POST MARKET

Indian equity indices ended on a weak note on May 9, amid a pick-up in war activity between India and Pakistan, ignoring positive global cues.

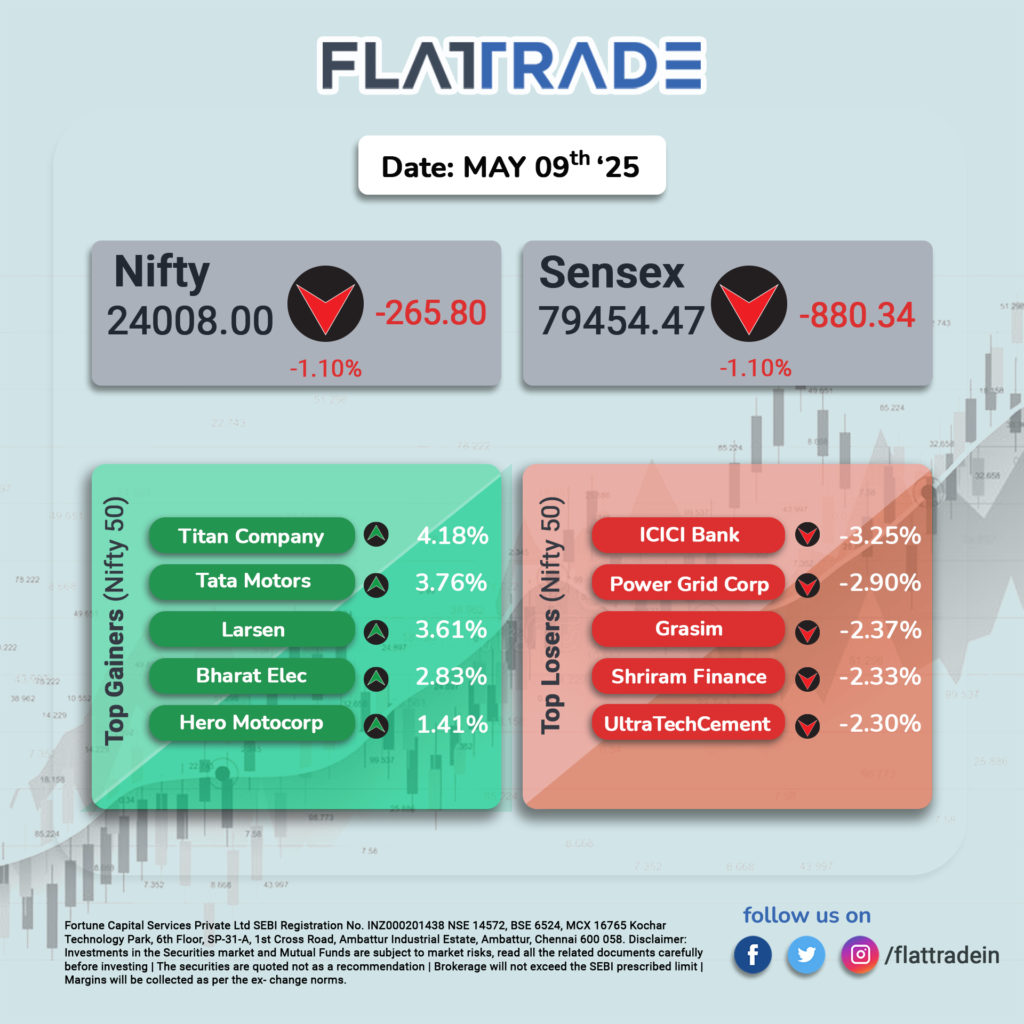

At close, the Sensex was down 880.34 points or 1.10 percent at 79,454.47, and the Nifty was down 265.80 points or 1.10 percent at 24,008.00. About 1336 shares advanced, 2372 shares declined, and 148 shares were unchanged.

ICICI Bank, Power Grid Corp, UltraTech Cement, Shriram Finance, and Grasim Industries were among the major losers on the Nifty, while gainers were Titan Company, Tata Motors, L&T, Bharat Electronics, and Hero MotoCorp.

On the sectoral front, the Realty index shed 2.3 percent, and the private bank index was down 1.3 percent, while the media, consumer durables, capital goods, and PSU Bank indices rose between 0.9 and 1.6 percent.

The broader market indices performed weak with BSE Midcap index ended flat, while smallcap index was down 0.3 percent.

STOCKS TODAY

Bharat Electronics

During today’s trading session, Bharat Electronics experienced a significant increase, with its shares climbing by 2.98% to Rs 316.60. This surge was accompanied by high trading volumes, indicating strong investor interest and active market participation. The stock’s performance reflects a positive shift in market sentiment, driven by robust financial indicators and favorable analysis.

Swiggy

Swiggy shares dropped over 1.5 percent to trade at Rs 310 apiece on May 9. This comes before the food delivery major released its results for the January-March quarter of financial year 2025.The fall in Swiggy’s share price comes as investors anticipate Q4 results similar to its rival Eternal.

Bharat Forge

The manufacturing company’s shares rose by over 4.5 percent to Rs 1,175 per share on May 9, as tensions between India and Pakistan escalated. The company’s Chairman and Managing Director also told CNBC-TV18 that the government has called defence equipment manufacturers to Delhi for discussions. It is noted that other deference stocks have also seen a gain between 4 to 5 percent.

Yes Bank

Shares of Yes Bank surged over 8 percent to hit a three-month high, after The Economic Times reported citing people familiar with the developments that the lender’s board as well that of State Bank of India (SBI) will meet today separately to finalise the sale of stake in Yes Bank to Japan’s Sumitomo Mitsui Banking Corporation (SMBC).

Patanjali Foods

Patanjali Foods shares experienced a decline of 3.09% during today’s trading session, with the price falling to Rs 1745.00. This movement positions Patanjali Foods among the top losers in the NIFTY MIDCAP 150 index. The decline in share price comes amidst neutral investor sentiment

MCX

The Multi Commodity Exchange of India’s shares crashed over 6 percent to trade at Rs 5,635 apiece. Notably, the fall in the share price was further fueled after the company’s Q4 FY25 results, which failed to meet expectations. MCX reported a net profit of Rs 135.46 crore for Q4 FY25, marking a 54 percent rise from the Rs 87.87 crore reported in Q4 FY24. Along with the Q4 results, the company also announced a final dividend of Rs 30 per equity share for FY25.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.