POST MARKET

Indian equity indices ended on a weak note as investors remained concerned over escalating tensions between India and Pakistan after Indian forces neutralized the air defence system in Lahore.

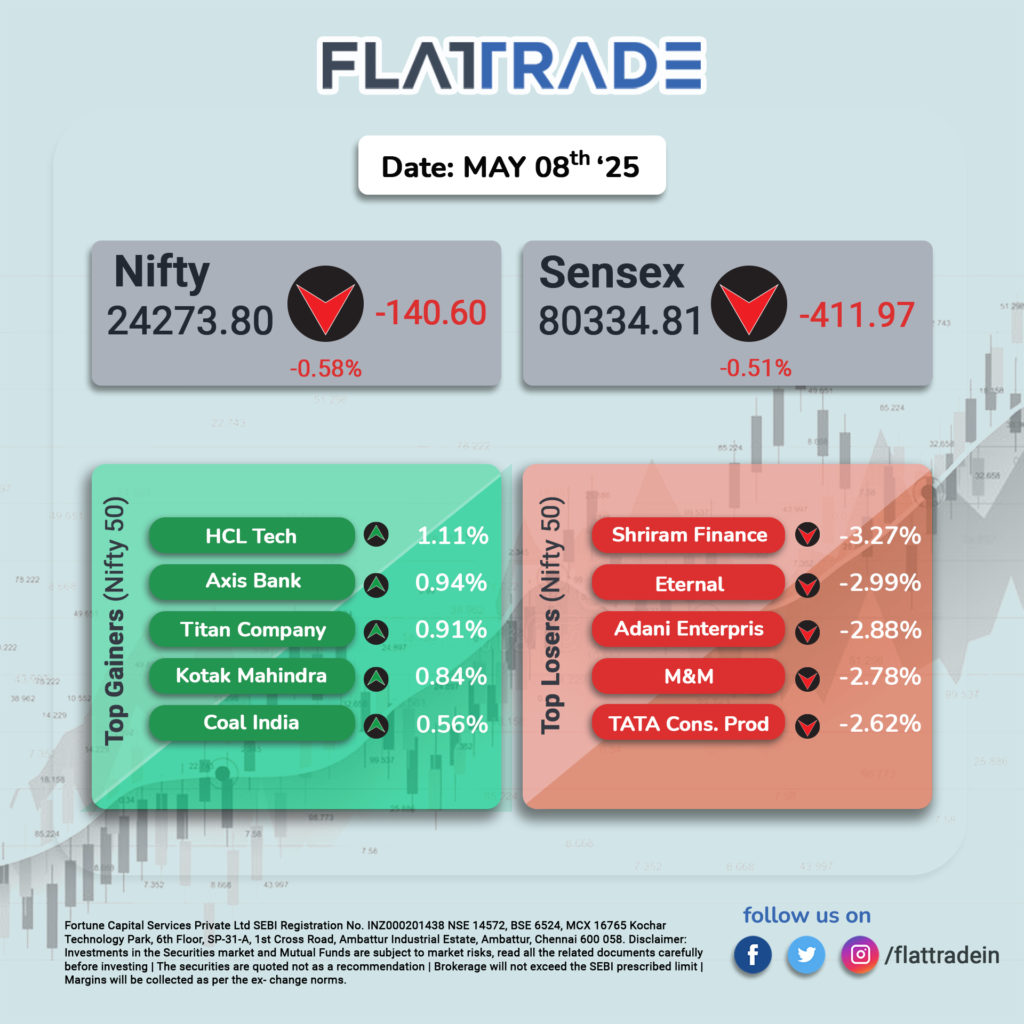

At close, the Sensex was down 411.97 points or 0.51 percent at 80,334.81, and the Nifty was down 140.60 points or 0.58 percent at 24,273.80. About 1256 shares advanced, 2497 shares declined, and 126 shares were unchanged.

The biggest Nifty losers were Shriram Finance, Eternal, M&M, Tata Consumer, Adani Enterprises, while gainers included HCL Technologies, Kotak Mahindra Bank, Titan Company, Axis Bank, and Coal India.

Except IT and Media, all other sectoral indices ended in the red with metal, oil & gas, pharma, PSU Bank, auto, consumer durables, and realty down 1-2 percent.

The broader market indices performed weakly, with the BSE midcap index shedding 1.9 percent and the smallcap index falling 1 percent.

STOCKS TODAY

TVS Motor Company

The company’s shares experienced a downturn of 3.19% during today’s trading session, with the price falling to Rs 2,706.00. This movement positions the stock among the day’s significant losers, drawing attention from investors and market analysts.

Niva Bupa Health Insurance Company

The company’s shares surged over 15 percent compared to yesterday’s closing. The shares also touched a four-month high of Rs 93 per share on May 8 after the company posted a better-than-expected performance for the March quarter of FY25. Over the past month, the stocks of this private health insurer have seen a 42 percent increase, in comparison to an 8 percent increase in the benchmark Nifty 50 index.

Tata Motors

Shares of the company went up by 3 percent amid expectations of Trump announcing a trade agreement with the UK. This announcement could potentially be beneficial for the company’s subsidiary Jaguar Land Rover as it will help in easing the 25 percent tariff imposed by the US on India, which will also boost investor optimism.

Coal India

Shares of Coal India increased over 3 percent on the May 8 trading session, after the company reported a reasonably strong performance for the March Quarter (Q4FY25), recovering from a subdued first half of the financial year. Despite such performance the stock has gained only 1 percent over he past month.

Bank of Baroda

The Public Sector Bank’s shares continued to fall for the third straight day, dropping over 2 percent to Rs 219 per share on May 8 after several brokerages downgraded the stock following a weak March quarter (Q4FY25) performance. In the last three trading sessions, the stock of the public sector lender has declined by over 11 percent.

DLF

Shares of the company experienced a downturn, falling by 3.05 percent to Rs 659.15. This movement positions DLF as a notable mover within the market, drawing attention from investors and analysts. This is due to a sharp downturn in the Indian market, and many companies have faced a reduction in their share prices due to this market-wide downturn.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.