Domestic benchmark equity indices suffered heavy losses tracking a sell-off across global markets.

All sectors and broader markets tanked on Dalal Street, with financial, automobile, oil & gas and metal stocks being the worst hit, while technology sector stocks closed in the green.

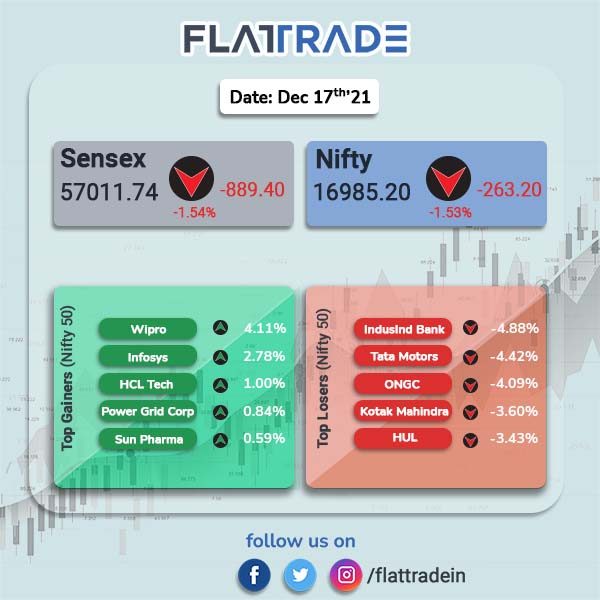

The Sensex closed 1.54% lower at 57011.74 and the Nifty tanked 1.53% to 16985.20. Index heavyweights like Reliance Industries and financial stocks plunged by 1.7% to 4%.

Reliance Industries fell 2.64%. Nifty Bank index tanked 2.54%, Nifty Auto lost 2.44%, Nifty FMCG fell 2.17% and BSE Energy was down 2.59%. Nifty IT was the only index which closed 1.35% higher.

Indian rupee fell to close at 76.08 against the US dollar on Friday.

Stock in News Today

Hindalco Industries Ltd: The company has signed a pact to acquire Hydro’s aluminium extrusions business in India for an enterprise value of Rs 247 crore. This will extend Hindalco’s footprint in South India, which is also the second largest extrusions market in India. The deal will expand company’s presence in the upper-end of the value-added market.

Persistent Systems: Shares of the company closed 3.03% higher after the company said it has been selected by ATOSS, a Germany-based software provider for workforce management with over 10,000 customers worldwide, to transform its customer relationship management with the help of Salesforce integrations. ATOSS will use the Salesforce platform to automate sales, integrate with existing back-end systems and introduce customer service and event management.

Tata Motors: The auto major said it has joined hands with the Maharashtra government to support setting up of a registered vehicle scrapping facility (RVSF) in the state. Under the MoU, the company and the state will set up a scrappage centre with a recycling capacity of up to 35,000 vehicles a year for end-of-life passenger and commercial vehicles.

Burger King India Ltd: The company has approved the acquisition of controlling stake in PT Sari Burger Indonesia. In an exchange filing on Thursday, Burger King said that it will acquire 83.24% stake from current shareholders of PT Sari Burger at an enterprise value of $183 million. Post the acquisition, the company will infuse $40 million fresh capital to support future business needs, expansion plans and further acquisitions.

Airtel: The telco has paid up Rs 15,519 crore to the government as pre-payment of the entire liability of spectrum it acquired in 2014 auctions, the company said in a statement. The company estimates that the prepayment will likely result in interest cost savings of at least ₹3,400 crore over the residual life for fully substituted capital.

RateGain Travel Technologies: The SaaS company made a weak stock market debut, as it got listed at 15% below its issue price. The stock got listed at Rs 360, a 15 per cent discount to its issue price of Rs 425 per share on the National Stock Exchange. Shares of the company closed almost 20% lower at Rs 340.05.

Indiabulls Housing Finance: Shares of the company closed 8.21% lower after the company’s main promoter Sameer Gehlaut sold 11.9% stake in housing finance company via open market deals on Thursday. With this sale, Sameer Gehlaut and his promoter companies now own 9.8 per cent of the company.

Greenlam Industries Ltd: The company has received permission to resume manufacturing activity at its Behror plant in Rajasthan. Greenlam said that it has the permission to run its manufacturing activity for 5 days per week without any restrictions on number of hours per day . The company had temporarily closed down the manufacturing activities at the plant on directions from Commission for Air Quality Management in National Capital Region and adjoining areas on December 10.

KEC International Ltd: The Engineering, Procurement, Construction company has won new orders of Rs. 1,041 crores across its various businesses. It has secured for Transmission & Distribution projects in India, Middle East and Americas. In addition, the business has also secured an order for building a Data Centre in Western India and orders for various types of cables in India and overseas. With these orders, their year-to-date order intake stood at Rs. 12,000 crore, it said in a regulatory filing.