With India aiming to reach the $5 trillion GDP target sooner or later, India’s economic growth in the coming years will be significantly driven by major investment in key sectors such as infrastructure development and investments in upgrading the physical infrastructure remains crucial for the development of other sectors and growth of overall economic activity.

Consequently, the Indian government has started to focus on building infrastructure of the future through a slew of initiatives. The $ 1.3 trillion national master plan for infrastructure, Gati Shakti, has been pivotal in bringing about a systemic and effective reforms in the sector.

During the Budget 2023-24, the government’s capital investment outlay for infrastructure was increased by 33% to Rs 10 lakh crore (US$ 122 billion), which would be 3.3% of GDP and nearly three times the outlay in FY20. Moreover, the central government is likely to increase its capex allocation by about 25% to a record Rs 12.5 lakh crore to develop infrastructure in FY25 in its interim budget next year. The table below shows the central government’s capex over the last four years,

|

Year |

Capex (Rs lakh crore) |

Growth from Previous Year (%) |

|

2020-21 |

4.1 |

– |

|

2021-22 |

5.9 |

43.9% |

|

2022-23 |

7.3 |

23.7% |

|

2023-24 |

10 |

37% |

The government also intends to spend Rs 2.40 lakh crore (US$ 29 billion) for developing the Railway infrastructure, which is the highest ever outlay and about 9 times the outlay made in 2013-14. Moreover, 100 critical transport infrastructure projects for last mile connectivity have been identified and will be taken up on priority with investment of Rs 75,000 crore (US$ 9 billion), including Rs. 15,000 crore (US$ 1.8 billion) from private sources. This is expected to benefit sectors such as ports, coal, steel, fertilizer, and food grains. The government also plans to improve regional air connectivity by reviving 50 additional airports, heliports, water aerodromes and advance landing grounds.

The Indian government has also decided to continue the 50-year interest free loan to state governments for one more year to spur investment in infrastructure and to subsidise them for complementary policy actions, with a significantly enhanced outlay of Rs 1.3 lakh crore (US$ 16 billion).

Further, Infrastructure Finance Secretariat will be established to boost opportunities for private investment in various infrastructure sectors such as railways, roads, urban development, and power, benefiting all stakeholders involved in promoting greater private investment in these areas.

