POST MARKET

Indian equity benchmark indices ended higher on January 27, recouping part of the losses from the previous session in a highly volatile trade led by metal, financial, IT, and oil & gas stocks.

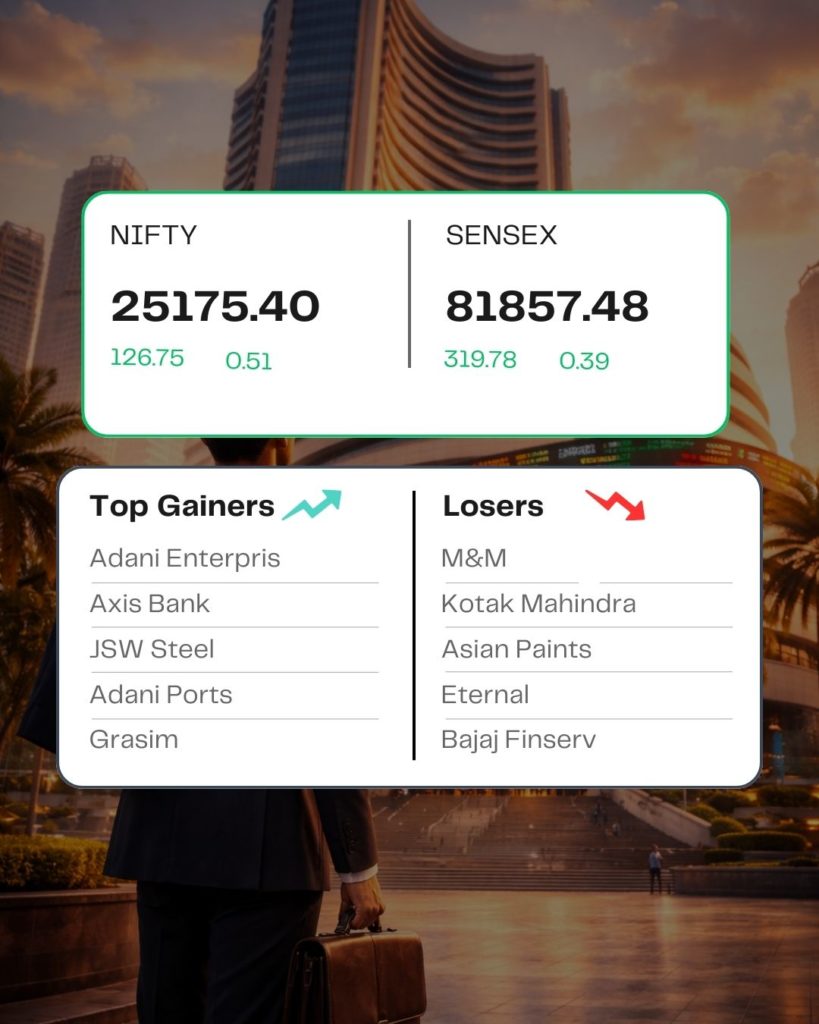

At close, the Sensex was up 319.78 points or 0.39 percent at 81,857.48, and the Nifty was up 126.75 points or 0.51 percent at 25,175.40. About 1901 shares advanced, 2209 shares declined, and 163 shares were unchanged.

The biggest Nifty gainers were Adani Enterprises, Axis Bank, JSW Steel, Adani Ports, Grasim Industries, while losers included M&M, Kotak Mahindra Bank, Asian Paints, Bajaj Finserv, and Eternal.

Except for auto, FMCG, media, and consumer durables, all other sectoral indices ended in the green with metal up 3%.

Among the broader market indices, the Nifty midcap and smallcap indices rose 0.5 percent each.

STOCKS IN NEWS

Apex Frozen

Shares of Indian seafood exporter Apex Frozen rose over 10 percent on Tuesday on optimism around the India-European Union trade deal, which is expected to lower tariffs on marine products over a phased period. According to the agreement, the European Union will cut tariffs on 99.5 percent of goods traded between the two sides over seven years, with duties on Indian marine products set to be reduced to zero.

Urban Company

The shares of Urban Company tumbled down 2.32 percent after the company released its results for the October-December quarter of the ongoing financial year 2026. The company reported a consolidated revenue from operations at Rs 382.68 crore for Q3 FY26, marking a 33 percent YoY rise from Rs 287.92 crore in Q3 FY25. The firm posted a loss of Rs 21.26 crore during the quarter, as against a net profit of Rs 231.84 crore in the same period last year.

DCB Bank

Shares of DCB Bank rose over 9 percent after brokerages turned positive following strong December quarter earnings. This comes after the private sector lender reported a 22 percent rise in net profit at Rs 185 crore for the December 2025 quarter, compared with Rs 151 crore in the year-ago period.

Tata Consumer Products

Tata Consumer Products Ltd (TCPL) shares went up over 3 percent, following the company reporting a 36.3 percent increase in consolidated net profit to Rs 384.52 crore in the third quarter ended December 2025, helped by higher sales at its domestic foods business.

JSW Energy

The shares of JSW Energy dropped almost 7.5 percent after their results for the October-December quarter of the ongoing financial year 2026 failed to meet analysts’ expectations. This came after the company reported a consolidated net profit of Rs 419.94 crore, marking a 150 percent year-on-year (YoY) rise from Rs 167.83 crore net profit reported in the same quarter of the previous financial year.

Source – Moneycontrol