India is steadily moving towards greener mobility as the country aims for an emission-free environment and has pledged to achieve net-zero emissions status by 2070. The EV industry has received good government backing over the last few years to increase EV penetration in India. The initiatives taken by the central government and the states to speed the EV transition like promotion of local battery production, and increase in electric vehicle affordability augurs well for the sector, according to rating agency CareEdge Research.

Though Electric Vehicles (EVs) penetration in India is still in its nascent stage, the electric two-wheelers (E2W) segment has witnessed significant growth over the years and currently it comprises about 62% of total EV sales in FY23, according to the rating agency.

E2W sales in FY23 grew by 188% compared to the previous year and the CAGR of E2W during the period FY19 to FY23 stood at 92%, the rating agency noted. This hike in sales can be attributed to the shift in customer preference towards EVs owing to government subsidies and technological developments, lower running costs, low maintenance charges, and growing sensitivity towards the environment, CareEdge Research said.

The sales of low-speed E2W are higher as compared to high-speed E2W. Further, in the electric two-wheeler segment, electric scooters have been a favourite choice for consumers so far, accounting for the majority of sales. Moreover, numerous launches are expected in the high-speed electric motorbike market, especially from the established players in the coming years which will provide impetus to this segment.

Government Push

The E2W sales continued to rise in FY23 due to the shift in customer preference from petrol two-wheelers to electric vehicles owing to government subsidies resulting in competitive prices and technological developments, lower running costs, low maintenance charges, and growing sensitivity towards the environment.

The increase in demand is primarily due to the government’s support through various incentives offered under the FAME-II scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles). Under the FAME-II scheme, the incentives for E2Ws have been increased from Rs. 10,000/kWh to Rs. 15,000/kWh, and the cap on incentives has gone up from 20% to 40%.

In addition, many states are offering additional subsidies & other incentives such as waiving off registration fees and road tax for electric vehicles. However, there was some impact on E2W sales in FY23, due to the withholding of subsidies under FAME-II for not complying with Phased Manufacturing Programme (PMP) guidelines under the scheme.

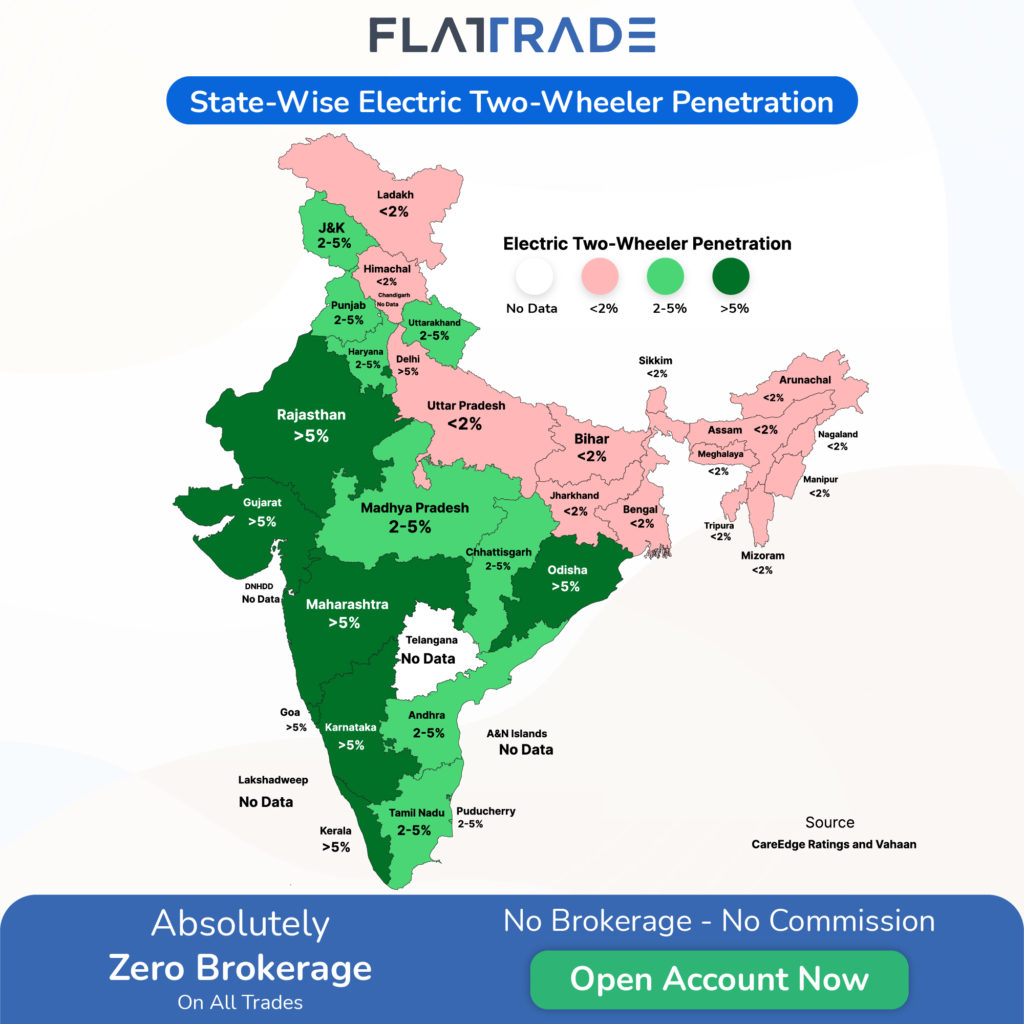

“Favorable state government policies coupled with central schemes have aided increasing penetration of EVs in states like Delhi and Maharashtra. These states are also relatively better placed in terms of the availability of charging stations, though still far behind in terms of the actual requirements,” said Tanvi Shah, Director of CareEdge Advisory & Research.

