An overall outlook

The Indian Mutual Fund industry has seen remarkable transformations influenced by global economic uncertainties and strategic domestic policy decisions. These global and domestic decisions have a remark on investor decisions. Investors are leaning towards shifts.

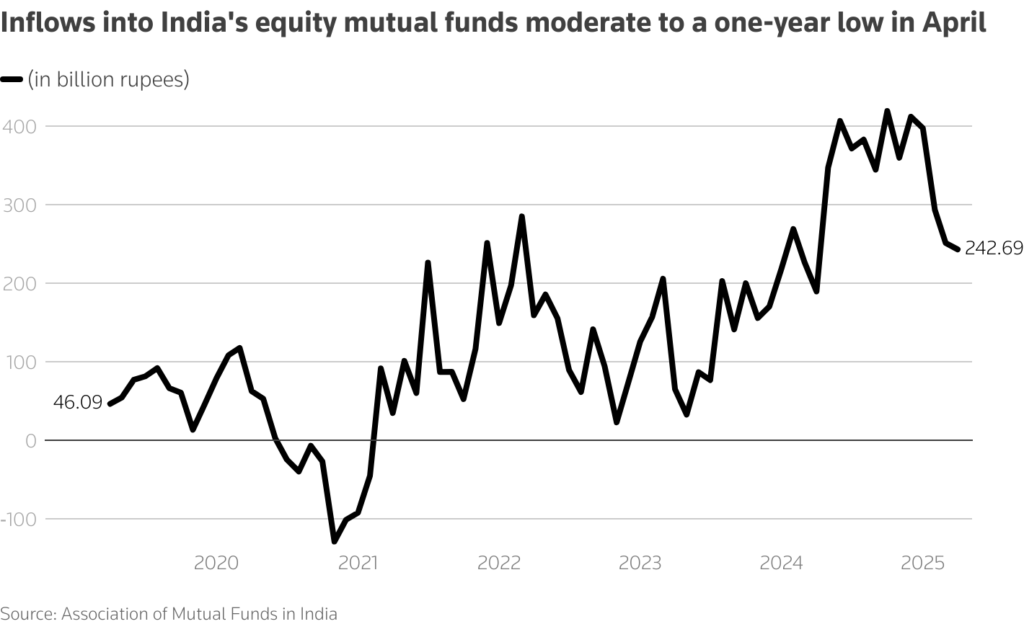

Decline in Equity Mutual Fund inflows

Inflows into India’s Equity Mutual Fund fell 3.24% month-on-month in April to about 242.69 billion rupees, making it the fourth consecutive month. The downfall in April is the lowest in the past year, and this is due to the ongoing US tariff concerns.

Even when India’s investment activity is predicted to rise over the medium term, investor tensions still exist. This drop shows the investor anxiety over high valuations, geopolitical tensions, and global uncertainty.

Renewed investor focus in Debt Mutual Funds

Unlike Equity inflows, debt mutual funds have seen a notable increase with 2.19 lakh crore rupees in April. This shift indicates a growing investor preference for fixed-income securities, driven by the Reserve Bank of India’s (RBI) liquidity-enhancing measures.

The five-year bond yield is expected to decrease 40-50 basis points to 5.6% – 5.7% this fiscal year.

RBI’s Liquidity push. LIC’s Senior Debt Fund Manager also expects the 10-year benchmark yield to decrease to 5.85% – 5.86%. The RBI has infused around 2 trillion rupees via open market bond purchases and plans to purchase another 500 billion in May.

Shift towards domestic sector

Indian Asset managers are shifting towards the domestic economy as a result of global uncertainties.

Investors are leaning towards Financial stocks after the RBI’s monetary easing and liquidity support, and for that reason, these stocks have increased by over 12%. Consumer stocks have also increased around 9% – 11%, following tax cuts and rate reductions.

Among sectoral indices, mutual funds aggressively bought into IT stocks, investing over ₹9,599 crore. Even though foreign investors exited tech stocks, this move has boosted domestic confidence. Mutual funds are shifting their investments based on sectors that benefit from domestic demand and macroeconomic stability.

Resilience amid market uncertainty

Indian Mutual Fund increased their cash holding in both March and April of 2025, to stay cautious amid market uncertainties.

In March, cash holdings in mutual funds increased by ₹18,061 crore to ₹2.05 lakh crore, while the cash-to-AUM ratio rose to 5.86%. SBI Mutual Funds topped the contributors list with ₹38,380 crore contributions.

In April, cash holdings increased further by ₹17,361 crore to ₹2.23 lakh crore, with 22 of 43 fund houses increasing their allocations. ICICI Prudential, HDFC, and SBI Mutual Funds led the additions, meanwhile, Axis Mutual Funds cut their allocation to 6.34%.

Source – Moneycontrol, Reuters, Economic Times, Mint

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.