“Intraday trading” sounds exciting. How do you make profits in Intraday trading?

Who doesn’t like making quick money! Aren’t we

Lets first understand what Intraday trading is?

Intraday trading is a trading strategy where a trader buys or sells a particular stock or a basket of stocks and ends the trading transactions the same day before the stock market closes. Here the stocks are not delivered to your demat account in T+2 days ( trade plus 2 days) which is followed in India. It is also called Day-trading among the trading community.

Many think Intraday trading is a gamble, The answer to this is a big “NO” Intraday trading has a scientific approach and it has been proven again and again. There are statistical tools which help in identifying the momentum in right stock and commodities. This is called Technical-analysis. The person who predicts this is called a Technical analyst.

What are the skills needed for a good Intraday trader?

Day traders should select stocks that have

Good liquidity, Highly liquid stocks allow a trader to buy more stocks and also allows the day trader to make any average if need arises. Similarly good liquidity allows the trader to book his profit at a particular price.

High volatility – Volatility is the key factor in day-trading. Volatility moves the stocks either to gain or lose value based on the news and information which is available in the market. The key skill here is to understand the market sentiment towards a particular stock and trade using volatility. Low volatility stocks do not provide any opportunity to trade.

Has a News or Noise in the current market which is trending.

And other external factors which are affecting the stock or the industry directly or indirectly.

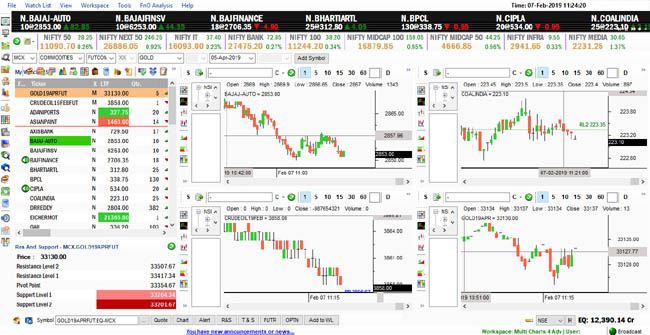

Make a note of the previous performance of the stocks that you have selected. Make sure you are aware of the resistance and support of the stocks that you have selected.

One should also remember the trend of the overall market.

Tools

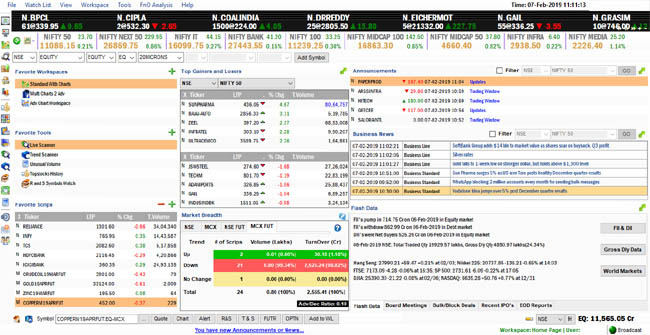

Flattrade Tracker – Flattrade Tracker is one of the Best Live Market Charting Software. This tool provides charting for NSE ( cash segment and F&0), and commodity MCX. It provides 60 Indicators and also provides Support and Resistance Levels of any instrument listed in the mentioned above exchanges. The best part of this tool is you can transact directly from this tool

Another feature to be mentioned about this tool is you can track multiple stocks and commodities under one single window.

Flattrade Tracker does not only provide charting and transaction enabled. You will also get access to the mentioned below data regarding to the stock market all that you need to know before you start trading.

Results Updates

Shareholders Meeting

Press Release

Company Board Meetings

Dividend and Bonus update

Conclusion

Always remember to pick the best stock that you have chosen.

Make sure you do enough homework using the Flattrade Tracker before you buy or short sell a stock or a commodity.

Do not try to trade against the market sentiment, you are no larger than the stock market.

Make sure you fix your target for the day, do not over trade. Greed leads to loss.