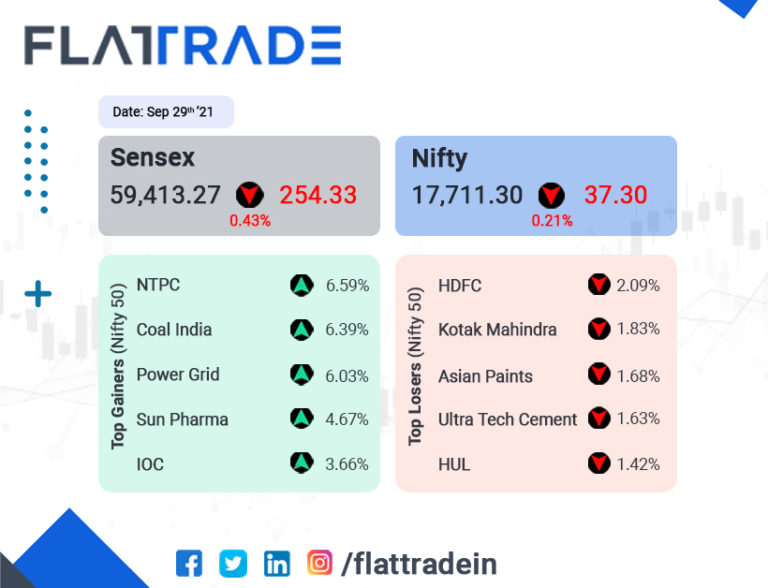

Benchmark Indian stock indices closed lower, weighed by losses in banking, FMCG, auto stocks and RIL. The Sensex fell 0.43% to 59,413.27, while the Nifty 50 Index fell 0.21% to 17,711.30.

Nifty Bank fell 0.53%, FMCG dropped 0.52% and Auto lost 0.38%. RIL was down 0.79%.

Indian rupee lost 10 paise to 74.15 against the US dollar on Wednesday.

Stock in News Today

Reliance Industries: The conglomerate said Saudi Aramco Chairman Yasir Al-Rumayyan met all regulatory criteria for his appointment as an independent director, pending a shareholder approval on the decision. The voting to confirm Al-Rumayyan’s appointment for a period of three years will end on October 19. In a stock exchange filing, RIL said that the appointment will help strengthen the Board’s diversity and skill-sets and benefit Reliance through the transition from oil to chemicals and the aim to achieve Net Carbon Zero by 2035.

Godrej Properties: The company plans to redevelop a land parcel in Wadala, Mumbai which is spread across 7.5 acres. The residential project will offer approximately 16 lakh square feet of saleable area comprising primarily of residential apartments of various configurations.

HDFC Bank: The private-sector lender said it has issued 4 lakh credit cards since the embargo imposed on it by the RBI was lifted. The number of card issued is as of September 21, 2021, and marks the aggressive growth plan the bank has embarked on post the embargo.

Larsen & Toubro Ltd: The company is in talks to merge its thermal power business with the Indian unit of Sembcorp Industries Ltd., a Singapore-based company, according to people with knowledge of the matter, Bloomberg reported. The share-swap deal will help L&T to pare debt and the transaction could value the combined business at around $4.5 billion including deb, according to the sources.

Britannia Industries: The company has partnered with Accenture, a global IT and professional services company, to speed up its digital transformation across multiple retail channels. In a joint statement, they said the digitization process will capture value and improve the customer and supplier experience.

Blue Star: The air conditioning and commercial refrigeration company plans to invest about Rs 550 crore over the next few years for setting up a greenfield manufacturing plant at Sri City, in Andhra Pradesh. The company expects the first phase of construction of 30,000 sq meters to be completed by July 2022. The company said the facility will be operational by Q2FY23 and will primarily manufacture room ACs with a maximum capacity of 12 lakh units per annum.

Piramal Enterprises Ltd: The company said it has completed the acquisition of the bankrupt Dewan Housing Finance Corporation Ltd (DHFL) according to the resolution plan. Piramal acquired DHFL for a total consideration of Rs 34,250 crore which includes an upfront cash component of Rs 14,700 crore and issuance of debt instruments of Rs 19,550 crore (10-year NCDs at 6.75% per annum on a half-yearly basis).

Morepen Laboratories: The company’s shareholders have approved to spin-off its medical devices business into a newly incorporated wholly-owned subsidiary. Morepen Devices Ltd, the new technology focused company, will have the ability to raise capital to make investment on innovation, research, capacity expansion and promotion of its products and fund its growth.