Fujiyama Power Systems IPO is a bookbuilt issue of ₹828.00 crore. It combines a fresh issue of 2.63 crore shares aggregating to ₹600.00 crore and an offer for sale of 1.00 crore shares aggregating to ₹228.00 crore.

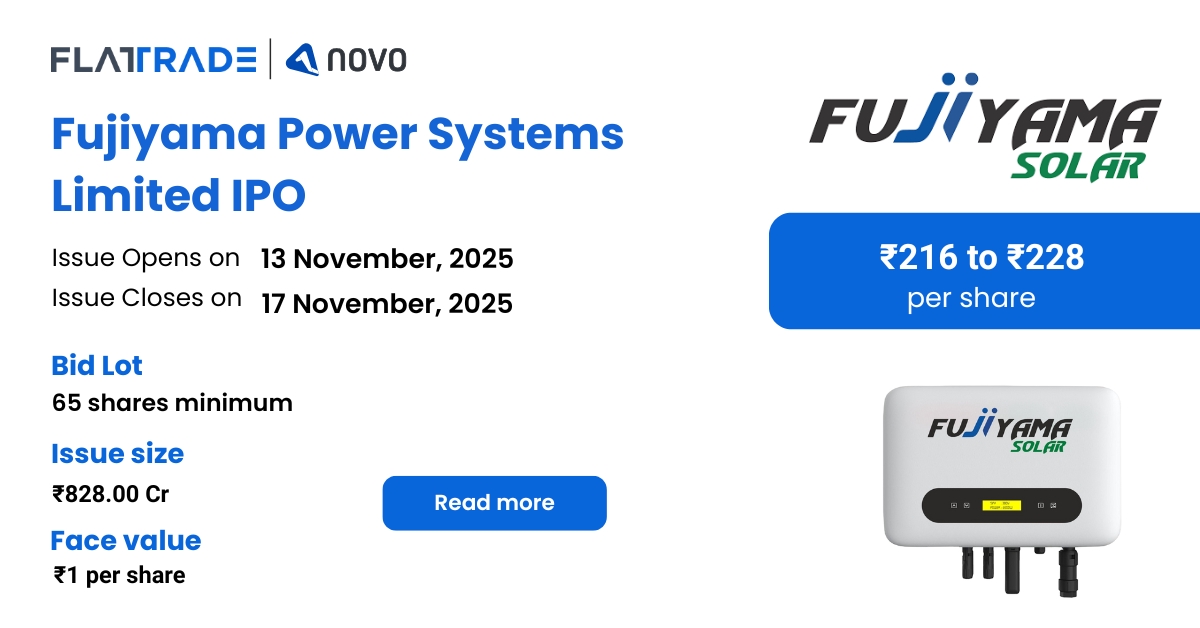

The IPO opens for subscription on November 13, 2025, and closes on November 17, 2025. The allotment is expected to be finalized on Tuesday, November 18, 2025. The price band for the IPO is set at ₹216 to ₹228 per share, and the minimum lot size for an application is 65 shares.

Company Summary

Founded in 2017, Fujiyama Power Systems Limited manufactures products and provides solutions in the rooftop solar industry, including on-grid, off-grid, and hybrid solar systems. The company has designed an extensive product portfolio of over 522 SKUs, including solar inverters, panels, and batteries, to reduce customer reliance on alternative OEMs.

The company serves customers via an extensive distribution network with over 725 distributors, 5,546 dealers, and 1,100 exclusive “Shoppe” franchisees trained to understand customer needs and supply customized solar systems. Additionally, we have over 602+ qualified service engineers providing maintenance and technical support.

The company offers a wide range of products, including solar PCUs, off-grid, on-grid, and hybrid inverters, solar panels, PWM chargers, other battery chargers, lithium-ion and tubular batteries, online and offline UPS systems, solar management units, and charge controllers.

The company has four manufacturing facilities in Greater Noida, Uttar Pradesh, Parwanoo, Himachal Pradesh, Ba2017wal, Haryana, and Dadri, UP.

