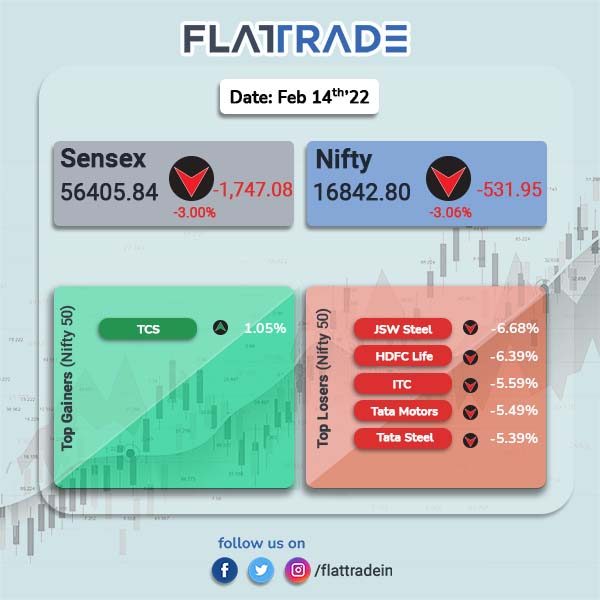

India’s equity indices tanked as investors’ worries exacerbated amid decline in global equities, escalating geopolitical tensions, surging crude prices and inflationary pressure. The Sensex and the Nifty tanked 3% and 3.06%, respectively. TCS [1.05%] was the only stock in benchmark index that ended in green.

Broader markets also fell mirroring benchmark indices. Nifty Midcap 100 plunged 3.94% and BSE Smallcap crashed 4.15%.

Top losers were Nifty PSU Bank [-5.95%], Realty [-5.29%], Metal [-5.06%], Media [-4.22%], Bank [-4.18%%]. All sectoral indices were affected severely by negative global cues.

Indian rupee lost 23 paise to 75.61 against the US dollar.

Stock in News Today

Reliance Industries Ltd (RIL): The company’s telecom arm Jio has announced its foray in satellite-based broadband communication with a tie up with Luxembourg-based firm SES. The two companies will form a joint venture with Jio Platforms Ltd and SES owning 51 per cent and 49 per cent stake, respectively.

Adani Wilmar: The company reported 66% jump in consolidated net profit at Rs 211 crore for the quarter ending December 2021, as against a net profit of Rs 127 crore in the year-ago period. The company’s consolidated revenue from operations rose 40% to Rs 14,379 crore in Q3FY22, as compared to Rs 10,229 crore in Q3FY21.

SpiceJet Ltd: Kalanithi Maran and KAL Airways informed the Supreme Court that SpiceJet’s offer of Rs 600 crore towards full and final settlement of the share transfer dispute was not acceptable. Maran told the top court that the dues to their side comes up to Rs 900 crore

Bharat Heavy Electricals Ltd (BHEL): The state-owned company said that it has bagged an order from Hindustan Aeronautics Ltd to supply compact heat exchanger sets for 83 LCA Tejas aircraft. The order envisages manufacturing, assembly, testing and supply of compact heat exchangers to be fitted in the light combat aircraft, Tejas, which is being manufactured by HAL.

Cadlia Healthcare Ltd: The company said its group firm Zydus Pharmaceuticals (USA) Inc has received final approval from the US health regulator to market its generic version of Roflumilast tablets in the strength of 500 mcg indicated to reduce the risk of chronic obstructive pulmonary disease (COPD) exacerbations. Zydus is eligible for 180 days of shared generic drug exclusivity, Cadlia Healthcare said in a regulatory filing.

RattanIndia Enterprises: The company announced the launch of its all-digital, financial aggregator platform, BankSe on mobile android and through web portal, www.bankse.in. The company aims to tap into the under penetration of credit in India with the country’s consumer lending market at Rs 32.8 lakh crore, as on FY20.

Glenmark Pharma: The drug maker has announced that its subsidiary Glenmark Pharmaceuticals Colombia and Astrazeneca Colombia entered into an exclusive licensing agreement for the commercialization of Astrazeneca’s drug Pulmicort Respules. Glenmark will be responsible for the commercialisation of Pulmicort respules in the Colombian market.

Ipca Labs: The company’s net profit fell 26% YoY to Rs 197.91 crore. Revenue rose 1.4% YoY to Rs 1,430.47 crore. Total costs edged up 7.6% YoY to Rs 1,182.74 crore.

Grasim Industries: The company’s standalone net profit rose 45.99% to Rs 522.47 crore in Q3FY22 as against Rs 357.87 crore during the previous quarter ended December 2020. Sales rose 56.49% to Rs 5784.74 crore in Q3FY22, as against Rs 3696.61 crore during the year-ago period.

KNR Constructions: The company’s net profit declined 48.94% to Rs 49.81 crore in the quarter ended December 2021 as against Rs 97.55 crore during the same quarter a year ago. Sales rose 16.32% to Rs 854.64 crore in the quarter ended December 2021 as against Rs 734.71 crore in the year-ago period.

Liberty Shoes: The company’s net profit declined 13.34% to Rs 5 crore in Q3FY22 as against Rs 5.77 crore in Q3FY21. Sales rose 3.05% to Rs 151.90 crore in Q3FY22 as against Rs 147.41 crore in Q3FY21.

Mrs. Bector Food Specialities: The company’s consolidated net profit dropped 25% to Rs 16 crore on a 17% rise in revenues to Rs 263 crore in Q3FY22 over Q3FY21. The board has declared an interim dividend of Rs 1.25 per equity share on face value of Rs 10 apiece for the fiscal year 2022.

Bharat Dynamics: The company’s net profit surged 333.54% YoY to Rs 213.26 crore in Q3FY22. Revenue from operations increased 75.13% YoY to Rs 803.90 crore in the reported quarter.