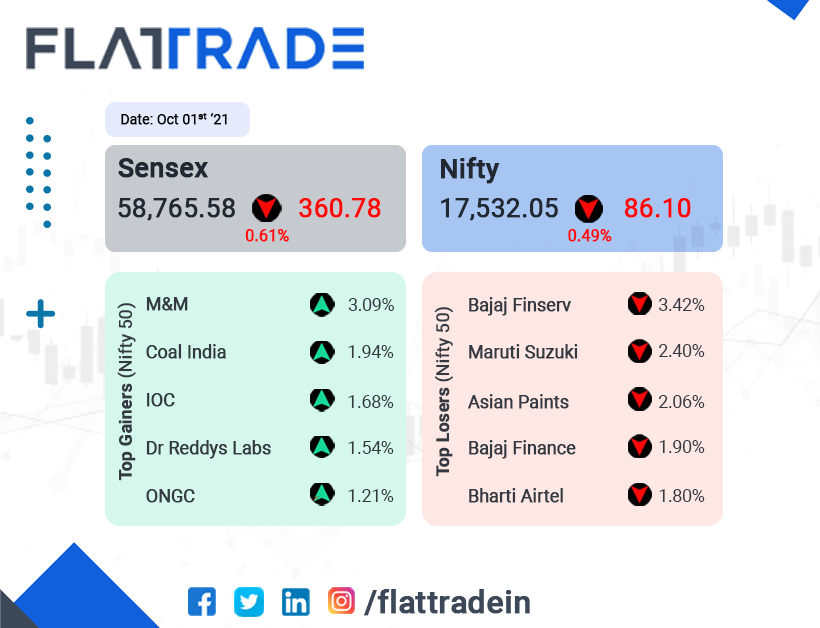

Benchmark Indian indices fell for the fourth day in a row, weighed by losses in banking and information technology stocks. The Sensex fell 0.61% to 58765.58 and Nifty closed 0.49% lower at 17532.05.

Nifty IT was down 0.71% and Nifty Bank fell 0.53%. Among indices, Nifty Pharma (0.84%), Media (0.75%), PSU Bank (0.71%), Energy (0.62%) and Metal (0.49%) were top gainers.

Indian rupee rose 13 paise to end at 74.12 against the US dollar on Friday.

Stock in News Today

Maruti Suzuki: The country’s largest carmaker’s sales fell 46.16% to 86,380 units in September. The company had sold 1,60,442 units in September last year. Domestic sales plunged 54.9% to 68,815 units last month as against 1,52,608 units in September 2020, it added. However, Exports jumped over two folds to 17,565 units as against 7,834 units in the year-ago period.

Zee Entertainment Enterprises: The company’s board refused to hold an Extraordinary General Meeting as demanded by shareholder Invesco. The company in a statement said that the board has arrived at a conclusion that the requisition is invalid and illegal and the company has accordingly conveyed its inability to convene the meeting.

Cipla: The drugmaker is on the lookout for deals that can boost its growth after the company’s cash and cash equivalents rose on the back of the Covid-19 windfall it garnered this year, Bloomberg reported. “We are completely open to M&A,” Samina Hamied, the company’s 45-year-old vice chairperson told Bloomberg in an interview.

ITC: The company’s hospitality arm ITC Hotel will launch a new brand of hotels, Mementos, including the recently announced Storii. Anil Chadha, divisional chief executive said that Storii as a premium and Mementos, as a luxury one, is in line with the company’s strategy to offer a differentiated experience to tourists.

Adani Green: The company’s subsidiary Adani Renewable Energy has acquired an operating solar project of 40 MW in Odisha. The company acquired the project at an enterprise value of Rs 219 crore. The project includes a long-term power purchase agreement (PPA) with Solar Energy Corporation of India (SECI) at Rs 4.235 per unit.

Paras Defence & Space Technologies: The company had a bumper stock market debut as its share prices rose 181% to Rs 492.45 on the NSE, as against its issue price of Rs 175 apiece. The stock zoomed 185% over the issue price and was locked in the upper circuit of 5% at Rs 498.75 on the BSE. The company has been admitted to dealings on the exchange in the list of ‘T ‘ group of securities, the BSE said in a notice.

Tata Power: Shares of the company continued to rise to hit a new high of Rs 165 in intraday trade on BSE after 13 years. The share rallied for the fourth straight day and it is up 19% during the period. The company has presence in production of renewable and conventional power including hydro and thermal energy, transmission & distribution, coal & freight, logistics and trading.

Piramal Enterprises: The company’s subsidiary Piramal Capital & Housing Finance (PCHF), has merged with debt-ridden Dewan Housing Finance (DHFL) through a reverse merger after paying Rs 34,250 crore to the creditors of DHFL. The company said that the buyout will provide an inorganic growth opportunity and leverages operating synergies.