POST MARKET

Indian equities extended their winning streak for the third straight session on Monday, closing higher amid strong buying in banking, IT, and healthcare shares.

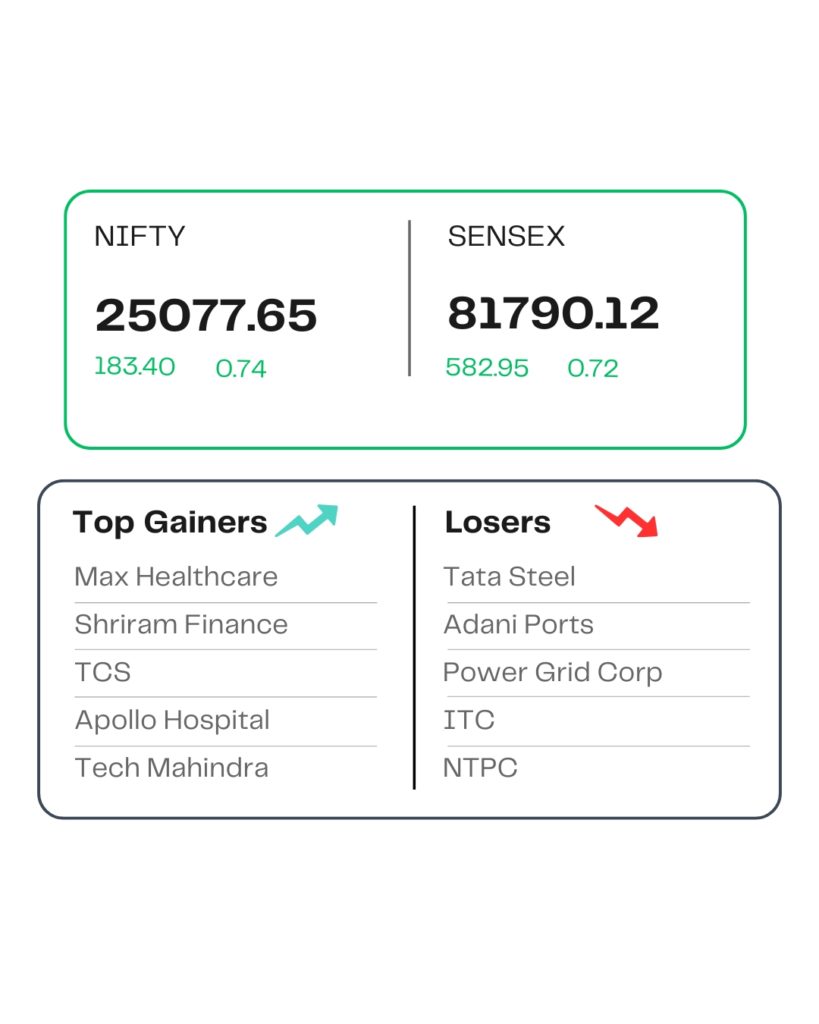

At close, the Sensex was up 582.95 points or 0.72 percent at 81,790.12, and the Nifty was up 183.40 points or 0.74 percent at 25,077.65. About 1715 shares advanced, 2370 shares declined, and 154 shares remained unchanged.

The biggest Nifty gainers were Max Healthcare, Shriram Finance, Apollo Hospitals, TCS, Tech Mahindra, while losers included Tata Steel, Adani Ports, Power Grid Corp, ITC, and NTPC.

Among sectors,the IT index rose 2 percent, the healthcare index rose 1 percent, the private bank index up 1.2 percent, the oil & gas index up 0.7 percent, and the PSU Bank index rose 0.4 percent, while metal, media, and FMCG down 0.3-0.9 percent.

Among the broader market indices, the BSE midcap index rose 0.7 percent, while the smallcap index ended marginally lower.

STOCKS TODAY

Vodafone Idea

Vodafone Idea shares fell almost 4 percent as the Supreme Court deferred hearing of the telco’s AGR plea to October 13, as the government has sought more time. Vodafone Idea’s counsel didn’t object to the government’s request for more time.

Nykaa

The shares of Nykaa-parent FSN E-Commerce Ventures surged 6.48 percent on October 6 after the firm shared its revenue update for the second quarter of the financial year 2026.

Avenue Supermarkets

The shares of DMart-parent Avenue Supermarts dropped 2.64 percent after the firm released its business update for the second quarter of the financial year 2026. Goldman Sachs has cut its target price for the shares of the retail major.

Aditya Birla Lifestyle Brands

The shares of Aditya Birla Lifestyle Brands jumped more than 10 percent on October 6 after a large block deal took place. Flipkart has likely sold its entire 6 percent stake in the company.

Tata Steel

Shares of Tata Steel Ltd fell over 2 percent on Monday, emerging as the top loser on the Nifty index, after the company said it had received a demand notice of about Rs 2,410 crore from the Department of Mines, Jajpur, Odisha.

Source – Money Control