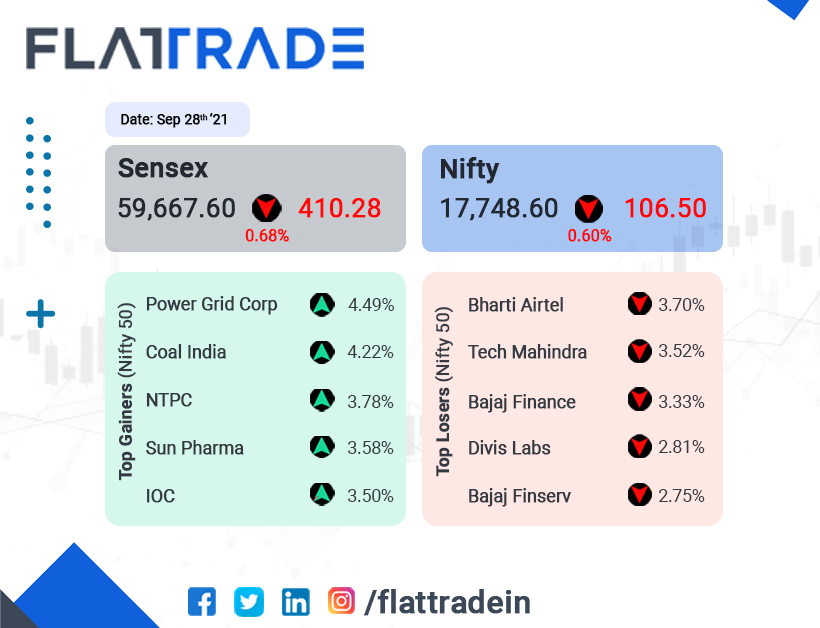

Benchmark Indian stock indices fell, weighed by IT companies and private sector banks, in a volatile trading session. The Sensex closed 0.68% lower at 59667.60 and Nifty was down 0.60% at 17748.60.

Top gainers were Nifty Energy index which jumped 2.01%. PSU Bank advanced 1.24% and Metal rose 0.55%. Nifty Realty (-3.02%) was the biggest loser. Nifty IT fell 2.20%. Private bank index was down 0.74%.

Indian rupee fell 20 paise to close at 74.04 against the US dollar.

Stock in News Today

Larsen & Toubro Infotech Ltd (LTI): The company has signed a strategic deal with eClinicalHealth for accelerating digital innovation in R&D Clinical Trials Management process for patient centric drug development. The company expects faster deployment of Clinpal, a leading cloud-based digital patient recruitment and engagement platform. LTI will also make use of exponential technologies such as analytics and AI to enhance patient engagement and faster clinical studies.

BHEL: The company’s shares rose after it was awarded an order for the supply of an upgraded Super Rapid Gun, the main gun used in most warships in Indian Navy, by Goa Shipyard. The order includes supply, installation and commissioning of the entire system and the guns will be manufactured by the company’s unit in Haridwar.

Lupin Ltd: The pharma company is planning to enter the diagnostics sector, with a formal launch expected in October, according to Business Standard news report. Lupin Diagnostics will be a part of Lupin Healthcare and will be a fully-owned subsidiary of Lupin. Lupin is hiring staff for the new business and finalising franchise partners. It is also setting up a 45,000 sq ft laboratory in Navi Mumbai.

Tata Consultancy Services: The IT services company has signed a deal with NORD/LB, a leading German commercial bank, as its strategic partner for the bank’s IT transformation. The deal is for five years and TCS will work with the bank to simplify and transform its various businesses –financial markets, wholesale and retail banking, through application consolidation and automation.

Cera Sanitaryware: Shares of the company surged nearly 12% in intraday trading on positive outlook and improved demand for its sanitaryware, faucetware and tiles. The company has a installed capacity of manufacturing 30,000 metric tonnes per annum of ceramic sanitaryware and installed capacity of 21 lakh pieces per annum of faucet ware .

REC Ltd: The public sector enterprise is planning to raise up tp Rs 85000 through issuance of non-convertible bonds or debentures and it has received shareholders’ approval for the fund raising. Further, it had said the amount planned to be raised shall be within the overall revised borrowing limit, being proposed for approval by the shareholders.

KIOCL Ltd: The National Financial Reporting Authority (NFRA) has found errors in the company’s financial statements for the fiscal year 2019-20 and has flagged that the company’s accounting policy for foreign exchange forward contracts was “erroneous”. The regulator has also recommended that KIOCL to examine, prepare and publish restated financial statements, if necessary, as per Ind AS 8 and Section 131 of the Companies Act, 2013.