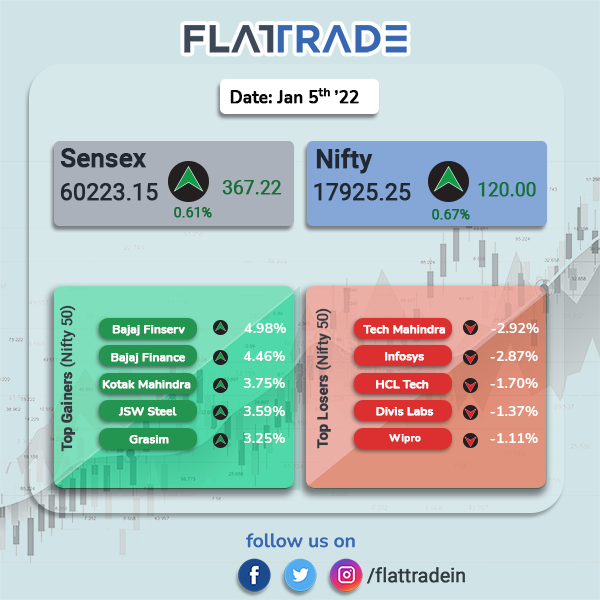

Domestic equity indices rose for the fourth consecutive day led by gains in banking, metal and auto stocks. The Sensex closed 0.61% higher to 60223.15 and Nifty rose 0.67% to 17925.25.

Top gainers in Nifty sectoral indices were Bank [2.32%], Metal [1.38%], Realty [1.20%], Commodities [1.17%] and Auto [1.05%]. Top losers are Nifty IT [-1.93%], Media [-0.44%] and Pharma [-0.29%].

Indian rupee rose 19 paise to 74.36 against the US dollar.

Stock in News Today

Adani Enterprises Ltd: The company has won a contract from NTPC and it will supply 1 million tonnes of overseas coal to India’s top electricity generator. Kolkata-based Damodar Valley Corp. Ltd., also state-owned, is examining a proposal from Adani for the supply of the same volume to its power plants, the people said.

Bajaj Finance: The company’s assets under management rose to Rs 181,300 crore in Q3FY22 from Rs 143,550 crore in the year-ago period, the NBFC said. The company clocked 74 lakh new loans in the December quarter, up from 60 lakh loans in the same quarter of the previous year. Consolidated liquidity surplus stood at approximately Rs 14,300 crore as of December 31, 2021, Bajaj Finance said in the quarterly update.

Future Retail: The company shares fell 2.23% after the Delhi High Court dismissed Future Retail’s appeal to declare arbitration proceedings with Amazon as illegal. Future Retail on Wednesday appealed again in the Delhi High Court and the case is likely to be heard by a two-judge bench during the day.

Bharti Airtel Limited: The telecom operator and Hughes Communications India Pvt Ltd (HCIPL), a majority-owned subsidiary of Hughes Network Systems LLC, a satellite and multi-transport technologies and networks company announced the creation of a joint venture to provide satellite broadband services in India. “With the combined capabilities of Airtel and Hughes, customers will get access to next generation satellite connectivity backed by proven enterprise grade security and service support,” said Ajay Chitkara, director and chief executive officer, Airtel Business.

Larsen & Toubro: The company’s heavy engineering arm has won significant contracts for its various business segments in the third quarter, according to its exchange filing. The orders are in the range between Rs 1,000 crore and Rs 2,500 crore. A hydrocabon sector customer in Middle East has awarded an order to the modification, revamp and upgrade business of L&T Heavy Engineering. MRU business also bagged a project for revamp of Fluid Catalytic Cracking system from hydrocarbon sector customer in Middle East The company also secured a project for the expansion of Barauni Refinery by India Oil Corporation.

TVS Motor Company: The two-wheeler company has appointed Venkat Viswanathan as the technical advisor for its electric mobility division. Viswanathan is currently an associate professor of Mechanical Engineering at Carnegie Mellon University and is a global leader in advanced batteries for electric mobility.

Macrotech Developers Ltd (Lodha): The company in an exchange filing said that its projects in London had achieved total sales of £191 million or Rs 1900 crore in the Q3FY22. In the past two quarter, the company has achieved almost £300 million of pre-sales, the developer said. “With these two quarters of strong performance, the $225 million bond is likely to be repaid fully in next four months from the sales proceeds, well in advance to its scheduled maturity of March 2023,” the company said.

NELCO Ltd: Shares of the company rose 5% after the company bagged contract from ONGC to enhance its communication infrastructure at offshore sites. The order pertains to supply, commission and maintenance of ONGC’s captive very small aperture terminal (VSAT) based network. Nelco will revamp the captive network of ONGC and enable voice and data communication between offshore installations and onshore locations.

Thermax: Shares of the company jumped 1.88% as the energy player bagged an order of Rs 545.6 crore for two flue-gas desulphurisation (FGD) systems. The order is from an Indian power public sector company to set up FGD systems for its two units of 500 megawatts (MW) capacity each in Uttar Pradesh.