You Might Also Enjoy

a

The month of July was good for the mutual fund industry in India as it saw a net inflow of Rs 1.14 lakh crore in July. Open-ended schemes attracted Rs 1.25 lakh crore of funds, while close-ended schemes saw a net outflow of Rs 11,664.84 crore.

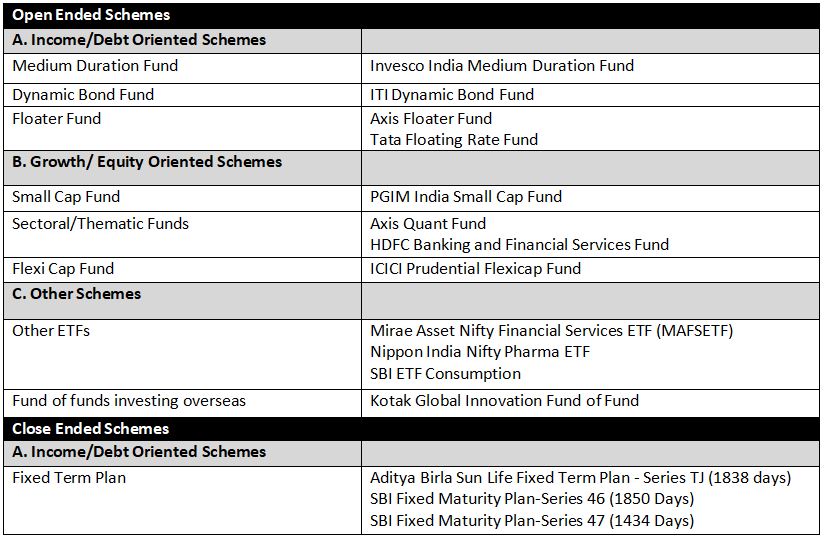

The open-ended and close-ended schemes are further classified into different sub-schemes and they are as follows:

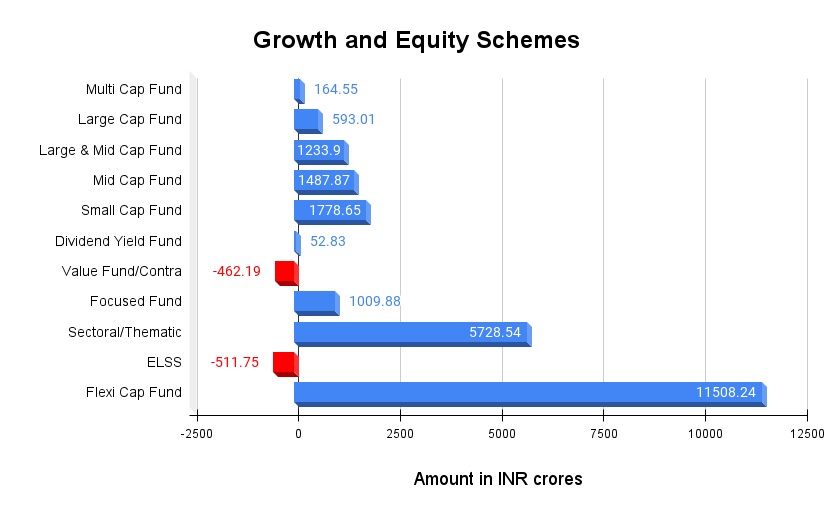

Among the five above-mentioned schemes under the open-ended schemes, income and debt-oriented schemes attracted the maximum net inflow of funds at Rs 73,694.04 crore, followed by growth and equity-oriented schemes at Rs 22,583.52 crore and hybrid schemes at Rs 19841.07 crore. The below graph shows net inflows into different funds under growth and equity schemes.

Solution oriented schemes which included retirement and children fund stood at on Rs 78.26 crore. Other schemes which comprised the index funds, gold ETFs, other ETFs and funds of funds overseas saw a net inflow of Rs 10,084.16 crore. Gold ETFs saw an outflow of Rs 61.49 crore.

Meanwhile, funds under close ended schemes saw a net outflow at Rs 11,664.84 crore. Fixed term plan under the debt-oriented schemes saw the maximum net outflow at Rs 9,779.07 crore. Equity schemes saw Rs 1,840.75 crore flowing out.

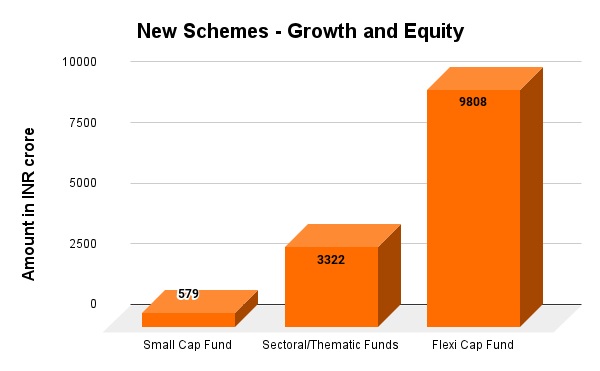

Growth and equity oriented-schemes saw a good net inflow because of the introduction of four new schemes, which added Rs 13,709 crore to the scheme. There were seven new schemes – open and closed-ended – launched in July under income and debt-oriented schemes which mobilised Rs 1,886 crore. Under other schemes Rs 1,737 crore was mobilised through four new schemes.

The below graph shows which funds added the most to equity schemes

New schemes launched by various fund houses in July are shown in the table below

a