Revenue growth of Corporate India is expected to decline to 10-12% year-on-year for the fourth quarter (Q4) of FY23 from 22.8% in the same quarter of fiscal 2022 due to continued headwinds to exports impacting volume growth, and high-base effect, according to rating agency CRISIL.

However, on a sequential basis, the revenue is estimated to have grown by 4-6%, boosted by higher domestic demand for consumer staples and discretionary products amid global volatility and also due to the festival season in the country, according to the report by CRISIL. The forecast is based on the analysis of 300 companies that excludes financial services firms and oil & gas companies.

Further, for the entire financial year 2023, revenue is estimated to have grown 19-21%, which is slower than the over 27% growth registered in the preceding fiscal.

According the report, decline in revenue growth was not broad-based, but continued to be driven by commodities and sectors relying heavily on exports. Out of the 47 sectors analysed by the rating agency, revenue in the commodities and export-oriented sectors, such as textiles, gems & jewellery, and information technology-enabled services, declined on a yearly basis.

Steel products, which account for around 11% of the revenue of the sample set, are estimated to have witnessed a 7-9% YoY drop during the fourth quarter, due to the imposition of export duty in May 2022 and weakness in global demand amid elevated input costs. Tepid global demand in the aluminium industry is likely to have pushed the revenue down by 17-19%.

Meanwhile, for cotton yarn and ready-made garments, prevailing weak demand offset benefits from easing cotton prices, while the gems & jewellery industry found it difficult to improve its revenues due to a drop in discretionary spending in the US, the largest consumer of cut and polished diamonds.

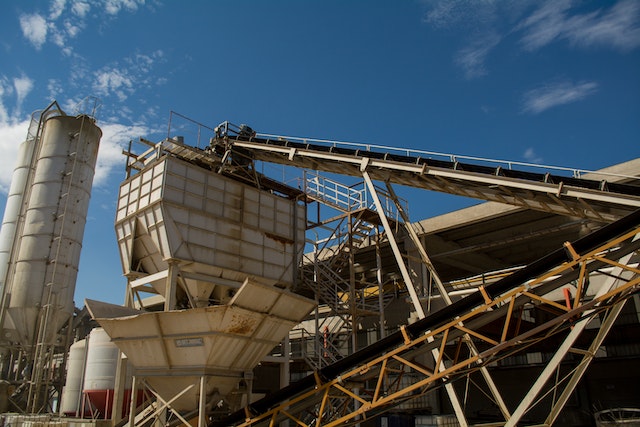

Meanwhile, hotels and airlines saw traction due to rise in leisure tourism and resumption of business travel that led to 98% and 67% revenue growth, respectively. Telcom companies witnessed 13% growth in revenues as the full impact of tariff hikes came into play. Staples such as pharmaceuticals and FMCG outperformed the industry’s growth. Construction-linked sectors such as cement and ceramics grew on the back of a strong construction season, which supported volume growth, coupled with a healthy rise in capital expenditure allocations by the central and state governments, translating into a strong order book for players.

Higher raw material prices weigh on operating margin

The rating agency said that operating margin contracted 150-200 bps during the March 2023 quarter, though revenue increased. While raw material prices are seen to be easing from their multi-quarter highs, they remain high. The pass-on through realisations remains lower than required, thereby weighing on margins.

Sequentially, operating profit margin is estimated to have improved marginally for the second consecutive quarter — from 19% in the December 2022 quarter to 19-20% during the March 2023 quarter. However, operating profit margin has remained subdued since clocking a high of 25% in the first quarter of fiscal 2022, noted CRISIL.

Aluminium producers likely saw a 1.7 to 1.8 percentage points fall in operating margins due to lower realisations, but the fall was cushioned by lower production costs and easing coal supply. Blended realisations, and lower power and fuel costs ensured moderate margins of cement manufacturers on a sequential basis, while it expanded 280 bps year-on-year.

Steel manufacturers are estimated to have seen a 750-800 bps contraction in margins, while automobile manufacturers registered a 45-55 bps improvement in profitability due to lower commodity prices and increased capacity utilisations alongside price hikes.

Sehul Bhatt, Associate Director-Research, CRISIL Market Intelligence and Analytics said, going ahead, a further moderation in input costs will be crucial as players’ ability to improve realisations remains constrained. the rating agency added that corporates are likely to see their profitability improve this fiscal as commodity prices decline and volumes drive revenue growth.