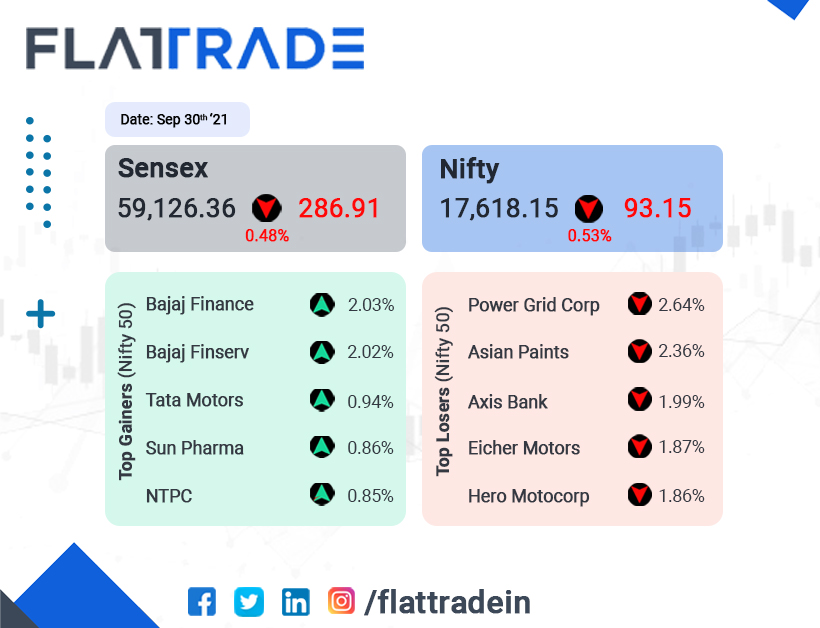

Benchmark Indian equity indices closed lower, dragged by losses in metals, banking and technology stocks. The Sensex closed 0.48% lower at 5916.36 and Nifty was down 0.53% at 17618.15.

Nifty Metal was down 0.88%, Bank lost 0.84% and technology index fell 0.72%.

Indian rupee fell 8 paise to 74.24 against the US dollar.

Stock in News Today

TCS & MCX: Tata Consultancy Services (TCS) has been selected by the Multi Commodity Exchange India (MCX), as the technology solution provider for its growth and transformation journey. TCS will help MCX build a new technology core, transforming its trading platform as well as post-trade functions, the IT firm said.

IRCTC: The company has fixed October 29, 2021 as the record date for the proposed 5-for-1 stock split. The company’s board in August 2021 had recommended for sub-division of one equity share of face value of Rs 10 each into five equity shares of face value of Rs 2 each.

NTPC: The company’s renewable energy arm NTPC Renewable Energy Ltd (REL) and Bank of India has signed the first green term loan agreement of Rs 500 crore. The loan agreement is for its two solar projects coming up in Rajasthan and Gujarat.

ONGC: The company’s overseas arm ONGC Videsh has drilled its first well in Bangladesh at Kanchan #1. This exploratory well will be drilled to a depth of 4,200 metres and will be targeting two prospective formations. It will be followed by drilling at two more exploratory locations, the company said.

Airtel: The company’s subsidiary Nxtra said it will make an investment to the tune of Rs 5,000 crore to triple its data centre capacity by 2025. The company said it will set up seven hyperscale campuses and increase the share of green power in running data centres to 50% from 35% at present.

Tata Steel: The company’s subsidiary T S Global Holdings (TSGH) Singapore has executed definitive agreements with TopTip Holding, a Singapore-based steel and iron ore trading company, to sell its entire equity stake in NatSteel Holdings for an equity value of Rs 1,275 crore. But, the wires business of NatSteel in Thailand has been retained by Tata Steel as part of the downstream wires portfolio.

State Bank of India: The public-sector lender has turned down Andhra Pradesh government’s Rs 6,500 crore ‘overdraft’ for implementing the Centrally Sponsored Schemes (CSS) in the state. The state government sought the overdraft to be used as working capital by five nodal implementing agencies “against securitisation of fund balances available in the Single Nodal Accounts” as its coffers have become dry.

IDBI Bank: Shares of the bank rallied after rating agency ICRA revised the company’s ratings. The bank in an exchange filing said the rating agency has upgraded its existing rating to ICRA A+ from ICRA A for Infrastructure bonds, Flexi Bond, Senior & Lower Tier II bonds and Subordinate debt.