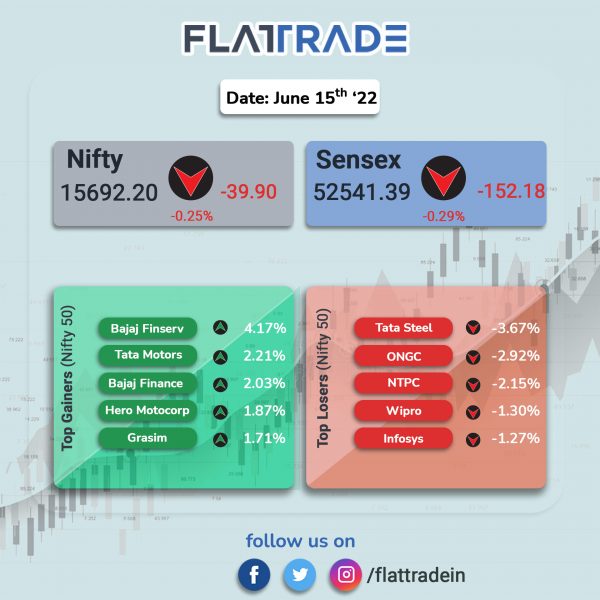

Benchmark equity indices fell as investors stayed on the sidelines ahead of the US Federal Reserve’s interest rate decision. The Sensex fell 0.29% and the Nifty 50 dropped 0.25%.

Broader markets outperformed headline indices. The Nifty Midcap 100 rose 0.39% and the BSE Smallcap gained 0.49%.

Top Nifty sectoral losers were Energy [-1.19%], Metal [-0.73%], Realty [-0.61%], IT [-0.5%] and FMCG [-0.45%]. Top gainers were Auto [0.92%], Pharma [0.35%] and Financial Services [0.27%].

Indian currency fell 15 paise to 78.10 against the US dollar on Wednesday.

Stock in News Today

Adani Transmission Limited (ATL): The company said its $700 million revolving loan facility has been tagged as ‘green loan’ by Sustainalytics. The projects associated with the $700 million revolving facility are being implemented in Gujarat and Maharashtra.

One 97 Communications (Paytm): Shares of the company closed nearly 2% higher after it posted a strong business update. The company said that its lending business rose 471% YoY in the two-months ending May. Loan disbursement during the two months ending May came in at 5.5 million and the loan value is Rs 3,576 crore. The company also continued it leadership in offline payments, with 3.4 million devices deployed for the purpose. Merchant payment volumes for the two months ending May also rose 105% YoY to Rs 1.96 lakh crore.

Delta Corp: Shares of the company fell after ace investor Rakesh Jhunjhunwala informed exchanges that he has trimmed his holding in the company. After the sale, Rakesh Jhunjhunwala holds 90,00,000 shares of the company (3.3652%) share capital.

Genesys International: The 3D mapping company surged 5% after the company received investment of Rs 250 crore equity. Malabar India Fund and marquee investors, including Sundar Iyer, Mathew Cyriac, Inder Soni, Vijay Karnani, participated in the investment round, the Mumbai-based company said in an exchange filing.

JSW Steel: The company’s crude steel production in May on a standalone basis jumped 31% to 17.89 lakh tonnes. The crude steel output in May of FY21 was 13.67 lakh tonnes. The company of said that production of flat-rolled products also expanded by 29% to 12.84 lakh tonnes for the month compared to 9.99 lakh tonnes in the same month last fiscal.

Canara Bank: The lender in an exchange filing said that it will consider capital raising plan for the financial year 2023 on June 24.

GAIL India: Shares of the company rose after Morgan Stanley reiterated Overweight rating and a target price of Rs 209 apiece. The investment and brokerage firm Morgan Stanley is upbeat about the company’s stock as declining Henry hub gas prices, uptick in domestic demand and higher LPG prices will aid earnings.

GR Infrprojects: Shares of the company extended its losing streak for the fifth day after the company said in an exchange filing that CBI filed FIR under Prevention of Corruption Action Against G R Infraprojects and three of the company’s officials. The CBI conducted raids at the residence of chairman Vinod Kumar Agarwal and the corporate office in Gurugram.

NTPC: The state-run power major declared commercial operation of second part capacity of 15 MW out of 56 MW Kawas Solar PV project in Gujarat. With this, standalone installed and commercial capacity of NTPC will be 54,666.68 MW, while group installed and commercial capacity of NTPC will become 69,031.68 MW, it added.