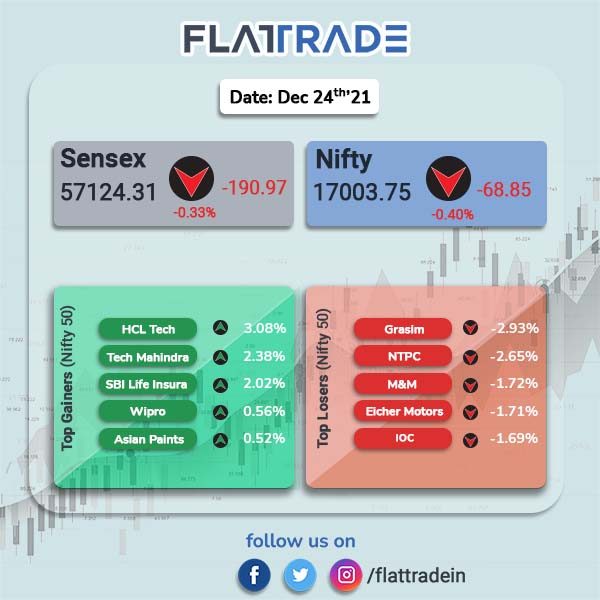

Sensex and Nifty closed lower, weighed by banking, energy, pharma and auto stocks. Sensex closed 0.33% lower at 57124.31 and Nifty fell 0.40% to 17003.75.

Broader markets also fell tracking benchmark indices. Nifty Midcap 100 lost 1.05% and BSE Smallcap dropped 0.60%.

Top losers were Nifty PSU Bank [-1.94%], Nifty Energy [-1.23%], Pharma [-1.12%] and Auto [-1.03%]. Nifty IT index was the only index that closed in the green as it rose 0.98%.

Indian rupee rose 22 paise to close at 75.02 against the US dollar on Friday.

Stock in News Today

L&T Finance Holdings (LTFH): Shares of the company closed 6.9% lower after the company said it would divest its asset management business. The company entered into a agreement with HSBC Asset Management India (HSBC AMC) to sell its wholly-owned subsidiary L&T Investment Management (LTIM) for an aggregate amount of $425 million.

Tata Consultancy Services (TCS): Shares of the company rose before paring its gains to close 0.22% higher after the company was selected by la Mobiliere, the oldest private non-life insurer in the Swiss market, to drive its digital transformation agenda. In an exchange filing, TCS said that it will help modernise the insurer’s I.T. estate with core system simplification, cloud adoption and application transformation.

SBI Cards & Payment Services Ltd: The company has approved the allotment of 6,500 fixed rate, unsecured, rated, taxable, redeemable, senior, listed non-convertible debentures of face value of Rs 10 lakh each, totalling to Rs 650 crore on private placement basis. In an exchange filing, the company said that the bonds will have an interest rate of 5.82% per annum for a tenure of 3 years. The final interest payment is set for December 24, 2024, when the debentures shall be redeemed.

HCL Technologies: Shares of the IT major surged almost 5% to trade at Rs 1,283.8 apiece in early trade on Friday, backed by heavy volumes after several large deals on the exchanges. However, shares of the company closed 3.08% higher tracking broader market sentiments. The stock’s rally came after the promoters of the IT giant announced to buy 45 lakh shares of the company through a block deal, according to CNBC Awaaz report on Dec 23.

Data Patterns: The company had a strong market debut, as its shares listed at Rs 864, a 48 per cent premium over its issue price of Rs 585 per share on the BSE. Shares of the company closed at Rs 754.85 per equity share.

Lupin Ltd: The pharma company said that it has received a tentative approval from the US health regulator for its generic Azilsartan Medoxomil tablets to treat high blood pressure. In a regulatory filing, the company said that the approval is for tablets strengths of 40 mg and 80 mg.

Ajanta Pharma: Shares of the company closed 3.16% higher after the company said that its board will meet on Tuesday, December 28 to consider a share buyback plan.

Sigachi Industries Ltd: The company received a Letter of Intent from Grasim Industries Ltd. for the operations and management of the three Chlorine Product Plans. In an exchange filing, Sigachi said that the agreement shall be for an amount of Rs 20 crore over a period of three years.

Surya Roshni: The company has won an order of Rs 124.35 crore (excluding GST) from IHB for the supply of API 5L Grade 3LPE coated pipes for LPG pipeline project from Kandla (Gujarat) to Gorakhpur (UP).

Ipca Laboratories Ltd: The company has fixed January 11, 2022 as the ‘record date’ for the members entitlement of sub-divided shares. Each fully paid-up equity share of Rs 2 each of the company is being divided into two shares of Rs 1 each.

Allcargo Logistics Ltd: The company has approved the demerger of container freight stations/inland container depots business into Allcargo Terminals Ltd. In an exchange filing, Allcargo Logistics said that the move will help the company accelerate growth, adding that the scheme is yet to be approved by NCLT.