The company’s production systems are certified under ISO 9001:2015 (Quality Management), ISO 14001:2015 (Environmental Management), and ISO 45001:2018 (Occupational Health and Safety).

The company exports its products to countries such as the USA and several Asian countries, including Bangladesh and the UAE.

Company Strengths

- Quality-centric and precision-driven large-scale manufacturing infrastructure is driving production efficiency.

- Robust distribution network and post-sale service capabilities are driving strong brand recognition.

- Track record of technological development and product innovation.

- Diverse solar products establish the company as a leader in the rooftop solar industry.

- Experienced Promoters and Senior Management, and a committed employee base.

Company Financials

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,243.88 | 1,013.96 | 609.64 | 514.56 |

| Total Income | 597.79 | 1,550.09 | 927.2 | 665.33 |

| Profit After Tax | 67.59 | 156.34 | 45.3 | 24.37 |

| EBITDA | 105.89 | 248.52 | 98.64 | 51.6 |

| Net Worth | 464.34 | 396.82 | 239.54 | 193.08 |

| Reserves and Surplus | 436.33 | 368.81 | 215 | 70.55 |

| Total Borrowing | 432.83 | 346.22 | 200.19 | 211.14 |

| Amount in ₹ Crore | ||||

Objectives of IPO

- Part-financing the cost of establishing the manufacturing facility in Ratlam, Madhya Pradesh, India

- Repayment and/or prepayment of all or a portion of certain outstanding borrowings availed by our Company

- General corporate purposes

Promoters of the company

The promoters of the Company are Pawan Kumar Garg, Yogesh Dua and Sunil Kumar.

IPO Details

| IPO Date | November 13, 2025 to November 17, 2025 |

| Listing Date | November 20, 2025 |

| Face Value | ₹1 per share |

| Price Band | ₹216 to ₹228 per share |

| Lot size | 65 shares |

| Total Issue size | 3,63,15,789 shares (aggregating upto ₹828.00 Cr ) |

| Fresh Issue | 2,63,15,789 shares (aggregating upto ₹600.00 Cr ) |

| Offer for Sale | 1,00,00,000 shares of ₹1 (aggregating upto ₹228.00 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 28,00,95,145 shares |

| Share Holding Post Issue | 30,64,10,934 shares |

Category Reservation Table

| Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

| Only RII | Upto Rs 2 Lakhs | Yes |

| Only sNII | Rs 2 Lakhs to Rs 10 Lakhs | No |

| Only bNII | Rs 10 Lakhs to NII Reservation Portion | No |

| Only employee | Upto Rs 5 Lakhs | Yes |

| Employee + RII/NII | 1. Employee limit: Upto Rs 5 Lakhs (In certain cases, employees are given a discount if the bidding amount is upto Rs 2 Lakhs) 2. If applying as RII: Upto Rs 2 Lakhs 3. If applying as NII: sNII > Rs 2 Lakhs and upto Rs 10 Lakhs, and bNII > Rs 10 lakhs | Yes for Employee and RII/NII |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 65 | ₹14,820.00 |

| Retail (Max) | 13 | 845 | ₹1,92,660.00 |

| S-HNI (Min) | 14 | 910 | ₹2,07,480.00 |

| S-HNI (Max) | 67 | 4,355 | ₹9,92,940.00 |

| B-HNI (Min) | 68 | 4,420 | ₹10,07,760.00 |

Allotment Schedule

| Basis of Allotment | Tue, 18 Nov, 2025 |

| Initiation of Refunds | Wed, 19 Nov, 2025 |

| Credit of Shares to Demat | Wed, 19 Nov, 2025 |

| Tentative Listing Date | Thu, 20 Nov, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on November 17, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Issue |

| Retail Shares Offered | Not less than 35% of the Net Issue |

| NII Shares Offered | Not less than 15% of the Net Issue |

Source – SEBI, Chittorgarh

To check allotment, click here