A market order is a very common term used by traders and investors in stock market world often to talk about the type of order they have placed through their demat account via broker like us.

A market order is an order placed by the investor to lock in the equity in an instant manner regardless of the price fluctuations. The order execution speed is important to make that particular stock purchase.

For instance, when you enter a market order to purchase Reliance shares at ₹2,950, the transaction will be executed at the next available price — which could be slightly higher or lower, based on current demand and supply.

In short – A deal executed instantaneously regardless of the price fluctuations.

Major Advantages of Market Orders:

- Instant execution

- No control over price

- Most appropriate for very liquid stocks

- Speed > Precision

Possible Risks:

- Slippage:

- Greatest risk.

- You may not receive the price you saw on screen — particularly in volatile markets.

- Illustration: You enter a market order to buy at ₹100, but because of abrupt movement, it gets executed at ₹105.

- Higher Costs:

- In illiquid stocks, market orders will buy via the order book, filling multiple price levels and incurring higher-than-expected costs.

- This is referred to as “market impact.”

- Bad Fill Prices in Illiquid Assets:

- Thinly traded stocks might have large bid-ask spreads, causing poor execution.

- You could pay much more (or receive much less) than intended.

- Overtrading or Panic Buying/Selling:

- Because they execute instantly, market orders can tempt traders to react emotionally.

- This can amplify losses during sudden market moves.

- Lack of Control:

- You can’t set a maximum buy price or a minimum sell price.

- Market orders take away control and only depend on what is available in the current market.

- Pre-Market or After-Hours Volatility:

- When placed outside normal hours, market orders can be filled at very volatile prices when the markets open.

Advantages of Market order:

Advantage | Why it matters? |

Instant execution | No waiting; your trade goes through fast |

Guaranteed Fill | Useful when you must buy/sell immediately |

Easy to Use | No technical setup like price point |

Good in Liquid Markets | Minimal price difference or slippage |

Efficient in Volatility | Helps avoid missing sharp moves |

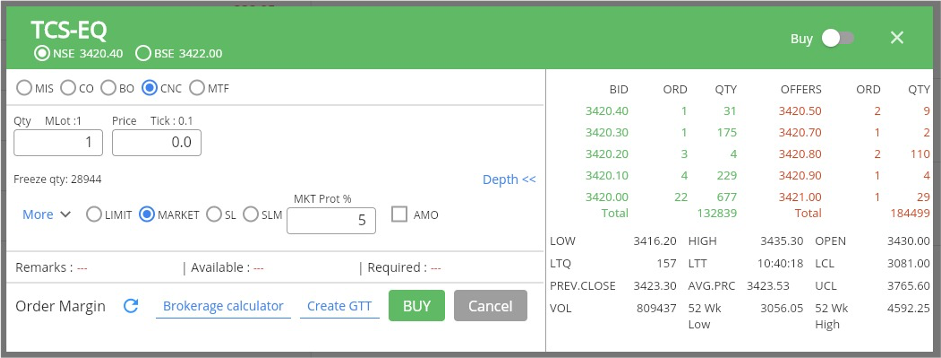

In the below screenshot in our Flattrade app, you can see Market option to choose from list of options such as Limit, SL and SLM. This is the buy screen of market order which shows different prices of this example stock TCS. We can choose any order execution option form below.

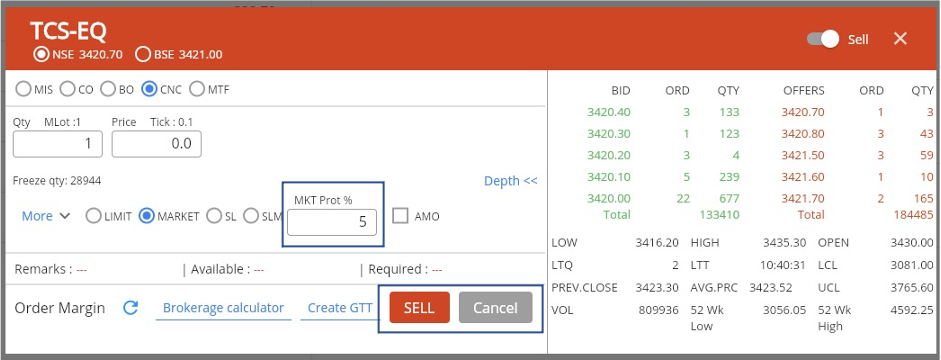

Same as above screen, the below screen is the Selling option screen for Market order option with different prices. You can also see the Market protection option which is the limit range around your market order. If the price moves beyond that band, your order is cancelled or partially filled to protect you from executing at a much worse price.

Market protection option:

With this market protection feature, you can set a percentage limit to safeguard your investment. For example, if you invest ₹1,000 and set a 5% protection level, the system will only allow your order if the stock price stays within that range. So, if the last traded price of ABC stock is ₹100, your order will be placed only if the price is ₹105 or lower. If it goes above ₹105, the order will automatically be cancelled to protect you from overpaying.

To take advantage of these features with zero brokerage, sign up using our link below — and start investing smarter today!