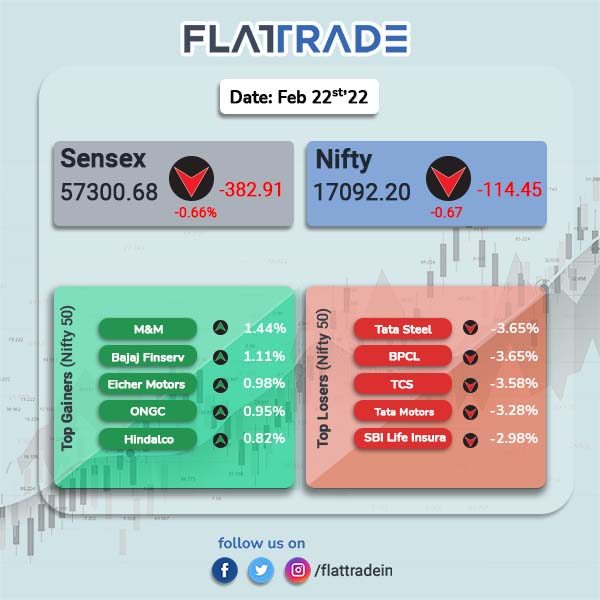

Indian equities indices recovered from early losses helped by gains in index heavyweights such a M&M, Bajaj Finserv, Eicher Motors, etc., but ended lower for a fifth consecutive day due to geopolitical tension between Russia and Ukraine. The Sensex fell 0.66% and the Nifty dropped 0.67%.

Top losers among Nifty sectoral indices were Media [-3.3%], Realty [-2.91%], PSU Bank [-1.48%], Metal [-1.11%] and IT [-0.99%]. All Nifty sectoral indices closed in the red.

Borader markets faced heavier losses than benchmark indices. Nifty Midcap 100 fell 1.02% and BSE Smallcap tanked 1.62%

Indian rupee fell 35 paise to 74.88 against the US dollar.

Stock in News Today

Tata Consultancy Services (TCS): Shares of the IT major closed 3.58% lower after its share buyback period ended today. It had approved a proposal to buy back shares worth up to Rs 18,000 crore. The company had said it will repurchase four crore shares, at Rs 4,500 apiece.

Indiabulls Real Estate Ltd: Shares of the company closed 10.23% higher after the company clarified that it is not related to the Enforcement Directorate’s investigation. “The said ED investigation did not pertain to Indiabulls Real Estate and has no bearing on the business and operations of the company,” it said in an exchange filing. Shares of the company close 10% higher.

Jet Airways: Jalan-Kalrock consortium-owned company on Tuesday announced the appointment of former SriLankan Airlines’ CEO, Vipula Gunatilleka as the Chief Financial Officer. “Vipula is an aviation expert and regarded as a turnaround specialist in the industry. He has been shortlisted after a rigorous process run by our Executive Team over the last several months,” said Ankit Jalan, Member of the Monitoring Committee of Jet Airways and part of Jalan-Kalrock Consortium.

Indiamart Intermesh: The company will buy 16.53% of the share capital (on fully diluted basis) of Fleetx Technologies. The company will invest Rs 91.42 crore in the current funding round to acquire 3,805 equity shares of face value of Rs 10 each at a price of Rs 57,315 aggregating to Rs 21.81 crore and subscription to 10,323 series B compulsorily convertible preference shares of face value of Rs 10 each at a price of Rs 67,420 aggregating to Rs 69.61 crore.

KPI Global Infrastructure: The company received a new repeat order for executing solar power project of 7.50 MWdc capacity from Anupam Rasayan India, Surat under Captive Power Producer (CPP) segment. Furthermore, KPI Global Infrastructure had already executed and commissioned 12.50 MWdc for Anupam Rasayan India in September 2021.

Marksans Pharma: The drug maker intimated that UK MHRA has granted market authorisation to the company’s wholly-owned subsidiary, Bell Sons & Co. (druggists) for Bells Healthcare All in One Oral Solution. Each 20 ml dose contains Paracetamol Ph. Eur. 500.0 mg, Guaifenesin Ph. Eur. 200.0 mg and Phenylephrine Hydrochloride Ph. Eur. 10.0 mg.