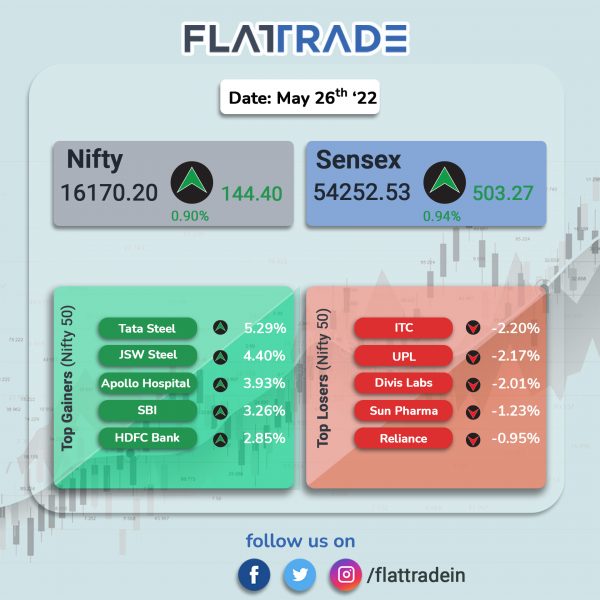

Major stock indices snapped three-day losing trend to close higher, aided by gains in banking, metal and information technology stocks. The Sensex jumped 0.94% and the Nifty was up 0.9%.

In broader markets, Nifty Midcap 100 advanced 1.35% and BSE Smallcap rose 0.78%.

Top gainers in Nifty sectoral indices were Metal [2.67%], Bank [2.2%], Financial Services [1.97%], Realty [1.4%] and IT [1.33%]. Meanwhile, FMCG fell 0.22% and Energy slipped 0.07% as Adani Green and RIL lost 1.07% and 0.95%, respectively.

Indian rupee fell 5 paise to 77.57 against the US dollar on Thursday.

Stock in News Today

Colgate-Palmolive (India) Ltd: The toothpaste maker posted a profit of Rs 323.6 crore in Q4FY22, up 2.8% from Rs 314.7 crore in the year-ago period. Its revenue rose 1.3% YoY to Rs 1300 crore in the reported quarter from 1283.2 in the year-ago period.

Page Industries: The company’s net income rose 65% at Rs 190.52 crore in Q4FY22 from Rs 115.56 crore in the year-ago period. Its revenue increased 26% YoY to Rs 1,111.11 crore as against Rs 880.77 crore in the year-ago period.

The company approved a fourth interim dividend for FY22 of Rs 70 per equity share. The record date fixed for payment of interim dividend is June 3, 2022. The payment of dividend is expected to be on or before June 24, 2022.

Bharti Airtel: Singapore-based telecom firm Singtel is in talks with Airtel chairman Sunil Mittal to sell its 2-4% stake in Airtel. Meanwhile, Ratings agency Moody’s upgraded ratings of Bharti Airtel’s senior unsecured debt from “Ba1” to “Baa3” on basis of the telco’s continued strengthening of the company’s operational metrics and stabilisation of financial profile.

Grasim Industries Ltd: The Aditya Birla group company is planning to raise upto Rs 2,000 crore through debentures to fund its capital expenditure programme. The company has lined up investment for foray into decorative paints with project cost estimated at Rs 10,000 crore by FY25.

HDFC: The mortgage lender said it has sold 10% of its stake in HDFC Capital Advisors Ltd (HCAL) to Abu Dhabi Investment Authority for Rs 184 crore.

HCL Technologies: The IT company has signed an end-to-end global digital transformation deal with Velux Group. HCL Tech will deliver a cloud-first, user-centric digital transformation program for the Velux group to modernise its applications and infrastructure landscape.Velux group is a leading Danish maker of roof windows.

RattanIndia Enterprises: The engineering company has acquired 60% stake in leading domestic drone maker Throttle Aerospace Systems. The company said it will target global markets for its drone products and services as well as reiterated plans to acquire best intellectual capital and technology available in the drone sector.

Aurobindo Pharma: The company’s subsidiary Eugia Pharma received final approval from U.S. FDA to manufacture and market Pemetrexed for injection, 100 mg, 500 mg and 1000 mg. The product is therapeutically equivalent to the RLD, Alimta for injetion, of Eli Lilly.

Sequent Scientific: Shares of the company fell 12.24% after the company reported weak results. The company’s consolidated net profit declined 56.57% YoY to Rs 8.96 crore in Q4FY22. Its revenue rose 6.05% YoY to Rs 383.71 crore in Q4FY22.

Praj Industries: The company’s consolidated revenue rose 46% to Rs 829.01 crore in Q4FY22 as against Rs 567.10 crore in the year-ago period. Its net income was up 11% to Rs 57.65 crore in the reported quarter compared with Rs 52.01 crore in the same period last year.

KPIT Technologies: The company announced the acquisition of cloud-based vehicle diagnostics specialist SOMIT solutions. The total value of the acquisition will be about Rs 75 crore. SOMIT enables after-sales operations of high tech luxury and new age OEMs through a cloud-based vehicle diagnostics platform & expert consulting services.

Kirloskar Industries: The company’s net profit declined 99.82% to Rs 12 lakhs in the quarter ended March 2022 as against Rs 67.49 crore during the same quarter ended March 2021. Sales rose 38.16% to Rs 1037.36 crore in the quarter ended March 2022 as against Rs 750.82 crore during the corresponding quarter last fiscal.