The Fintech company plans to raise capital of ₹18300 crore through the initial public offering (IPO). The IPO comprises of a fresh issue of ₹8300 crore of equity shares with a face value of ₹1, while Offer For Sale (OFS) is for ₹10000 crore. The price band is fixed at ₹2080 to ₹2150 per equity share. The IPO subscription will open on November 8, 2021 and close on November 10, 2021.

Company Summary

One 97 is one of the leading fintech players in the digital ecosystems. It also has an e-commerce business that caters to range of merchants based on their size of business.

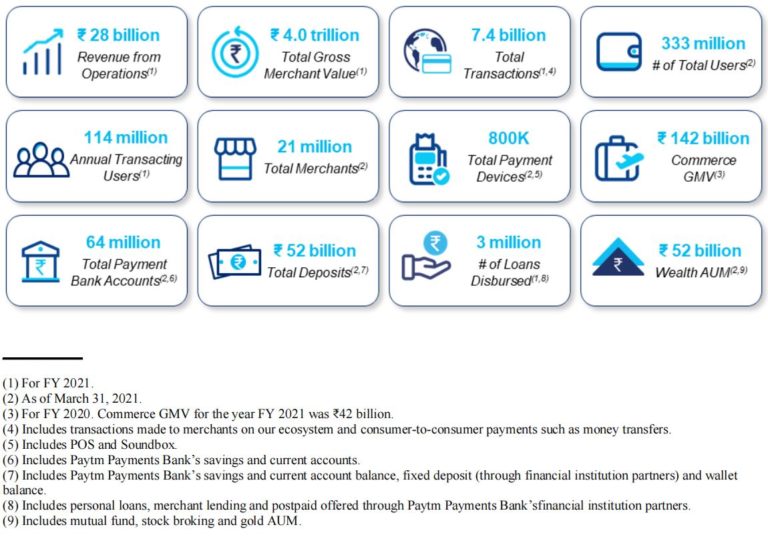

The company is present in the following businesses – payment services, commerce and cloud services, and financial services. It caters to 333 million consumers and over 21.1 million merchants, as of March 31, 2021.

The company has a robust ecosystem where both retail customers and merchants form their customer base. This enables Paytm to provide financial services through their financial institution partners, by leveraging technology to improve the livelihood of their customers and help merchants grow their businesses.

The company is backed by some ace investors of the world such as SoftBank Vision Fund, Berkshire Hathaway, Ant Group, Alipay, Alibaba Group, SAIF Partners and Elevation Capital.

The below image gives a bird’s eye view of the company’s important numbers with respect to its diverse businesses.

Company Strengths

- The company is one of India’s leading digital payments and online financial service providers

- Strong brand identity with its value pegged at $6.3 billion.

- Country-wide customer base with 333 million total customers, 114 million annual transacting users, and 21 million registered merchants.

- Paytm Super-app to access a wide range of digital services like online payments, e-commerce, investments, etc. over mobile phones.

Company Promoters

The company does not have an identifiable promoters, according to SEBI ICDR Regulations and the Companies Act, 2013, as the company is professionally managed.

Financial Summary

Particulars | For the year/period ended (Rs in crore) | ||

31-Mar-21 | 31-Mar-20 | 31-Mar-19 | |

Total Assets | 9151.3 | 10303.1 | 8766.8 |

Total Revenue | 3186.8 | 3540.7 | 3579.7 |

Profit After Tax | (1701.0) | (2942.4) | (4230.9) |

Purpose of the IPO

The proceeds from the IPO will be used for the following purposes,

- To strengthen the digital ecosystem through customer acquisition, retention and providing them greater access to technology and financial services totalling Rs 4300 crore.

- Investing in new business initiatives, strategic partnerships, and acquisitions aggregating to Rs 2000 crore.

- The remaining proceeds will be used for general corporate purposes.

Paytm IPO Details

IPO Opening Date | Nov 8, 2021 |

IPO Closing Date | Nov 10, 2021 |

Issue Type | Book Built Issue IPO |

Face Value | ₹1 per equity share |

IPO Price | ₹2080 to ₹2150 per equity share |

Market Lot | 6 Shares |

Min Order Quantity | 6 Shares |

Listing At | BSE, NSE |

Paytm IPO Lot Size

The Paytm IPO market lot size is 6 shares. A retail-individual investor can apply for up to 15 lots (90 shares or ₹193,500).

Application | Lots | Shares | Amount (Cut-off) |

Minimum | 1 | 6 | ₹12,900 |

Maximum | 15 | 90 | ₹193,500 |