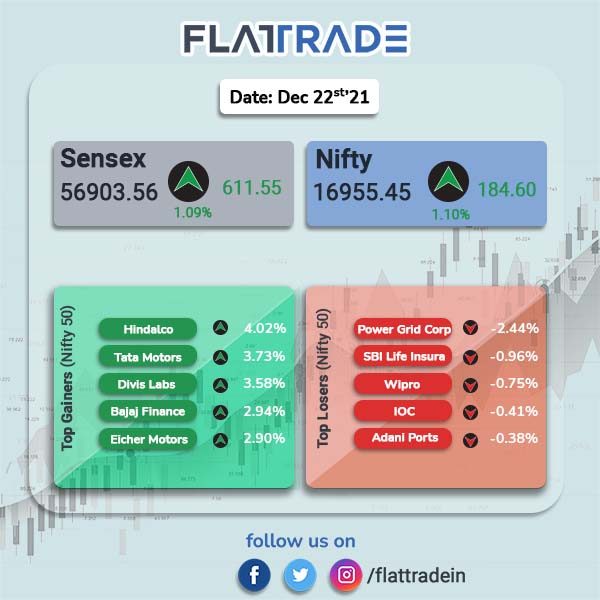

Benchmarks equity indices rose for the second day in a row, led by gains in banking, auto, metals and realty stocks. The Sensex closed 1.09% higher at 56930.56 and the Nifty closed 1.10% higher at 16955.45.

Broader markets also gained as the Nifty Midcap 100 jumped 1.55% and BSE Smallcap gained 1.66%. Nifty 500 rose 1.23%.

Top gainers in sectoral indices were Nifty Realty [2.95%], Pharma [1.99%], Metal [1.78%], PSU Bank [1.74%] and Auto [1.61%]. All other indices also closed in green.

Indian rupee rose 5 paise to 75.55 against the US dollar on Wednesday.

Stock in News Today

Reliance Industries Limited: The company’s clean energy arm is expected to receive investments from Sovereign wealth funds including Singapore’s GIC Pte, Abu Dhabi Investment Authority and UAE’s Mubadala Investment Co, Mint newspaper reported, citing two people aware of the development. An Abu Dhabi Investment Authority spokesperson declined to comment on the matter.

Larsen & Toubro Ltd: Shares of the company closed 2.4% higher after the company’s construction arm, L&T Construction, bagged a ‘significant’ order for its buildings and factories business from a reputed developer. The order is valued in the range between Rs 1,000 crore and Rs 2,500 crore. The order includes construction of one of the largest residential townships in Bengaluru and the project is expected to be completed in 42 months.

Paytm: Shares of the fintech company got a boost after two brokerages initiated coverage with a higher target price than the current market price. Morgan Stanley has initiated coverage with an overweight rating and set a target price of Rs 1875 a share. Goldman Sachs also initiated coverage with neutral rating on the stock and set a target price of Rs 1630.

Zee Entertainment Enterprises: The company’s board approved its merger agreement and terms with Sony Pictures Networks India. After the deal, Sony Pictures will own 50.86% stake in the combined entity, Essel will own 3.99% stake and other ZEEL shareholders will hold 45.15%. Punit Goenka will be the MD & CEO of the combined entity.

ABB India Ltd: Shares of the company closed 3.8% higher after the company approved the incorporation of a wholly owned subsidiary and the sale of company’s turbocharger business as a going concern, on a slump sale to its wholly owned subsidiary for Rs 310 crore. The slump sale will be completed by the end of February, 2022. The turbocharger business has a turnover of Rs 187 crore, 3% of the total turnover of the company for the financial year ending December 31, 2020.

IDFC Ltd: Shares of the company closed 7.96% higher after the company approved the appointment of Anil Singhvi as the Chairman of board of directors of the company with immediate effect. The firm also approved the proposal to seek shareholders’ nod for the appointment of Anita Belani as an additional director in the category of independent director for a period of three years and a scheme of amalgamation of IDFC Alternatives Ltd., IDFC Trustee Company Ltd. and IDFC Projects Ltd. into IDFC Ltd.

Cadila Healthcare: Shares of the drugmaker closed 2.53% higher after the company received tentative approval from U.S. FDA for Pimavanserin tablets. The drug is used to treat the symptoms of a certain mental/mood disorder that might occur with Parkinson’s disease. The drug will be produced at the company’s manufacturing facility at the SEZ, Ahmedabad.

PNC Infratech Ltd: Shares of the company closed 4% after the company received Letter of Award from NHAI for “collection of user fee at 135 km long Eastern peripheral expressway fee plazas in the states of Haryana and Uttar Pradesh for one year. The contract value of the project is Rs 369 crore.

India Cements: Shares of the company closed 5.3% after hitting an intraday high of Rs 192. 35 on the BSE as a regulatory filing showed that billionaire investor Radhakishan Damani increased his stake in the company to 22.76 percent, up from 21.14 percent at the end of September.

Macrotech Developers (Lodha): Shares of the company rose after it got positive rating from India Ratings and Research. The rating agency reaffirmed the company’s credit rating and revised the outlook to ‘positive’ from ‘stable’. The revised ratings for bank loans, non-convertible debentures and fund-based limits are IND BBB+/Positive.

Mindteck Ltd: The company in an exchange filing said that it has bagged a new project from an analytical instrument client and the project will involve tech upgrades to the data management software, database migration, feature enhancements and third-party tool integration. The company said that the Europe-based client provides precision instrumentation monitoring solutions to reduce occupational and environmental health risks.

Deepak Nitrite: Shares of the company closed 2.20% higher after its board approved raising capital upto Rs 2,000 crore through issuance of equity shares via Quatified Institutions Ptacement. share share. Firm also approved proposal to seek shareholders’ nod for planned QIP.

Central Bank of India: The public-sector lender has entered into a strategic co-lending partnership with Ugro Capital Ltd., to offer loans to MSME borrowers under priority sector. Under this partnership, the two entities aim to disburse up to Rs 1000 crore to U GRO Capital’s varied MSME segments under its programmes like Pratham, Sanjeevani, Saathi, GRO MSME and Machinery financing, in the next 12 months.

ITC Ltd: The conglomerate said that its Master Chef frozen snacks has entered into a strategic partnership with Havmor Ice Cream, owned by South Korean conglomerate Lotte group, to enhance distribution reach. The partnership will enable ITC Master Chef to leverage 100 Havmor Ice Cream carts to make available its range of 15 easy-to-cook snacks, the company said in a statement.

Metro Brands: Shares of the company rebounded and closed at Rs 493.35, slightly below its issue price. The stock listed at Rs 437 apiece, a 12.6% discount to its IPO issue price of Rs 500, on the National Stock Exchange. The stock fell to a low of Rs 426 in intraday trading.