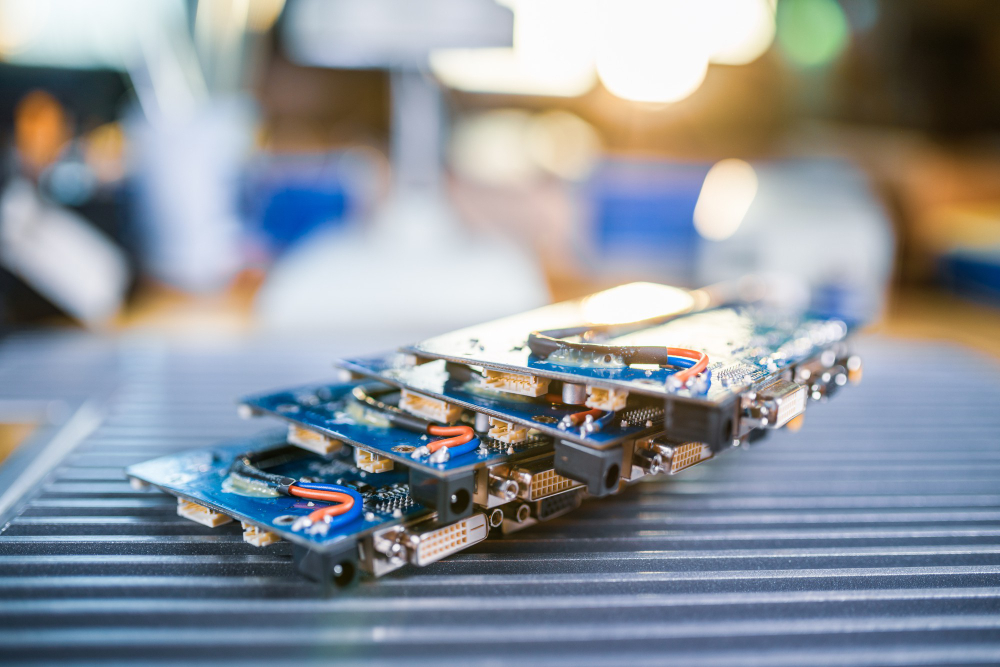

Syrma SGS Technology is a leading electronics manufacturing services (EMS) provider in India, offering a comprehensive range of services including product design, quick prototyping, PCB assembly, box build, repair and rework, and automatic tester development. The company caters to various sectors such as healthcare, industrial, automotive, and IT, with a strategic focus on high-margin businesses and exports. With a robust order book of ₹4,800 crore and a commitment to innovation and quality, Syrma SGS is well-positioned for sustained growth in the dynamic electronics manufacturing landscape.

Disclaimer: The above article is written for educational purposes, and the companies’ data mentioned may change over time. The securities quoted are exemplary and are not recommendatory.