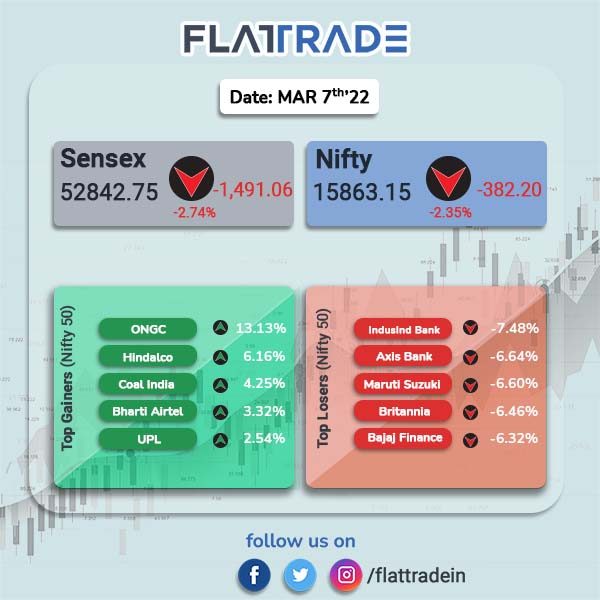

Benchmark equity indices witnessed a free fall as Nifty breached below the 15,900-mark. Investors were spooked as surging crude price amid the Russia-Ukraine war would lead to higher inflation in India. The Sensex plunged 2.74% an the Nifty tanked 2.35%.

Nifty Bank index fell 4.47% today. The index has entered bear market as it has fallen more than 20% from a high of 41,829.6 on October 25, 2021.

Brent Crude prices jumped to $124.96 per barrel and WTI Crude soared to $122.57per barrel.

Indian rupee plunged 80 paise to a new low of 76.96 against the US dollar.

Stock in News Today

Hindalco Industries: Shares of the company jumped 6.16% after research firm Jefferies maintained ‘buy’ call and raised its target price to Rs 700 from Rs 660 per share. The research firm also increased FY23-24 by 5-11 per cent on the back of higher aluminium prices. It is also noted that the company will have cost benefits as bulk of its coal requirements come from Coal India that is below-global prices.

Infosys Ltd: The company has announced collaboration with Telenor Norway to transform its finance and supply chain operations through standardized, Oracle Cloud ERP solution. “The ERP platform developed jointly by Telenor and Infosys enables Telenor Norway to drive operational excellence, which ultimately translates into a superior customer experience,” said Anand Swaminathan, EVP, Communications, Media and Technology, Infosys.

Larsen & Toubro: The company announced the launch of L&T SuFin, an integrated e-commerce platform for B2B industrial products and services. According to the company, the B2B e-commerce platform is expected to empower businesses, especially MSMEs, to enable them source their industrial supplies pan India, digitally and cost-effectively.

Bharti Airtel and Axis Bank: The two companies announced their strategic deal to strengthen India’s digital ecosystem through a range of financial solutions. Airtel and Axis Bank launched ‘Airtel Axis Bank Credit Card’. The two firms plan to bring several financial offerings and digital services for Airtel’s 34 crore customers, including co-branded credit card with pre-approved instant loans, BNPL offerings. The partnership is expected to improve penetration in tier-2 and tier-3 markets and enhance adoption to digital payments.

Tata Consultancy Services (TCS): The IT major has informed the exchanges that SEBI has given its observation to the draft letter of offer filed by the company regarding the buyback of equity shares. The date of opening of the buy back offer period is March 9 and it will close on March 23. The last date of settlement of bids on the stock exchanges is April 1, 2022.

Computer Age Management Services (CAMS): The company said it has acquired a majority stake in Fintuple Technologies, a fintech platform for alternative investment funds (AIFs) and portfolio managers. Fintuple was founded in 2018 and it offers services such as client digital on-boarding, KYC, fund data, fact sheets and analysis, and other digital support solutions for AIF and PMS. The company did not disclose the financial details of the deal.

JSW Energy: The company announced signing of a 35-year power purchase agreement (PPA) with Haryana Power Purchase Centre (HPPC) for the supply of 240-megawatt hydro power. The agreement was signed at a levelised ceiling tariff of Rs 4.50 per kWh (kilowatt-hour), JSW Energy said in statement.

Zydus Lifesciences: The company, earlier known as Cadila Healthcare, said it has received an approval from the Drug Controller General of India (DCGI) for Oxemia (Desidustat), a first-of-its-kind oral treatment for anaemia associated with chronic kidney disease (CKD).

Balkrishna Industries Ltd: The company said that it has commenced commercial production of brown field expansion and debottlenecking project at Bhuj Plant (Gujarat). The production of tyres will be increased up to 50,000 MTPA. The complete ramp-up in production is expected to be achieved in the next 6 months, the company added.

V-Mart Retail: The company rallied 3.38% and pared some gains to close 1.14% higher after SBI Mutual Fund (MF) bought 8.97 lakh equity shares or 4.54% stake of the company, last week. After this development, SBI Mutual Fund (MF) increased its shareholding to 8.7602% stake from 4.2153% stake held in V-Mart Retail.

Cantabil Retail: The company announced that it opened eight new showrooms across India during the month of February 2022. Post this, the company’s total number of showrooms/ shops now stands at 375. Cantabil Retail India (CRIL) is engaged in the designing, manufacturing, branding and retailing of apparel and apparel accessories for men, ladies and children in the middle to high-income segment through a pan-India network of exclusive brand outlets.

JK Cement: The company shares fell after it announced its foray into paints business. The company through a wholly owned subsidiary will foray into paint business.