Higher infrastructure spending

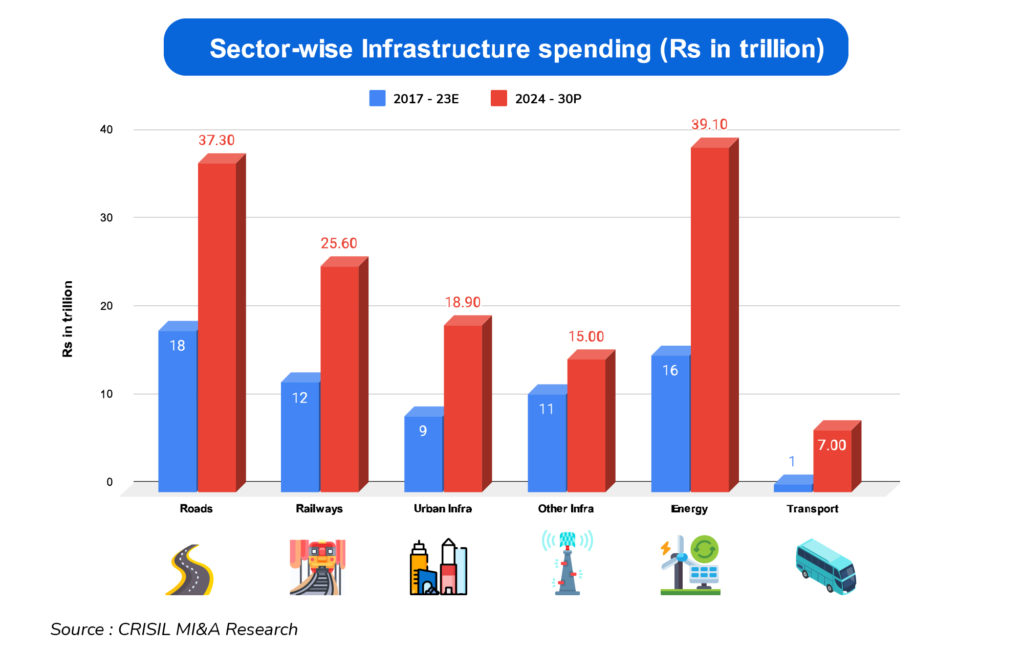

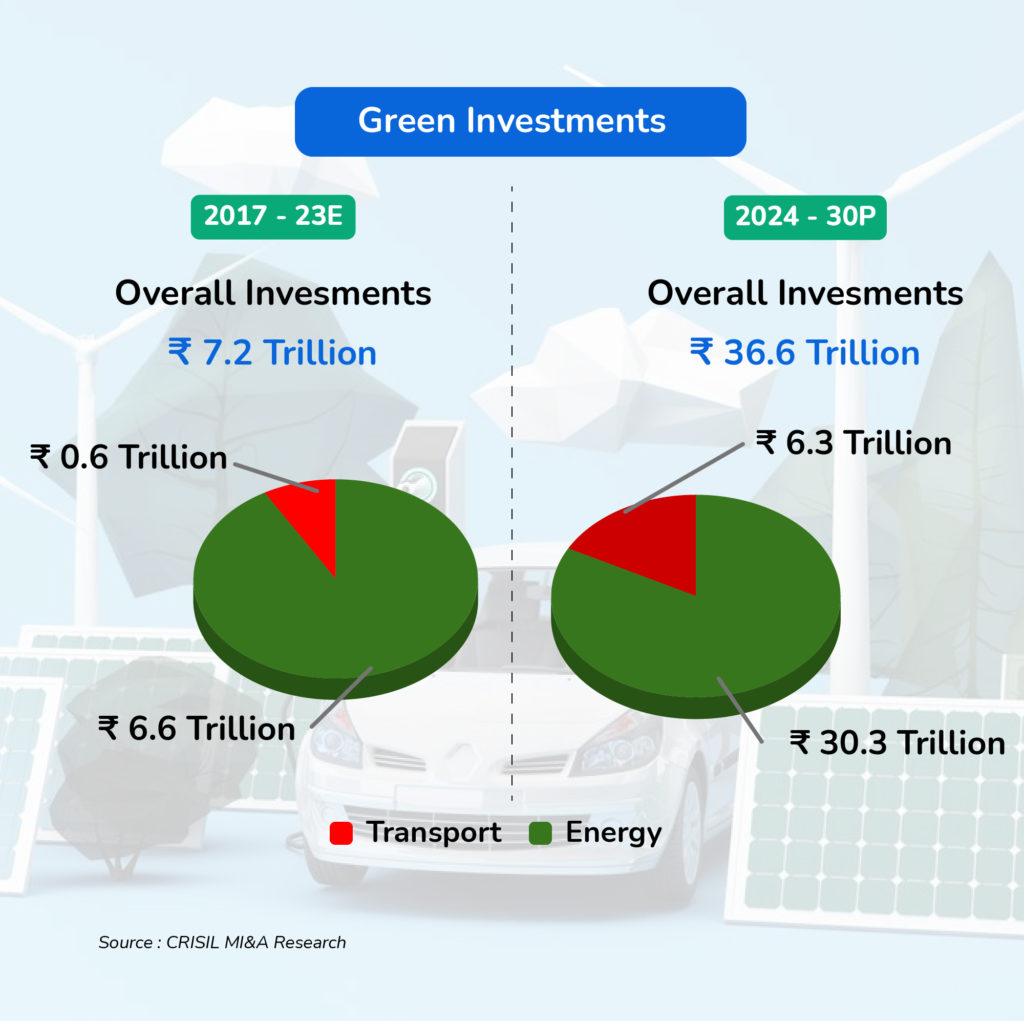

India is likely to spend nearly Rs 143 lakh crore on infrastructure in seven fiscals through 2030, more than twice the amount of about Rs 67 lakh crore spent in the previous seven fiscals between 2017 and 2023, according to rating agency CRISIL. Out of this, Rs 36.6 lakh crore will be green investments, marking a 5x rise compared with fiscals 2017-2023, the rating agency said.

“India’s gross domestic product is expected to grow at an average 6.7% through fiscal 2031 to be the fastest-expanding large economy. Per capita income is seen rising from ~$2,500 now to ~$4,500 by fiscal 2031, creating a middle-income country. This growth will be underpinned by massive all-round infrastructure development, with sharp focus on integrating sustainability,” said Amish Mehta, Managing Director & CEO, CRISIL.

The rating agency stated that the next stage of infrastructure development is expected to witness rise in average project size and a substantial increase in mega-scale projects. Implementing suitable and consistent policy measures along with regulatory interventions, as well as a dedicated emphasis on prompt execution, will create win-win situation for diverse stakeholders and boost investments across various infrastructure sectors.

Sectors that will shape infrastructure development in future

The rating agency said that though important sectors such as roads and power are expected to remain major contributors, electric vehicles (EVs), renewable energy, battery storage, and hydrogen will play a vital role in creating the future of sustainable infrastructure development. The rating agency projects green investments will rise 5x times to Rs 36.6 lakh crore in the next seven years compare to the previous seven year.

The market share of electric vehicles in India’s overall vehicle sales is estimated to reach about 30% by the end of this decade. Electric two-wheeler vehicle sales are expected to surpass vehicle sales in other segments up to 2028, while demand for EV buses will come from state transport undertakings. Moreover, favourable total cost of ownership and acquisition for two- and three-wheelers will push EV demand in coming years.

Renewable energy is projected to expand rapidly over the next decade, according to CRISIL. By 2030, renewable sources are expected to account for four times the share of total energy capacity compared to 2023, the rating agency noted. Solar power will make up about half of the incremental non-fossil generation. Emerging renewable technologies like floating solar panels, offshore wind farms, and green hydrogen will be increasingly important to leverage.

The hydrogen industry in particular is poised for major investments of around Rs 1.5 lakh crore between 2024 and 2030. This growth will be driven by government incentives for green hydrogen production. Such policies will be crucial since green hydrogen currently costs twice as much to make as hydrogen from fossil fuels. Mandates requiring the use of green hydrogen could further spur its adoption and bring down costs through scale, CRISIL said.

Funding India’s infrastructure development

CRISIL noted that the substantial funding needs could be addressed through an upsurge in bond market participation, increased foreign investment enthusiasm, and robust equity markets. CRISIL believes India’s first sovereign green bond issue will open doors for further green bond issues in domestic markets.

The rating agency also said banks and NBFCs are well-positioned to further lend to infrastructure, thanks to healthier balance sheets and greater focus by sector-based NBFCs. Additionally, new asset monetization models can ensure timely funding and returns for current investors.