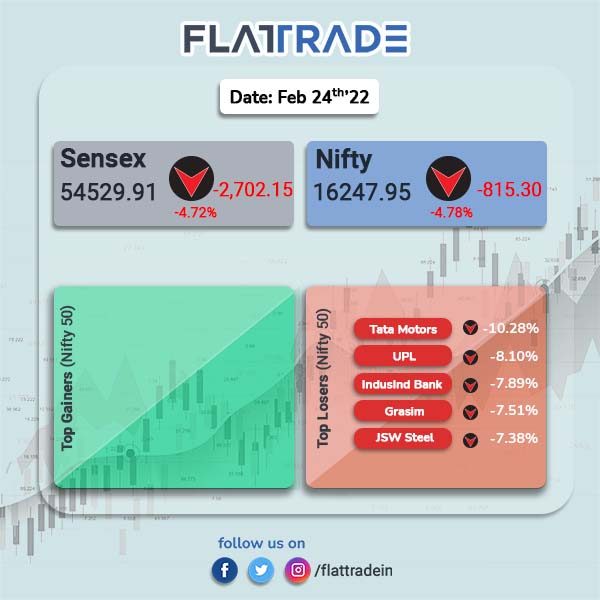

Indian markets went into a tailspin, mirroring global markets, as Russia invaded Ukraine. The Sensex tanked 4.72% and Nifty plunged 4.78%.

Broader markets also lost heavily. Nifty Midcap fell 5.74% and BSE Smallcap was down 5.77%.

Top losers were PSU Bank [-8.26%], Realty [-7.17%], Media [-6.95%], Auto [-6.26%], Private Bank [-5.98%]. Other sectoral indices also closed in red.

Indian rupee tanked Rs 1.10 to 75.65 against the US dollar. Brent crude soared 7.66% to $104.26 per barrel. Spot gold surged 2.7% to 1960.54 per ounce.

Stock in News Today

Indian Oil Corp (IOC): The company has bought Russian Urals crude for the first time in two years, after spot differentials slumped, according to trade sources and Refinitiv data, reported Reuters. The opportunity for India to buy more of the Russian flagship grade after its discount to global benchmark Brent fell to the widest since 2005, hit by rising tensions between Russia and the West over Ukraine.

Bharti Airtel: The telecom company announced that it has acquired a strategic stake in Singapore-based Blockchain platform Aqilliz for an undisclosed sum. Airtel aims to deploy Aqilliz’s Blockchain technologies at scale across its fast growing adtech (Airtel Ads), digital entertainment (Wynk Music & Airtel Xstream) and digital marketplace (Airtel Thanks App) offerings.

Hindustan Unilever Ltd (HUL): FMCG major has separated the position of chairman of the board and the chief executive officer & managing director (CEO & MD). The change will come into effect from March 31. The FMCG major has announced the appointment of Nitin Paranjpe, currently chief operating officer of Unilever as the non-executive chairman of the company and Sanjiv Mehta will continue as CEO & MD.

Reliance Retail: The retail arm of Reliance Industries continues to execute strongly and has grown its retail footprint by 39 per cent (in sq.ft) since pandemic, added multiple brands and expanded its digital commerce business, according to a report by foreign brokerage Bernstein. The report also said Reliance Retail is expected to grow at 30 per cent CAGR over FY22-25 while expanding margins.

IDBI Bank: The lender has informed the stock exchanges that its board has approved the re-appointment of Rakesh Sharma as the managing director and chief executive officer (MD&CEO) of the bank for a period of three years, effective March 19, 2022.

Saregama India: The company has approved sub-division of one equity share of the company having face value of Rs 10 each to 10 equity shares of face value of Rs 1 each. The share split is expected to be completed within two months from approval of shareholders.

Bharat Forge: The company has entered into a definitive agreement to acquire Coimbatore-based JS Autocast Foundry Private Ltd. JS Auto is a supplier of critical machined Ductile iron castings for wind, hydraulic, off-highway and automotive applications.

Federal-Mogul Goetze India: Shares of the company rose 9% in intraday trading but closed 5.55% higher after the company entered into a merger agreement with Pegasus Holdings. Pegasus Holdings made an open offer to buy 25.02% of the fully diluted voting share capital of the Federal-Mogul.