JSW Cement IPO is a bookbuilt issue of ₹3600.00 crore. It combines a fresh issue of 10.88 crore shares aggregating to ₹1600.00 crore and an offer for sale of 13.61 crore shares aggregating to ₹2000.00 crore.

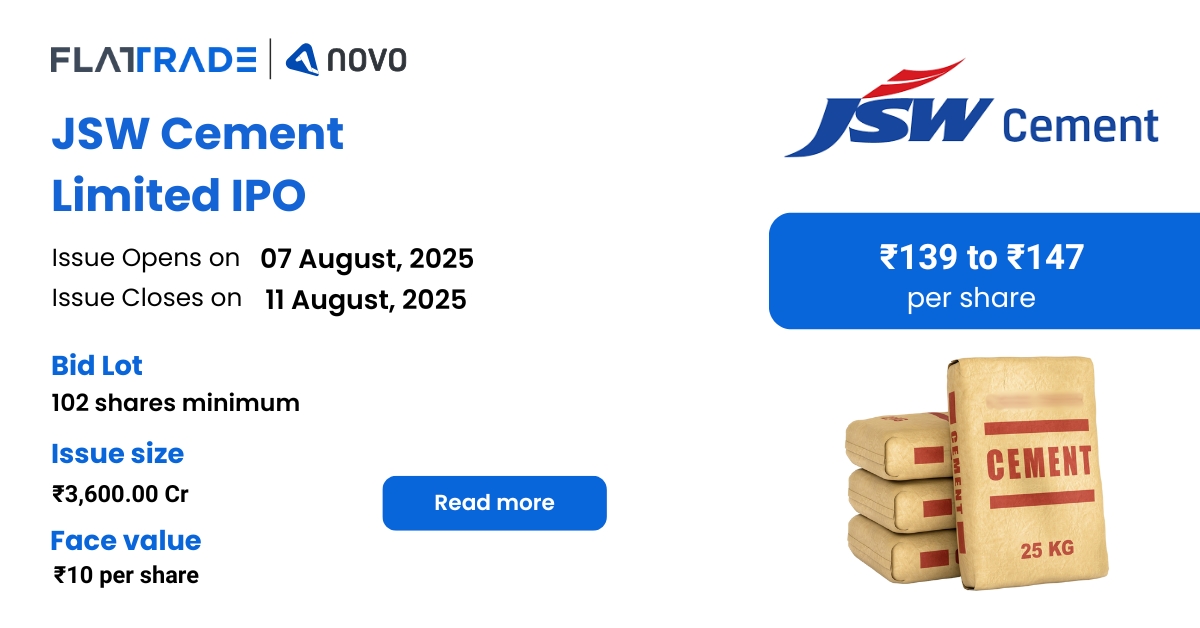

The IPO opens for subscription on August 7, 2025, and closes on August 11, 2025. The allotment is expected to be finalized on Tuesday, August 12, 2025. The price band for the IPO is set at ₹139 to ₹147 per share, and the minimum lot size for an application is 102 shares.

Company Summary

Incorporated in 2006, JSW Cement Limited is a manufacturer of green cement in India. As part of the JSW Group, the company is committed to sustainability and innovation in the cement industry.

The company operated seven plants across the country, including one integrated unit, one clinker unit, and five grinding units located in Andhra Pradesh (Nandyal plant), Karnataka (Vijayanagar plant), Tamil Nadu (Salem plant), Maharashtra (Dolvi plant), West Bengal (Salboni plant), and Odisha (Jajpur plant and the majority-owned Shiva Cement Limited clinker unit).

As of March 31, 2025, JSW Cement Limited had an installed grinding capacity of 20.60 MMTPA, comprising 11.00 MMTPA in the southern region, 4.50 MMTPA in the western region, and 5.10 MMTPA in the eastern region of India.

JSW Cement Limited distributes its products through a well-connected network. As of March 31, 2025, the company had a distribution network comprising 4,653 dealers, 8,844 sub-dealers, and 158 warehouses.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Product Portfolio

- Cement: Blended Cement and Ordinary Portland Cement

- Ground Granulated Blast Furnace Slag: GGBS is commonly used in blended cement products such as PSC and PCC and as a replacement material for OPC in concrete production.

- Clinker: Clinker is manufactured by burning limestone and clay together at a high temperature

- Allied Cementitious Products: RMC, Screened Slag, Construction Chemicals

Company Strengths

- The company is the fastest-growing cement manufacturing company in India in terms of increase in installed grinding capacity and sales volume.

- The company is India’s largest manufacturer of GGBS and has a proven track record of scaling up this business.

- Strategically located plants are well-connected to raw material sources and key consumption markets.

- The company has the lowest carbon dioxide emission intensity among our peer cement manufacturing companies and the top global cement manufacturing companies.

- Extensive sales and distribution network in India and a focus on a strong brand.

- The company benefits from its strong corporate lineage of the JSW Group and its qualified management team.

Company Financials

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 12,003.94 | 11,318.91 | 10,218.61 |

| Revenue | 5,914.67 | 6,114.6 | 5,982.21 |

| Profit After Tax | -163.77 | 62.01 | 104.04 |

| EBITDA | 815.32 | 1,035.66 | 826.97 |

| Net Worth | 2,352.55 | 2,464.68 | 2,292.1 |

| Reserves and Surplus | 1,287.31 | 1,399.06 | 1,296.66 |

| Total Borrowing | 6,166.55 | 5,835.76 | 5,421.54 |

| Amount in ₹ Crore | |||

Objectives of IPO

- Part-financing the cost of establishing a new integrated cement unit at Nagaur, Rajasthan

- Prepayment or repayment, in full or in part, of all or a portion of certain outstanding borrowings availed by the Company

- General Corporate Purposes

Promoters of the Company

Sajjan Jindal, Parth Jindal, Sangita Jindal, Adarsh Advisory Services Private Limited, and Sajjan Jindal Family Trust are the company promoters.

IPO Details

| IPO Date | August 7, 2025 to August 11, 2025 |

| Listing Date | August 14, 2025 |

| Face Value | ₹10 per share |

| Price Band | ₹139 to ₹147 per share |

| Lot size | 102 shares |

| Total Issue Size | 24,48,97,958 shares (aggregating up to ₹3600.00 Cr) |

| Fresh Issue | 10,88,43,537 shares (aggregating up to ₹1600.00 Cr) |

| Offer for sale | 13,60,54,421 shares of ₹10 (aggregating up to ₹2000.00 Cr) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 1,25,45,21,399 shares |

| Share Holding Post Issue | 1,36,33,64,936 shares |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 102 | ₹14,994.00 |

| Retail (Max) | 13 | 1,326 | ₹1,94,922.00 |

| S-HNI (Min) | 14 | 1,428 | ₹2,09,916.00 |

| S-HNI (Max) | 66 | 6,732 | ₹9,89,604.00 |

| B-HNI (Min) | 67 | 6,834 | ₹10,04,598.00 |

Allotment Schedule

| Basis of Allotment | Tue, 12 Aug, 2025 |

| Initiation of Refunds | Wed, 13 Aug, 2025 |

| Credit of Shares to Demat | Wed, 13 Aug, 2025 |

| Tentative Listing Date | Thu, 14 Aug, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 11, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII Shares Offered | Not less than 15% of the Offer |

To check allotment, click here