Laxmi India Finance IPO is a bookbuilt issue of ₹254.26 crore. It combines a fresh issue of 1.05 crore shares aggregating to ₹165.17 crore and an offer for sale of 0.56 crore shares aggregating to ₹89.09 crore.

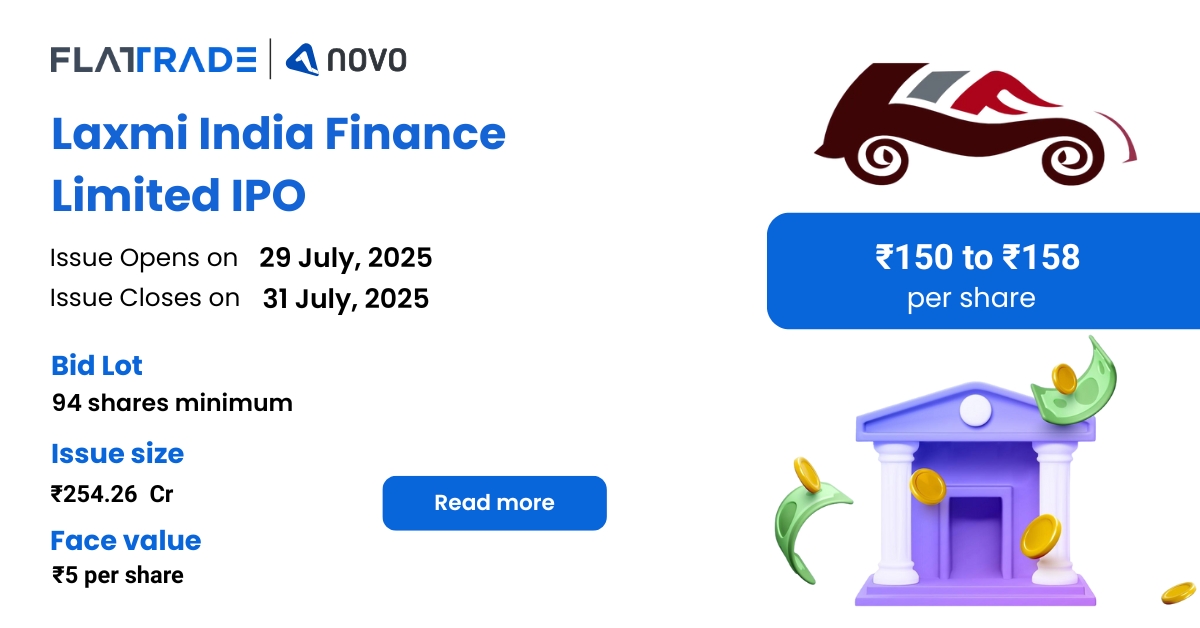

The IPO opens for subscription on July 29, 2025, and closes on July 31, 2025. The allotment is expected to be finalized on Friday, August 1, 2025. The price band for the IPO is set at ₹150 to ₹158 per share, and the minimum lot size for an application is 94 shares.

Company Summary

Incorporated in 1996, Laxmi India Finance Limited is engaged in the business of Non Non-Banking Financial Company.

The company offers MSME loans, vehicle loans, construction loans, and other lending products, supporting small businesses and entrepreneurs, with over 80% of MSME loans qualifying as Priority Sector Lending.

As of March 31, 2025:

- Asset Under Management (AUM): Rs 12,770.18 million in 2025, with MSME and Vehicle loans accounting for 76.34% and 16.12% respectively.

- Customer base: 35,568 customers, including 18,596 active MSME customers and 12,423 active vehicle loan customers, with 48.78% growth from 23,906 customers as on March 31, 2024. 37.10% of its customer base includes first-time borrowers.

- Branch network: 158 branches from 135 branches as of March 31, 2024. The company has branches across Rajasthan, Gujarat, Madhya Pradesh, and Chhattisgarh, with the highest number of branches in Rajasthan.

- Accessed funds from 47 lenders -8 public sector banks, 10 private banks, 7 small finance banks, and 22 NBFCs.

Company Strength

- Focus on MSME financing

- Access to diversified sources of capital and effective cost of funds

- Comprehensive credit assessment, underwriting, and risk management framework

- Deeper regional penetration in semi-urban and rural areas is supported by a mix of direct and indirect sourcing channels

- Our Hub and Branch model streamlines operations, reduces costs, and increases customer accessibility, driving business growth and market expansion

- Experienced management with good corporate governance practices.

Company Financials

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,412.52 | 984.85 | 778.71 |

| Revenue | 248.04 | 175.02 | 130.67 |

| Profit After Tax | 36.01 | 22.47 | 15.9 |

| EBITDA | 163.88 | 114.59 | 85.96 |

| Net Worth | 257.47 | 201.22 | 152.33 |

| Reserves and Surplus | 236.99 | 181.87 | 134.23 |

| Total Borrowing | 1,137.06 | 766.68 | 615.49 |

| Amount in ₹ Crore | |||

Objectives of IPO

- Augmentation of the capital base to meet the future capital requirements for onward lending

- General corporate purposes

Promoters of the company

Deepak Baid, Prem Devi Baid, Aneesha Baid, Hirak Vinimay Private Limited, Deepak Hitech Motors Private Limited, Prem Dealers Private Limited, and Vivan Baid Family Trust are the promoters of the company.

IPO Details

| IPO Date | July 29, 2025 to July 31, 2025 |

| Listing Date | August 5, 2025 |

| Face Value | ₹5 per share |

| Price Band | ₹150 to ₹158 per share |

| Lot size | 94 shares |

| Total Issue Size | 1,60,92,195 shares (aggregating up to ₹254.26 Cr) |

| Fresh Issue | 1,04,53,575 shares (aggregating up to ₹165.17 Cr) |

| Offer for sale | 56,38,620 shares of ₹5 (aggregating up to ₹89.09 Cr) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 4,18,14,300 shares |

| Share Holding Post Issue | 5,22,67,875 shares |

Category Reservation Table

| Application Category | Maximum Bidding Limits | Bidding at the Cut-off Price Allowed |

| Only RII | Up to Rs 2 Lakhs | Yes |

| Only sNII | Rs 2 Lakhs to Rs 10 Lakhs | No |

| Only bNII | Rs 10 Lakhs to NII Reservation Portion | No |

| Only employee | Up to Rs 2 lakhs | Yes |

| Employee + RII/NII | 1. Employee limit: Up to Rs 2 lakhs (In certain cases, employees are given a discount if the bidding amount is up to Rs 2 Lakhs) | Yes for Employee and RII/NII |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 94 | ₹14,852.00 |

| Retail (Max) | 13 | 1,222 | ₹1,93,076.00 |

| S-HNI (Min) | 14 | 1,316 | ₹2,07,928.00 |

| S-HNI (Max) | 67 | 6,298 | ₹9,95,084.00 |

| B-HNI (Min) | 68 | 6,392 | ₹10,09,936.00 |

Allotment Schedule

| Basis of Allotment | Fri, 1 Aug, 2025 |

| Initiation of Refunds | Mon, 4 Aug, 2025 |

| Credit of Shares to Demat | Mon, 4 Aug, 2025 |

| Tentative Listing Date | Tue, 5 Aug, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 31, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

To check allotment, click here