ESAF Small Finance Banks plans to raise up to Rs 463 crore through an initial public offering (IPO). The subscription for the IPO will be open from November 3 to November 7, 2023. The price band is fixed at Rs 57- Rs 60 per share and the face value is set at Rs 10 per share.

The IPO consists of fresh issue of shares worth Rs 390.7 crore and offer for sale of equity shares worth Rs 72.3 crore. Employees of the company will get a discount of Rs 5 per shares to the final issue price.

Company Summary

ESAF Small Finance Bank is a financial services company headquartered in Kerala with a focus on unbanked and under-banked customer segments, especially in rural and semi-urban centres. The company’s primary products are advances and deposits

As of June 30, 2023, the lender’s gross advances to customers in rural and semi-urban centres accounted for 62.97% of its gross advances and 71.71% of their banking outlets were located in rural and semi-urban centres.

The company offers micro loans, gold loans, mortgages, personal loans, vehicle loans, micro, small and medium enterprises (MSMEs) loans, agricultural loans, and loans to financial institutions. Deposits include current accounts, savings accounts, term deposits and recurring deposits.

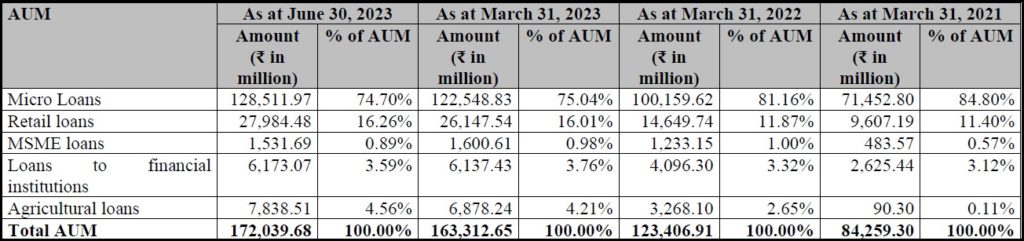

The lender’s AUM grew from Rs 84,259.30 million at the end of March 31,2021, to Rs 163,312.65 million as of March 31, 2021 and 2023, registering a CAGR of 39.22%, and increased to Rs 172,039.68 million as of at June 30, 2023.

The lender’s business is concentrated in South India, particularly in the states of Kerala and Tamil Nadu. As at June 30, 2023, 73.09% of its gross advances are from customers in South India (43.45% from Kerala and 22.14% from Tamil Nadu) and 86.90% of its deposits are from banking outlets in South India (including 80.04% from Kerala and 3.36% from Tamil Nadu).

The bank provides safety deposit lockers, foreign currency exchange, Bharat Bill Payment System, money transfer services and Aadhaar Seva Kendra services. It also distributes third-party life and general insurance policies and Government pension products.

The bank has a network of 700 banking outlets including 59 business correspondent-operated banking outlets, 767 customer service centres, 22 business correspondents, 2,116 banking agents, 525 business facilitators and 559 ATMs spread across 21 states and two union territories, serving 7.15 million customers as of June30, 2023.

Company Strengths

- Deep understanding of the micro loan segment.

- Strong focus on rural and semi-urban banking franchise.

- Track record of growing retail deposits portfolio.

- Best-in-class banking services and customer-centric products for micro loan customers.

- Technology-driven model and digitalised central credit-processing unit for mico loans.

- Experienced board memebers and senior management personnel having expertise in credit evaluation, risk management, treasury and

technology.

Company Financials

| Period Ended | Q1FY24 | FY23 | FY22 | FY21 |

| Total Assets (Rs in crore) | 20,795.94 | 20,223.66 | 17,707.56 | 12,338.65 |

| Revenue (Rs in crore) | 991.78 | 3,141.57 | 2,147.51 | 1,768.42 |

| Net Worth (Rs in crore) | 1,839.09 | 1,709.13 | 1,406.80 | 1,352.06 |

| Net Interest Income (Rs in crore) | 585.45 | 1836.34 | 1147.13 | 921.59 |

| Profit After Tax (Rs in crore) | 129.96 | 302.33 | 54.73 | 105.39 |

| Return on Average Assets | 0.63% | 1.63% | 0.39% | 0.95% |

| Return on Average Equity | 7.33% | 19.36% | 4.12% | 8.85% |

| Retail Deposits to Total Deposit Ratio | 89.28% | 90.85% | 93.17% | 97.74% |

| Provision Coverage Ratio | 74.35% | 56.67% | 59.38% | 52.77% |

| Net NPA Ratio | 0.81% | 1.13% | 3.92% | 3.88% |

Purpose of the IPO

- The net proceeds from fresh issue of shares worth Rs 390.7 crore will be utilised towards augmentation of the bank’s Tier-I capital base to meet the bank’s future capital requirements, for increasing business of the bank, and to ensure compliance with regulatory requirements on capital adequacy prescribed by the RBI.

- The company plans to achieve the benefits of listing the equity shares on the stock exchanges and carry out the Offer for Sale of equity shares. The company will not receive any proceeds from the Offer for Sale and the proceeds totalling Rs 72.3 crore will go to the selling shareholders after deducting the offer expenses.

Company Promoters

Kadambelil Paul Thomas and ESAF Financial Holdings Private Limited are the promoters of the company.

IPO Details

IPO Subscription Date | November 3, 2023 to November 7, 2023 |

Face Value | Rs 10 per share |

Price | Rs 57 – Rs 60 per share |

Lot Size | 250 |

Total Issue Size | Rs 463 crore |

Fresh Issue | Rs 390.7 crore |

Offer for Sale | Rs 72.30 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 250 | Rs 15,000 |

Retail (Maximum) | 13 | 3250 | Rs 1,95,000 |

Small HNI (Minimum) | 14 | 3,500 | Rs 2,10,000 |

Small HNI (Maximum) | 66 | 16,500 | Rs 9,90,000 |

Large HNI (Minimum) | 67 | 16,750 | Rs 10,05,000 |

Allotment Details

Event | Date |

Allotment of Shares | November 10, 2023 |

Initiation of Refunds | November 13, 2023 |

Credit of Shares to Demat Account | November 15, 2023 |

Listing Date | November 16, 2023 |

To check allotment, click here