POST-MARKET REPORT

Benchmark indices ended with marginal gains in a choppy day of trade. Banks saw buying in dips, while metals and realty came under selling pressure.

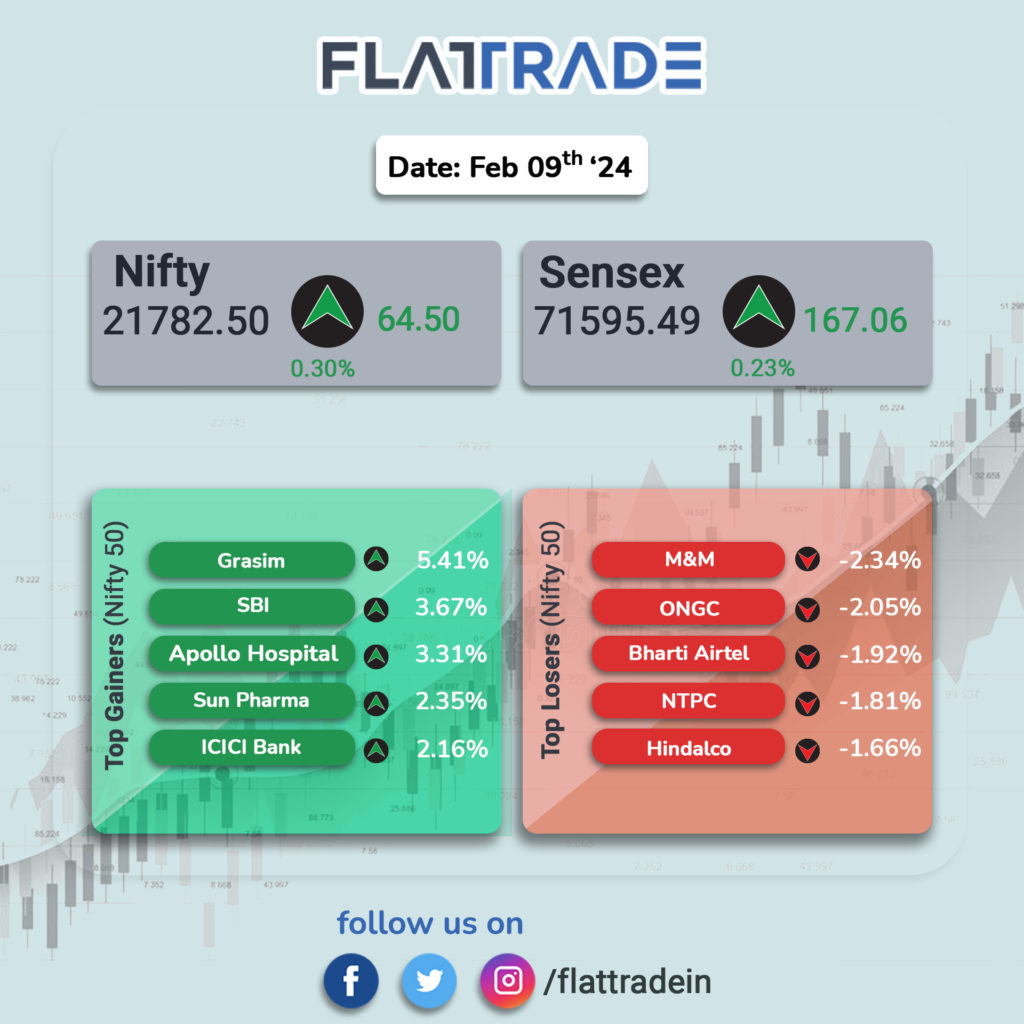

The Sensex closed 167.06 points, or 0.23 percent, up at 71,595.49, while the Nifty closed 64.55 points, or 0.3 percent, higher at 21,782.50.

Broader markets closed lower, underperforming the benchmarks. Nifty Midcap 100 declined 0.89 percent and Nifty Smallcap 100 1.40 percent.

On the sectoral front, auto, capital goods, oil & gas, metal, power, and realty are down 0.5-2 percent each. On the other hand, PSU Bank and pharma indices are up 0.5 percent each.

BSE Midcap and Smallcap indices are down 1 percent each.

The Indian rupee traded slightly weaker by 0.06rs at 83.03, fluctuating within a range of 82.94-83.05.

STOCKS TODAY

Life Insurance Corporation of India (LIC): Shares of LIC closed 1.92 percent lower after the stock rose 4 percent intraday after the state-run insurer’s net profit jumped 49 percent on-year to Rs 9,441 crore, and net premium income grew 4.67 percent YoY to Rs 1.17 lakh crore in the quarter under review.

Quess Corp Ltd.: Quess Corp shares were down 1.3 percent after forensic-cum-activist investment firm Muddy Waters said that its promoter Fairfax Financial Holdings used Quess as an accounting lever to create $889.9 million of profit and book value in 2018.

Torrent Power: Shares of Torrent Power traded 2.6 percent lower, a day after the company reported a 47 percent on-year decline in Q3FY24 profit. Torrent Power reported a consolidated net profit of Rs 359.8 crore for the quarter ended December 2023, around 47 percent lower than the previous fiscal. Revenue from operations for the same period also fell 1.2 percent on-year to Rs 6,366 crore for the quarter.

CG Power: CG Power and Industrial Solutions Ltd informed exchanges that it is in a pact with Renesas Electronics America Inc and Stars Microelectronics (Thailand) Public Co. to set up an Outsourced Semiconductor Assembly and Testing (OSAT) facility in India. CG has inked technology and services, offtake, and manufacturing agreements with Renesas Electronics Corporation, Japan, and a technology know-how sharing and technical support agreement with Stars.

IndiGo, SpiceJet: shares of these companies took a knock after a parliamentary panel proposed route-specific capping of airfare. The panel also proposed the creation of a separate entity to regulate and control air ticket prices, as customer concerns over surging airfares mounted.

Bharti Airtel: The Bharti Airtel stock plunged 1.94 percent after the cabinet approved spectrum auctions in eight bands for mobile phone services. The government set the base price at Rs 96,317.65 crore, said Information and Broadcasting Minister Anurag Thakur.

Paytm: The Paytm stock fell 6.16 percent a day after it was reported that the digital payments company is set to acquire Bengaluru-based Bitsila even as the future of its banking arm remains uncertain following RBI curbs.