POST MARKET

The Indian equity indices snapped their six-day winning run and ended lower in a volatile session on November 18 amid broad-based selling.

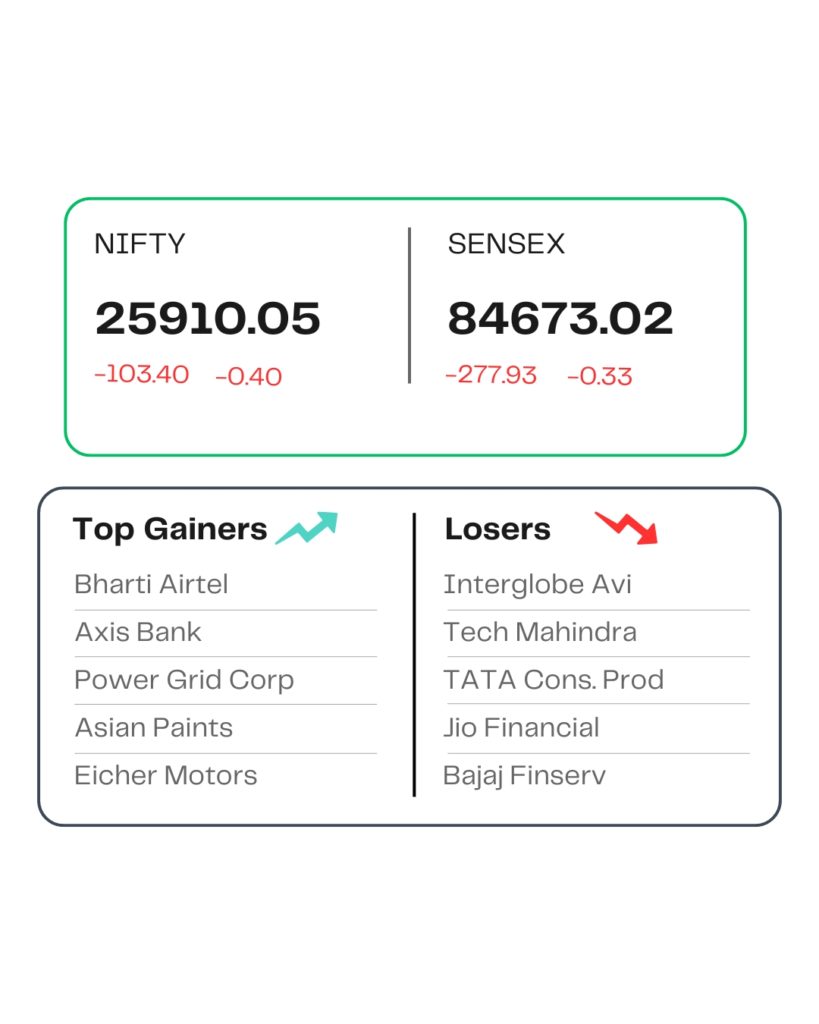

At close, the Sensex was down 277.93 points or 0.33 percent at 84,673.02, and the Nifty was down 103.40 points or 0.40 percent at 25,910.05. About 1393 shares advanced, 2632 shares declined, and 131 shares were unchanged.

Bharti Airtel, Axis Bank, Power Grid Corporation, Bajaj Auto, and Asian Paints were among the major gainers on the Nifty, while losers were Tech Mahindra, Tata Consumer, Jio Financial, Interglobe Aviation, and Bajaj Finserv.

All the sectoral indices ended in the red with IT, metal, and realty down 1 percent each.

Among the broader market indices, the BSE midcap index shed 0.7 percent, and the smallcap index shed 0.8 %.

STOCKS TODAY

Devyani International

The shares of Devyani International jumped 3.86 percent. This comes as Indian Railways may soon allow ‘Premium Brand Catering Outlets’ to operate at railway stations. The company operates KFC and Pizza Hut outlets in India.

One97 Communications

Shares of One97 Communications Ltd, the parent of Paytm, fell 3 percent after a large block deal in which 1.32 crore shares — amounting to 2.07 percent of the company’s equity changed hands. The shares in the block deal were transacted at Rs 1,307 apiece, taking the total deal value to about Rs 1,722 crore.

Mankind Pharma

Indian drugmaker Mankind Pharma, shares went down by over a percent as the company saw a rough patch due to lacklustre domestic revenue, margin pressure, and finance costs associated with the acquisition of Bharat Serums and Vaccines (BSV) and related integration challenges, all of which have weighed down its guidance.

Emcure Pharmaceuticals

Shares of Emcure Pharmaceuticals fell 2.41 percent after a large block trade hit the exchanges, with roughly 40.6 lakh shares, about 2.4 percent of the company’s equity, changing hands in two block deals. The transaction is likely linked to Bain Capital’s BC Investments, which had been expected to offload up to 2 percent of its stake.

Source – Money Control