India’s domestic footwear companies are likely to register muted performance in FY2022 and the recovery to pre-Covid levels is expected by Q2 FY2023, according to rating agency ICRA.

While the industry posted a robust recovery in the second- and third-quarter of FY22, the negative impact of Omicron variant of the coronavirus is likely to slow down recovery of the domestic players.

The Omicron variant is expected to likely weigh on sales and could potentially erase up to 10% of the revenue in the last quarter of FY22 compared to last fiscal year. This would mean the industry will see a revenue growth of 20-25% in the current financial year.

ICRA estimates that the revenue of domestic footwear companies to grow between 8% and 10% in FY2023, thereby, returning to pre-pandemic levels.

Factors affecting operating margin

The operating margins of ICRA’s sample of six entities are expected to remain under pressure in the fourth quarter of FY22 due to localised lockdown and restrictions impacting operating hours and footfalls. This is despite an estimated margin increase of 13.8% in Apr-Dec 2021 period compared with 11.7% rise in the year-ago period.

Generally, raw material costs, rental, employee, selling/promotional expenses are the key cost components of footwear companies, accounting for approximately 30-40% of their total costs. According to ICRA, there has been approximately 14% growth in employee expenses in H1 FY2022 compared with H1 FY2021.

Further, companies having high retail presence will be be more affected as headwinds exist in terms of cost rationalisation. ICRA said that though rental concessions would support margins to an extent, it is to be noted that the extent of concessions was relatively lower in Apr-Dec period of FY22 compared with the previous fiscal, indicating limited room for further reduction in the fixed cost.

In addition, cost of raw materials such as Polyvinyl Chloride(PVC) and Ethylene vinyl acetate (EVA) have increased significantly in the last 12 months. This was offset partially by increasing prices, but it continues to remain high which if sustained would negatively impact profitability of footwear players in FY23.

All the above factors indicates a limited scope for further reducing of fixed expenses.

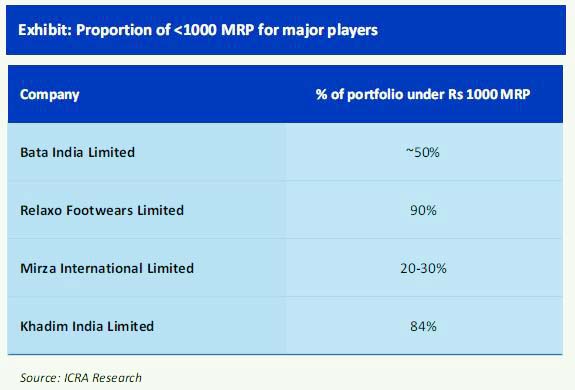

Moreover, about 80% of overall footwear sales takes place in the less than Rs 1000 MRP segment. Therefore, depending on the portfolio mix of footwear retailers, the GST hike could have a negative impact on existing inventory and hence on operating margins in Q4 of the current fiscal.

Favourable conditions

ICRA expects the footwear companys’ financial health is likely to remain robust with strong on-balance sheet liquidity and low financial leverage. The companies are aggressively expanding in Tier 3 towns and rural areas through the franchisee route thus limiting their own capital expenditure costs.

With low leverage and healthy liquidity, the credit metrics is likely to remain comfortable with interest coverage of 7.7 times and Debt/OPBDITA of 1.5 times in FY2023 as against 6.5 times and 1.7 times in FY2022 respectively. The rating agency also believes these metrics would improve further in fiscal year 2023.

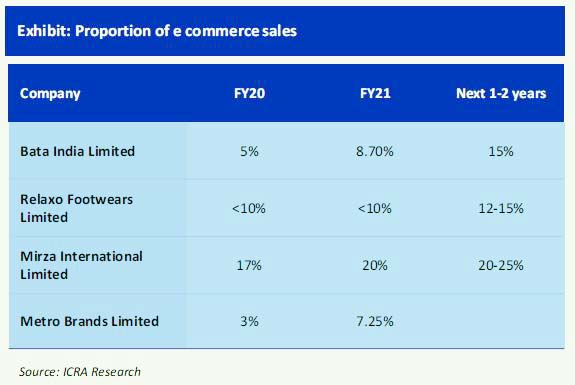

Additionally, the online presence of industry players has also improved and expanded in recent years, with major players reporting significant jump in online sales.

Stocks to watch

We have compiled the big players in the footwear industry as seen below. Investors can look at these stocks for investments.

Stock Name | Market Cap (Cr) | Last Traded Price in INR |

Relaxo Footwears Ltd. | 30,291.80 | 1,813.50 |

Bata India Ltd. | 23,308.50 | 1,216.90 |

Metro Brands Ltd. | 14,770.00 | 544 |

Mirza International Ltd. | 1,813.60 | 232 |

Khadim India Ltd. | 416.8 | 175.2 |

Sreeleathers Ltd. | 405.7 | 167.7 |

Liberty Shoes Ltd. | 232.4 | 150.8 |

Superhouse Ltd. | 184.9 | 136.4 |

Lehar Footwears Ltd. | 49.2 | 36 |

Phoenix International Ltd. | 43.1 | 25.7 |