Glenmark Life Sciences, a subsidiary of Glenmark Pharmaceuticals, is going to launch its initial public offering on 27 July 2021. The initial public offering (IPO) comprises a fresh issue of Rs 1,060 crore and an offer for sale of up to 63 lakh equity shares by promoter Glenmark Pharmaceuticals.

The manufacturer of Active Pharmaceutical Ingredients (APIs) has about 120 APIs in its portfolio, which are supplied to more than 540 pharma companies across the world.

At present, about 50% of it sales are coming from North America, Europe, Latin America and Japan. China is one of its main destinations in sourcing raw materials such as chemicals and intermediates. However, the company said it is actively developing other suppliers.

The company has an aggregate annual total installed capacity of 726.6 kl at the end of fiscal year 2021. It currently operates four multi-purpose manufacturing facilities at Ankleshwar (511 kl) and Dahej (141.9 kl) in Gujarat, and Mohol (49.1 kl) and Kurkumbh (24.6 kl) in Maharashtra.

The company plans to utilise the net Proceeds towards the following purposes:

- Payment of outstanding purchase consideration to the Promoter for the spin-off of the API business from the Promoter into the Company pursuant to the Business Purchase Agreement dated October 9, 2018.

- Funding the capital expenditure requirements

- General corporate purposes

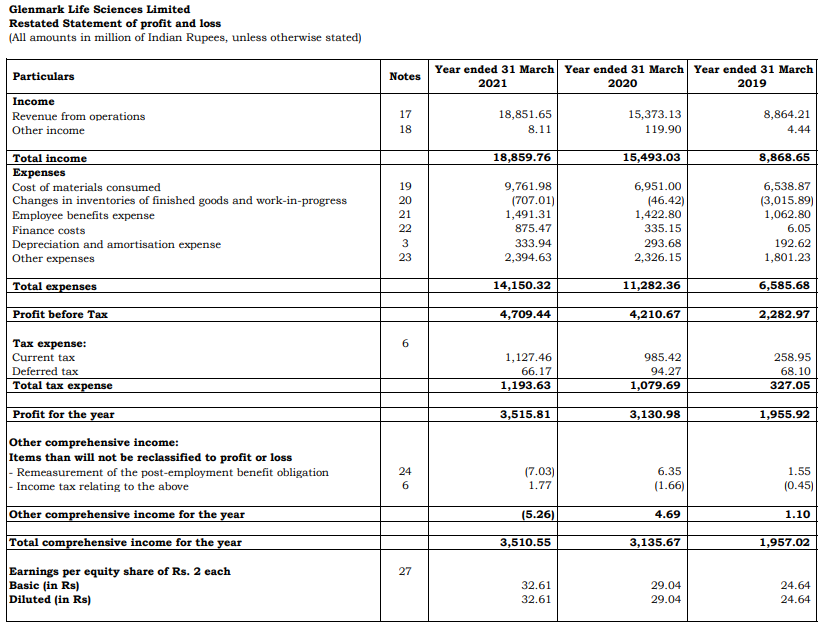

Company's Profit And Loss Summary

The pharmaceutical company’s revenue from operation increased 22.62% to Rs 1885.17 crore in FY21. In FY20, operating revenue rose 73.43% to Rs 1537.31 crore. Profit after tax rose 12.29% to Rs 351.58 crore in FY21. It rose 60.07% to Rs 313.09 crore in FY20. Its earnings per share rose 12.3% and 17.85% in FY21 and FY20, respectively. Below is the profit and loss statement of the company for the last three financial years.

Overview Of Global API Market

The API market around the world is expected to grow at a compounded annual growth rate (CAGR) of 6.2% to $259.3 billion by 2026, from its current size of $181.3 billion. The bulk drug industry in India is also likely to grow at 9.6% between fiscal year 2021 and 2026, after the industry saw a CAGR growth of 9% from 2016 to 2020. This growth potential offers a lot of opportunities for the company in a changing environment of the pharmaceutical industry, with price and regulatory enforcement being two of the most significant drivers of change.

Company Promoters:

Glenmark Pharmaceuticals Limited is the promoter of the company.

IPO Details

IPO Opening Date | July 27, 2021 |

IPO Closing Date | July 29, 2021 |

Issue Type | Book Built Issue IPO |

Face Value | Rs 2 per equity share |

IPO Price | Rs 695 to Rs 720 per equity share |

Market Lot | 20 Shares |

Min Order Quantity | 20 Shares |

Listing Exchanges | NSE,BSE |

Expected Date of Listing | August 6, 2021 |

IPO Lot Size

Glenmark Life Sciences’ IPO market lot size is 20 shares. A retail investor can apply up to 13 lots (260 shares or ₹187,200).

Application | Lots | Shares | Amount (Cut-off) |

Minimum | 1 | 20 | Rs 14,400 |

Maximum | 13 | 260 | Rs 187,200 |