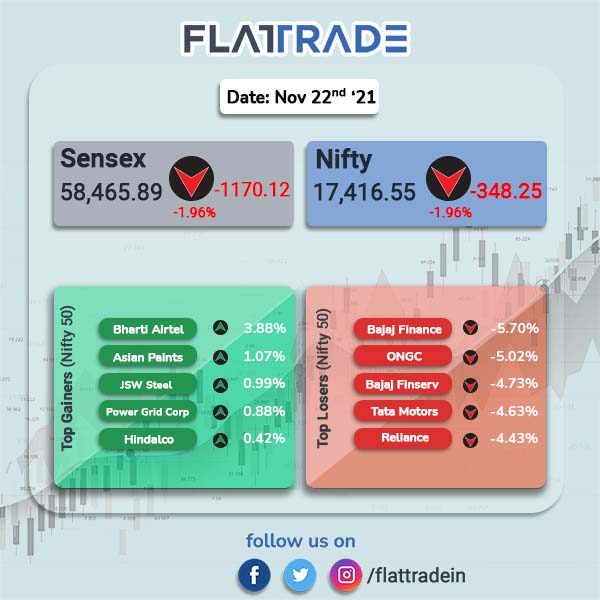

Dalal Street tanked as investors’ refrained from taking new bullish bets and due to heavy selling across sectors. The Sensex fell 1.96% to 58465.89 and Nifty tanked 1.96% to 17416.55.

Broader markets also plunged, tracking the benchmark indices. BSE Small cap index was down 2.96% and Nifty Mid cap 100 index lost 3.01%.

Top losers among Nifty sectoral indices were PSU Bank (-4.5%), Auto (-3.13%), Energy (-2.84%), Bank (-2.23%) and Pharma (-1.75%).

Indian rupee was fell 16 paise to 74.40 against the US dollar on Monday.

India VIX rose 17.92% to 17.52 levels.

Stock in News Today

Reliance Industries: The conglomerate’s shares plunged after the company said it has called off its agreement with Saudi Aramco. RIL and Saudi Aramco signed a non-binding Letter of Intent in August 2019 for a potential 20% stake sale in RIL’s oil-to-chemicals business to Saudi Aramco. Shares closed 4.43% lower at Rs 2363.75.

Airtel: The telecom company shares rose more than 6% in intraday trading after the company raises tariffs by 20-25% for subscribers for a range of services with effect from November 26. The company believes this will improve their Average Revenue Per User and enable significant investments in network and spectrum.

Bharat Electronics: The government-owned enterprise said it has signed a contract deal with Airbus Defence and Space for the manufacture and supply of Radar Warning Receiver (RWR) and Missile Approach Warning System. Vinay Kumar Katyal, Director of Bengaluru Complex, BEL said that the contract is the biggest export order received till date by BEL.

Paytm: Shares of the fintech continued its downward spiral after brokerage and research firm Macquaire in a second report reaffirmed its earlier price target of Rs 1200 and underperform rating. Shares closed down 12.89% at Rs 1359.60, as against its issue price of Rs 2150. The company is likely to release it quarterly results data on Saturday (November 27, 2021).

JBM Auto Ltd: Shares of the company rose over 9% to Rs 973.8, from its previous day close, in intraday trade after the company announced that its board of directors will consider a share split from face value of Rs 5 to a lower value on December 8. However, it closed at Rs 918.05 per share, below its opening price of Rs 950 apiece. JBM is a auto ancillary company engaged in business of sheet metal components, tools and dies.