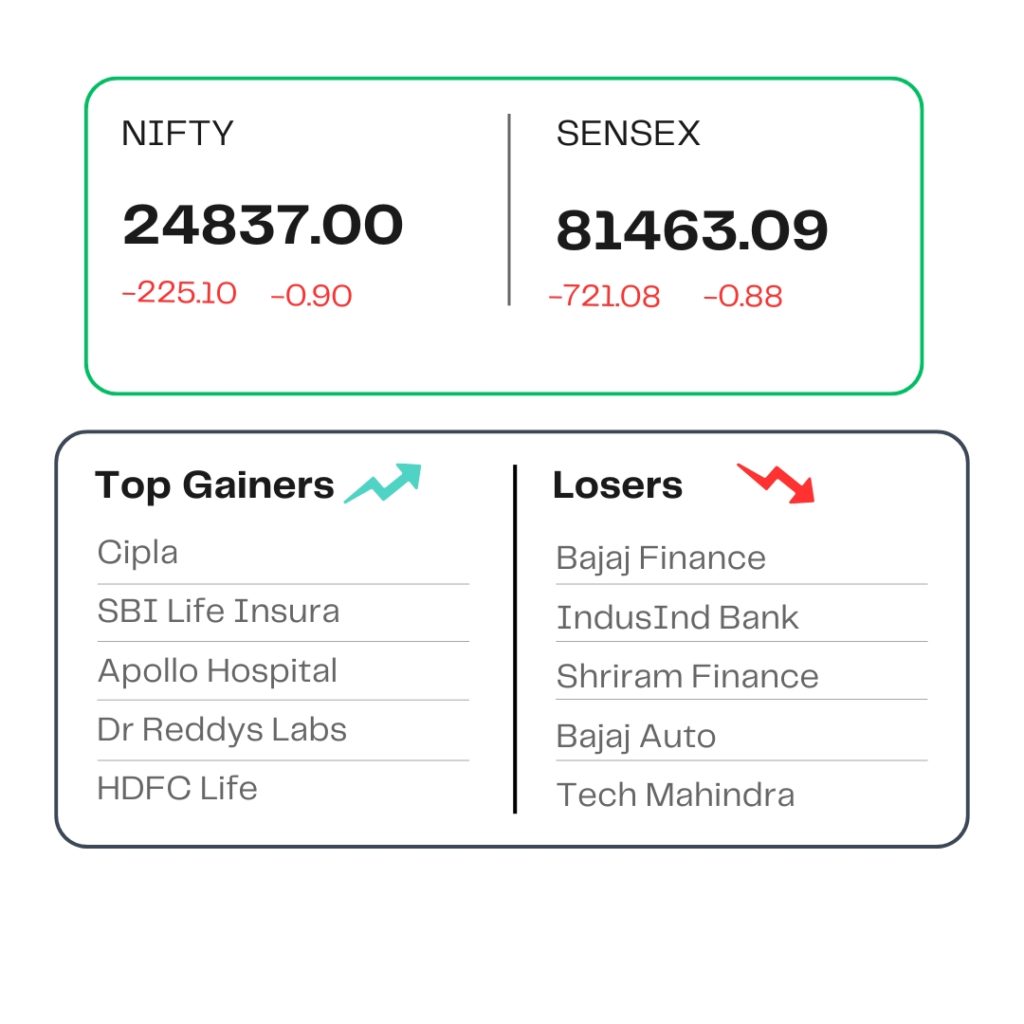

POST MARKET

Indian equity indices extended their decline on Friday, losing nearly a percent amid weak global cues. Benchmark indices remained under pressure from the outset, largely due to disappointing earnings, with the situation worsening as the session progressed.

At close, the Sensex was down 721.08 points or 0.88 percent at 81,463.09, and the Nifty was down 225.10 points or 0.90 percent at 24,837. About 826 shares advanced, and 2,654 shares declined.

Cipla, SBI Life Insurance, Apollo Hospital, Dr Reddy’s Labs, and HDFC Life were among major gainers on the Nifty, while losers included Bajaj Finance, IndusInd Bank, Shriram Finance, Bajaj Auto, and Tech Mahindra.

All sectoral indices, barring pharma and healthcare, sank deep into the red. The Nifty Media index led losses, sinking over 2.5 percent, while the Nifty IT, Metal, Auto, PSU Bank, and Realty indices were over one percent lower each.

The broader market indices are underperforming the benchmark indices, which were also trading in the red after recording sharp losses up to 2 percent.

STOCKS TODAY

Bajaj Finance

Shares tumbled 6 percent in trade on Friday, after India’s leading non-banking financial company reported its earnings for the quarter ended June 30, 2025. JPMorgan downgraded its rating on Bajaj Finance to ‘neutral’ from ‘overweight’ earlier. The brokerage noted that while Bajaj Finance remains a top-tier NBFC, the unexpected MSME stress and weak 2W/3W loans may lead to earnings downgrades.

IEX

Shares took a U-turn to soar over 12 percent on Friday, July 25. Indian Energy Exchange reported a standalone net profit of Rs 113 crore for the first quarter of the financial year 2026, up 21 percent from the Rs 93 crore net profit reported in the corresponding quarter of the previous financial year.

Trident

Shares swung 8 percent to end the session 1 percent lower even as the home textiles and paper products manufacturer posted a sharp jump in quarterly profit, brushing aside a slight dip in revenue. The company’s net profit surged 89.7 percent year-on-year to Rs 140 crore in the April–June quarter. Experts say the positive momentum also stems from the India-UK FTA, which will benefit textile stocks.

Shriam Finance

Shares of the BFSI major plunged as much as 3 percent after declaring its Q1 results. Its net interest income (NII) for the quarter came in at Rs 5,773 crore, falling slightly short of the estimated Rs 6,002 crore. However, it still marked a 10.3 percent year-on-year growth from Rs 5,234 crore in the same period last year.

Cipla

Shares rallied as much as 3 percent after its consolidated net profit increased 10.3 percent to Rs 1,298 crore in the first quarter ended June 30, 2025. The company had reported a consolidated net profit of Rs 1,178 crore for the April-June period a year ago. Moneycontrol poll of 6 brokerages had pegged Rs 1,208 crore net profit; however, revenue was a miss, which had estimated Rs 7,145 crore revenue.

Source – Money Control