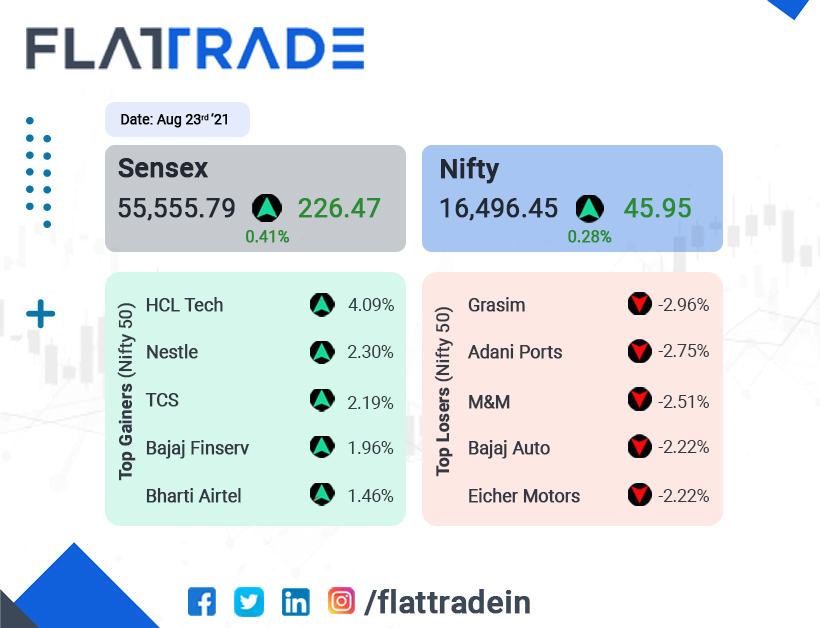

Indian indices closed higher on Monday, boosted by gains in IT sector and stocks with higher weightage like RIL and HDFC Bank. The Sensex closed 0.41% higher to 55,555.79 and the Nifty closed up 0.28% to 16,496.45.

Nifty IT rose 1.70%, RIL and HDFC Bank gained 0.66% and 0.65%, respectively. Top 3 losers in Nifty were Grasim Industries (-2.96%), Adani Ports (-2.75%) and M&M (-2.51%).

Indian rupee gained 19 paise to close at 74.21 against the US dollar.

Stock in News Today

Adani Enterprises: The company’s shares slipped 2.34% on Monday after capital market regulator SEBI put on hold Adani Wilmar’s IPO due to an investigation against Adani Enterprises. Adani Enterprises owns 50 percent of Adani Wilmar and Adani Group’s spokesperson said that they have not received any communication from SEBI with respect to the IPO observations being kept in abeyance.

HCL Technologies: The IT major has signed a deal with Germany’s reinsurer Munich Re to transform the reinsurer’s digital workplace services in 40 countries. The company said it will adopt a strategy that will support the reinsurers global workforce in multiple languages, implement a highly personalized service desk solution and leverage automation to improve efficiency.

Tata Motors: The automaker plans to launch a new mini SUV Punch during the Diwali festive season. Punch is based on the H2X concept and it will be priced below Nexon. “Tata PUNCH, as the name suggests, is an energetic vehicle with a capability to go anywhere,” said Shailesh Chandra, President Passenger Vehicle Business Unit, Tata Motors.

Nuvoco Vistas: The cement maker had a weak debut in Indian stock exchanges as the company’s shares fell 17% to Rs 471 from its issue price of Rs 570 per share. The company is the fifth largest cement maker in India with a very strong presence in Eastern part of India. However, the stock recovered and closed 7.13% at Rs 529.35.

HDFC Bank: The bank is planning to regain its lost market share in the credit card market within one year, said Parag Rao, its group head for payments and consumer finance, digital banking and IT. The bank will aim for 3 lakh monthly new credit cards in the first three months and will try to achieve higher sales number in the coming months after two quarters.