Market Update

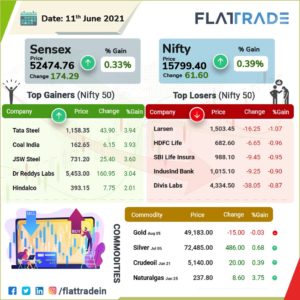

Indian Stocks had traded higher on June 11, led by gains in IT and metal stocks such as TATA steel, HINDALCO and JSW steel. Sensex rose by 0.33% and gained 174 points to 52,474. The Nifty surged by 61points to 15799.

Economy Updates

Asia-Pacific were mixed on June 11, following gains overnight on Wall Street that saw the S&P 500 sailing to a record closing high.

The Reserve Bank of India (RBI) on June 10 announced the third tranche of Open Market Purchase of Government of India Securities and State Development Loans under G-sec Acquisition Programme (G-SAP 1.0).Under this, the RBI will purchase government securities of Rs. 40,000 crore on June 17, 2021. Of this, state development loans (SDLs) would be purchased up to Rs 10,000 crore, the RBI said in a release.

Indian rupee opened higher at 72.94 per dollar on June 11On June 10, rupee ended lower by 9 paise at 73.06 per dollar against June 10 close of 72.97.

Stocks In News

- IPCA Labs 13.09% more stake in Tropic Wellnes

- Solar Industries got a huge order from COAL INDIA –Solar Industries India secured multiple orders from Coal India having contract value of approximately Rs. 365 crore for the supply of Cartridge Explosives and Accessories over a period of two years.

- IT major Tata Consultancy Services (TCS) has expanded its strategic partnership with Virgin Atlantic, one of the UK’s leading airlines, to help the latter embark on a new phase of recovery and growth.

- Vakrangee board meeting will be held on June 19, to consider and approve the Scheme of Arrangement for demerger of Physical Vakrangee Kendra and Digital Vakrangee Kendra (Bharat Easy Super App). The demerger will unlock value of both businesses and would result in shareholder value maximization.

- Yes Bank – The Board of Directors of the Yes Bank at its meeting held on June 10, has approved borrowing/raising funds in Indian/foreign currency up to an amount of Rs. 10,000 crores by the issue of debt securities.

Earning News

Lumax Industries Q4 earnings (YoY)

Net profit surged by 38.8% YoY to Rs. 22.7 crore Vs. Rs. 16.3 crore

Revenue rose by 30.2% YoY to Rs. 504.4 crore Vs. Rs. 387.3 crore

EBITDA up by 28.5% YoY to Rs. 49.6 crore Vs. Rs. 38.6 crore

Deccan Cements Q4 earnings (YoY)

Net Profit at Rs 22.1 cr Vs loss of Rs 3 cr

Revenue up by 72.8% to Rs. 213.8 crore Vs. Rs. 123.7 crore

EBITDA at Rs. 37 crore Vs. Rs. 11.3 crore