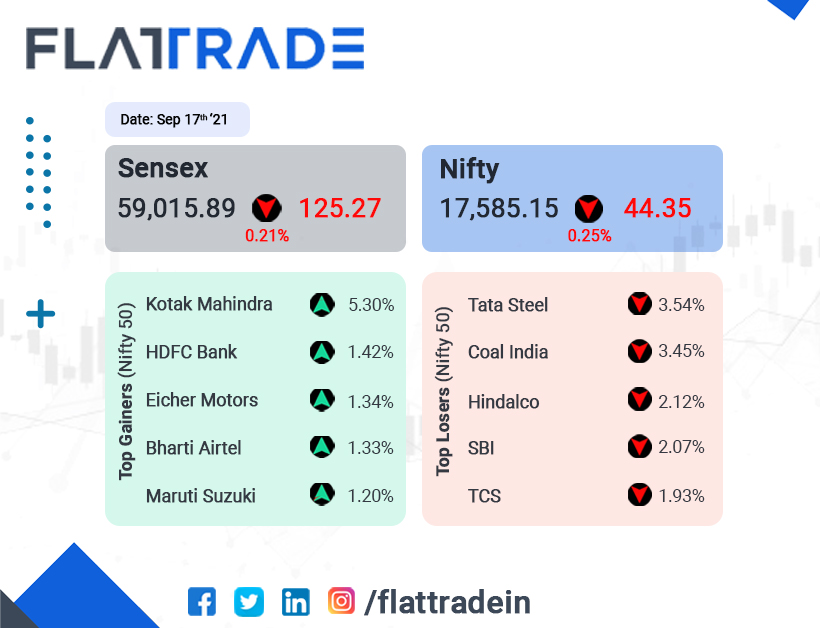

Benchmark Indian stock indices rose to record highs in the first half of the session on Friday, but gave up its gains and closed lower, weighed by PSU Bank, metal, energy and pharma stocks. The Sensex closed 0.21% lower at 59015.89 and Nifty ended 0.25% down at 17585.20.

Top losers among sectors in NSE were PSU Bank (-2.96%), Metal (-2.38%), Energy (-1.02%) and Pharma (-0.94%). Gains in 3 private bank stocks – Kotak Mahindra (5.30%) and HDFC Bank (1.42%) and Axis Bank (0.59%) – helped Nifty Bank (0.38%) index to close in the green.

Indian rupee gained 4 paise against the US dollar to close at 73.48 on Friday.

Stock in News Today

IndiGo and SpiceJet: Share of InterGlobe Aviation, parent company of IndiGo airlines, surged on rising optimism over demand recovery in the aviation sector. Spicejet share prices also surged more than 7% in intraday trade. Indigo shares closed 10.92% higher at Rs 2196.05 and Spicejet shares close 3.42% higher at Rs 78.55.

IDFC Ltd: The board of directors of IDFC and IDFC Financial Holding Company Ltd (IDFC FHCL) approved to divest the mutual fund business — IDFC Asset Management Company (IDFC AMC) Ltd. IDFC AMC is the direct subsidiary of IDFC FHCL and indirect subsidiary of IDFC. IDFC held 99.96% in IDFC AMC as of March-end in FY21. IDFC AMCs average assets under management for the June quarter stood at Rs 1,26,070 crore, according to AMFI data.

Poonawalla Fincorp: The NBFC’s shares tanked 5% and hit the lower circuit after its MD, Abhay Bhutada, resigned a day after the SEBI barred him from dealing in securities for allegedly using price sensitive information in trading in the shares of Magma Fincorp before it was acquired by the Poonawalla Group. the company’s group CEO Vijay Deshwal is expected to continue to oversee the company’s operations.

eClerx Services: The company’s board has approved buyback of Rs 303 crore-worth of shares at Rs 2,850 per equity share. The company will buy back 10.6 lakh shares — equivalent to 3.1 percent of equity. It has set a record date of September 30.

CESC: Shares of the power utility company rallied 10% to Rs 96.75 in intra-day trade on the BSE after the 1:10 stock split came into effect. The the record date for the stock split in the ratio of 1:10, i.e. a equity share with the face value of Rs 10 to be sub-divided into 10 equity shares with a face value of Re 1 each, was September 17,2021. CESC said it is focusing on optimising costs and increasing non-tariff revenue by leveraging its reach in the market.