POST MARKET

Indian equity indices slipped back into the red on August 8, snapping the previous day’s relief rally, as lingering tariff worries dampened sentiment. Losses were broad-based, with autos, metals, IT, and pharma leading the decline.

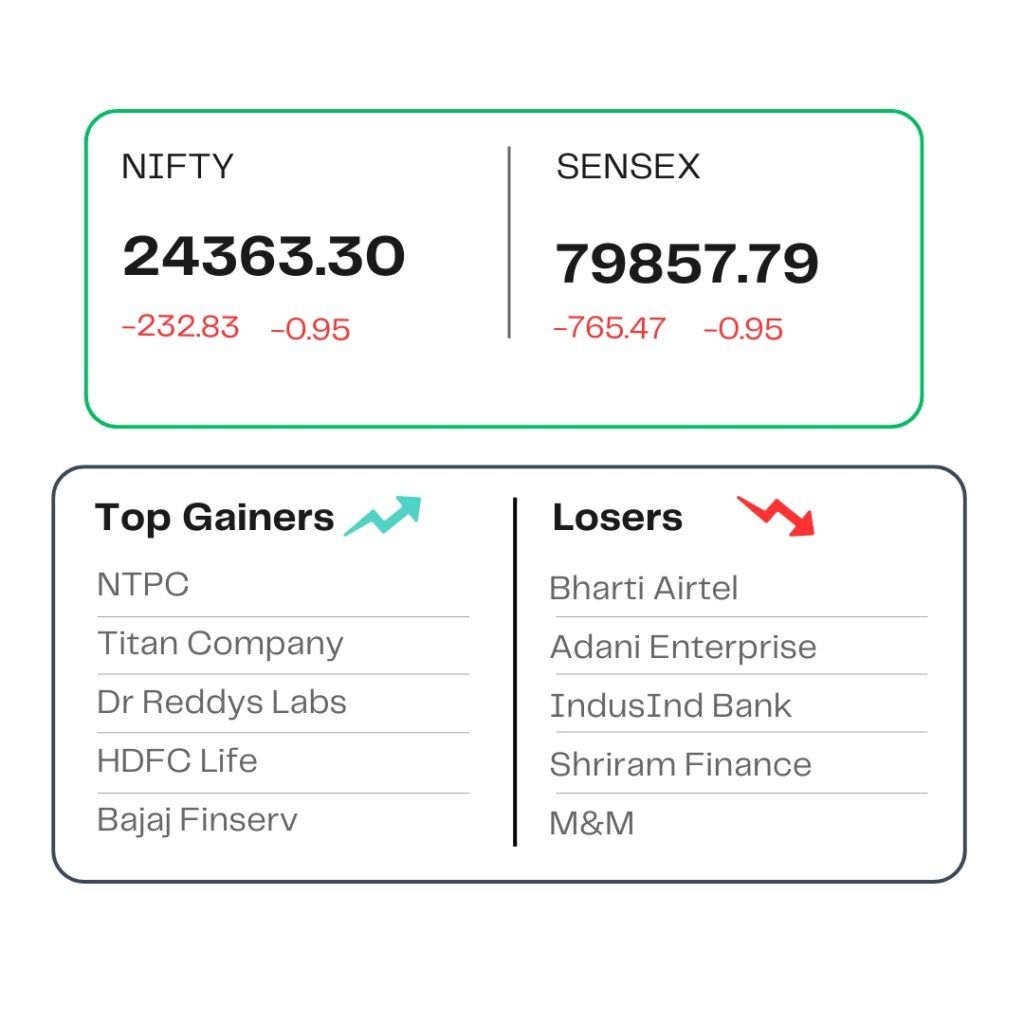

At close, the Sensex was down 765.47 points or 0.95 percent at 79,857.79, and the Nifty was down 232.85 points or 0.95 percent at 24,363.30. BSE Midcap index fell 1.5 percent, and the smallcap index shed 1 percent.

Biggest Nifty losers included Adani Enterprises, Bharti Airtel, Shriram Finance, IndusInd Bank, M&M, while gainers were Titan Company, NTPC, Dr Reddy’s Labs, HDFC Life, Bajaj Finserv.

All the sectoral indices ended in the red with metal, realty, pharma, auto, private bank, and consumer durables down 1-2 percent.

Among the broader indices, the BSE Midcap index fell 1.5 percent and the smallcap index shed 1 percent.

STOCKS TODAY

NSDL

Shares of the recently listed depository service provider have surged another 18 percent on August 8, extending their gains for the third consecutive session after listing. With this move, the stock has now risen 67 percent from its IPO price in just three trading sessions.

Coforge

Shares of the IT firm slipped 6 percent to Rs 1,605 in the afternoon, sinking for the third time in four sessions and wiping out over 10 percent in just four days, after key client Sabre Corp plunged 35 percent on the Nasdaq overnight following a lacklustre quarterly report.

Tata Motors

Shares slipped over 2 percent, marking its third straight day of losses, as investors turned cautious ahead of the automaker’s Q1 results later today, with analysts bracing for a sharp decline in profit and revenue. According to a Moneycontrol poll of six brokerage firms, the Nexon maker is anticipated to record an 8.7 percent year-on-year decrease in revenue, reaching Rs 98,600 crore.

LIC

Shares jumped 3 percent on August 8, even as the headline indices ticked lower amid tariff woes. The gains are buoyed by the quarterly results wherein the company reported a 5 per cent rise in net profit and exuded confidence of a double-digit growth in the bottom line in the current financial year (FY2026).

Grasim

Aditya Birla Group-owned Grasim Industries saw its shares slip over 2 percent after the company’s net loss widen to Rs 118 crore on a standalone basis for the June quarter compared to Rs 52 crore a year ago, on the back of Grasim’s Rs 10,000 crore investment into paints business – Birla Opus – as well as other new-age businesses such as e-commerce.

Source – Money Control