The rating agency said Delhi, Maharashtra, Haryana, UP, and Punjab have the most holistic EV policies, while Arunachal Pradesh, Manipur, Himachal Pradesh, Ladakh, Kerala, and Uttarakhand have the least comprehensive EV policies.

Few state policies have comprehensive designs which balance E2W sales, manufacturing, and overall ecosystem growth. The increasing number of public charging stations is expected to be driven by a range of players, such as pure-play charge points operators, oil marketing companies, utilities, and EV fleet operators. The public sector oil companies such as IOCL, HPCL, and BPCL also plan to set up EV charging facilities.

The Ministry of Power even revised its guidelines and standards for EV charging infrastructure. The revisions included easing provisions for EV owners to charge at home/office using existing electricity connections, a revenue-sharing model related to land use to make charging stations more economical, guidance on providing affordable tariffs, timelines for connectivity of charging stations to the grid, and a fixed ceiling on service charges for electricity.

EV-Charging Infrastructure

Although sales of these electric vehicles are increasing, there are several issues impacting the growth of EVs. India’s adoption of electric vehicles is hampered by a lack of significant charging infrastructure. The primary challenges faced by electric two-wheeler users in India were poor battery charging infrastructure, limited top speed, unavailability of prompt support network, less range and poor build quality.

Despite significant growth in the number of public charging stations over the last year, India still has a long way to go to achieve its goals. As of January 2023, India had 5,254 public electric vehicle (EV) charging stations, to cater to a total of 20.65 lakh EVs. Till date, the FAME-II program has provided subsidies of Rs. 10 billion to develop almost 2,900 charging stations across 25 states. As of January 2023, Delhi has the maximum number of vehicles per charging stations, followed by Goa and Karnataka. The gaps need to be addressed through better regulation, improved monitoring, mechanisms, and capacity building across the policy value chain.

Meanwhile, Indian Government has also been focusing on Battery Swapping Policy, which would initially give priority to battery swap services for electric scooters, motorcycles, and three-wheeled auto-rickshaws. This is likely to help in increasing the deployment of EVs for last-mile delivery and ride-sharing, the rating agency noted.

Further, EV drivers can use battery swapping to replace discharged batteries with freshly charged ones at swap stations. As battery is the most expensive component in an EV, switching it allows companies to offer it as a service via lease or subscription models which would help in lowering the cost of owning and maintaining the EV, according to CareEdge Research.

Outlook

India’s domestic electric vehicle market will see a 49% compound annual growth rate between 2022 and 2030, with 10 million annual sales by 2030, as per the Economic Survey 2023. As the EV market is growing exponentially in India, vehicle manufacturers are gradually inclined to manufacture more electric-run vehicles, said CareEdge Research. A few major players in the EV market include Hero Electric, Ola Electric, Ather Energy, Tata Motors, Mahindra Electric, Hyundai, and MG Motors. Other key players have also announced plans to produce additional EV models fit for the Indian market in the future, thereby increasing market rivalry and boosting adoption.

CareEdge Research added that adequate investments must be made by the manufacturers and emphasis should be given to the Research and Development (R&D) so that innovative methods of EV manufacture, battery disposal, battery use, and extraction of minerals required for EV batteries should be established to minimise any footprint left by EV adoption on the environment.

Moreover, the proactive measures taken by the Government, as well as the State Government to accelerate EV transition, development of local manufacturing of batteries, and increasing affordability of the vehicles, augur well for the sector which is anticipated to see long-term growth in the future. The report by the rating agency said that the overall outlook for EVs in India is positive, and the country is well on its way towards achieving a sustainable and eco-friendly transportation ecosystem.

Stock To Watch

Some of the listed companies that are heavily investing in green mobility and its ecosystem are as follows: Greaves Cotton, Hero MotoCorp, TVS Motors, Bajaj Auto, Tata Motors, Mahindra & Mahindra, Atul Auto, Olectra Greentech, Ashok Leyland, Eicher Motors, Exide Industries, Amara Raja Batteries, Tata Power, Indian Oil Corporation, BPCL, Reliance Industries, NTPC, Powergrid Corporation, Tata Chemicals, Himadri Speciality Chemical, Gujarat Fluorochemicals, Neogen Chemicals, Motherson Sumi, Graphite India, and Uno Minda.