Indian equity markets closed flat-to-negative on Wednesday as profit booking and divergent global cues put the indices in the back foot all session long. Following a robust rally in previous sessions, investors were seen to be in wait-and-watch mode prior to crucial macroeconomic data and the US Federal Reserve policy decision.

Key Highlights:

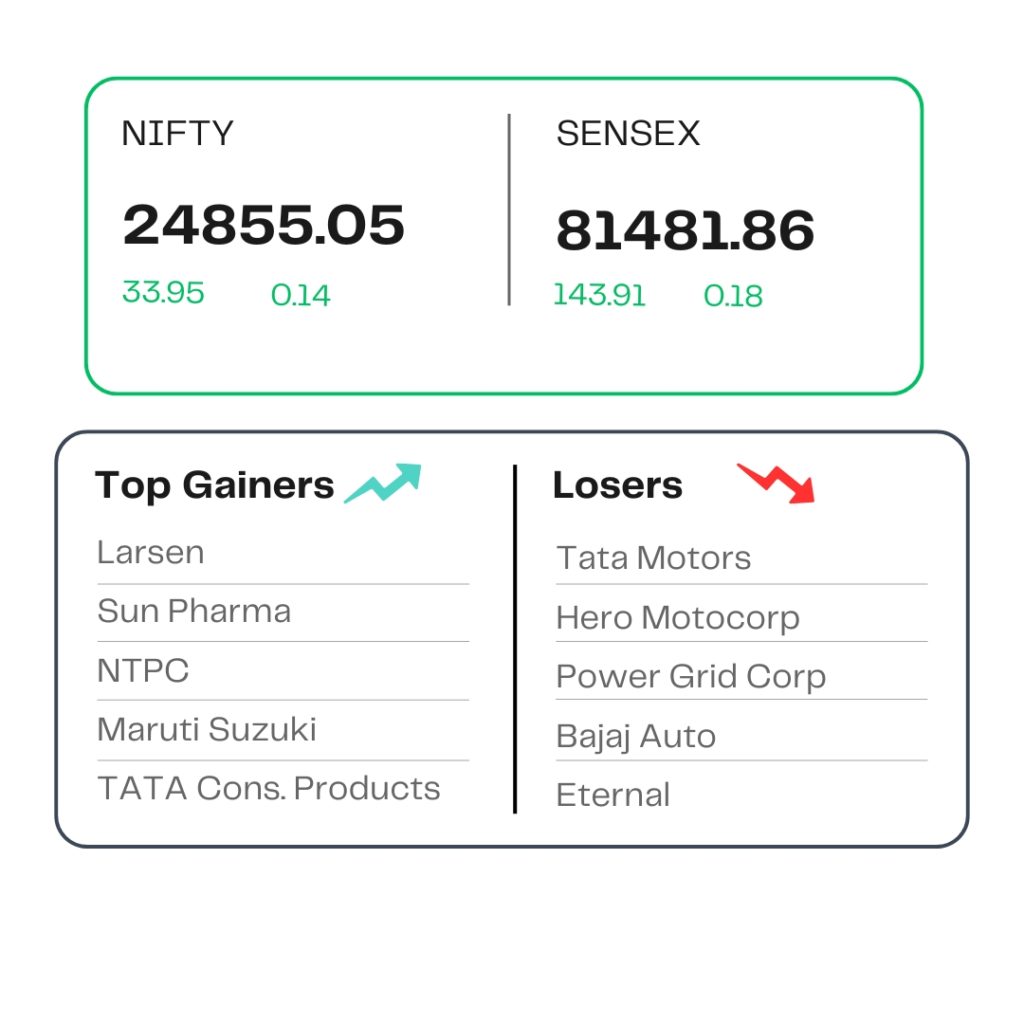

Sensex rose 144 points (0.18 percent) to 81,482, while Nifty 50 rose 34 points (0.14 percent) to 24,855.

Midcap and Smallcap indices were up, keeping on drawing wider market participation.

IT and FMCG shares saw selling pressure, whereas Auto and PSU Banks provided some support to the market.

Volatility index India VIX rose, reflecting more nervousness from traders.

Stocks in News Today:

Larsen and Toubro (L&T):

Shares of Larsen and Toubro (L&T) surged 5 percent, as the market reacted positively towards the June quarter earnings of the engineering and construction major. The shares were the top Nifty 50 gainer. The firm on July 29 reported a consolidated net profit of Rs 3,617 crore during the April-June quarter of financial year 2026. This is a 30 percent on-year increase from the Rs 2,786 crore net profit during the same quarter last year. L&T operational revenue increased 15.5 percent on-year at Rs 63,679 crore in Q1 FY26, compared to Rs 55,120 crore in the year-earlier period.

DMart:

Supermarket giant, informed analysts on an investor call on July 30 that the company will accelerate on store additions in the future, and that competition in the form of quick commerce won’t impact its financials, propelling shares up by more than 7 percent. D-mart’s store count as of date is at 426, the company said, having added 11 stores in the June quarter.

New India Assurance:

Shares rose close to 15 percent following the PSU insurer‘s robust first-quarter earnings of the financial year 2026. The New India Assurance Company in its July 29 filing reported gross premium income of Rs 13,334 crore during the April-June quarter of the financial year 2026. This reflects a 13 percent rise compared to the Rs 11,788 crore gross premium income of the same quarter of the last financial year. The company‘s after–tax profit surged over 80 percent on-year to Rs 391 crore in Q1 FY26, from Q1 FY25’s Rs 217 crore. The insurer added, though, that the plane crash involving Air India in June was detrimental to the underwriting performance.

International Gemmological Institute (IGIL):

The shares on July 29 posted a net profit of Rs 126 crore in Q1 FY26. This is an increase of over 62 percent on-year from the Rs 77.8 crore net profit in the same quarter last year’s financial year. The company’s top line meanwhile grew about 16 percent on-year to Rs 301 crore in the quarter ended September. IGIL shares gained almost 8 percent to touch an intraday high of Rs 442 per piece.

Ather:

Energy shares surged more than 3 percent on the day as the electric vehicle company entered into an MoU with the Commerce Ministry to accelerate growth in clean mobility and advanced manufacturing, under the Build in Bharat initiative of Startup Policy Forum (SPF), a government statement on July 29 read. In the wake of the news, Nomura and HSBC started coverage with buy on the counter. Part of the tie–up includes Ather Energy‘s commitment to ‘strategic mentorship’ towards deep-tech startups, as well as infrastructure-related assistance towards future players in the EV value chain.

Tata Motors:

The shares fell 4 percent as reports surfaced that India’s auto giant is in talks to buy the truck business of Italy‘s Iveco Group for $4.5 billion. The negotiations between Tata Motors and Iveco, owned by the Agnelli family, are focused on the commercial and defence truck business, CNBC TV-18 reported.

Indiqube:

Shares of Indiqube Spaces tied up weakly on the stock markets on July 30, listing at Rs 216 per share on NSE on July 30. This is a discount of almost 9 percent below the IPO price. Indiqube Spaces had floated its IPO to mobilise Rs 700 crore from the capital markets through a fresh issue of equity shares of Rs 650 crore and an offer for sale of Rs 50 crore by promoters