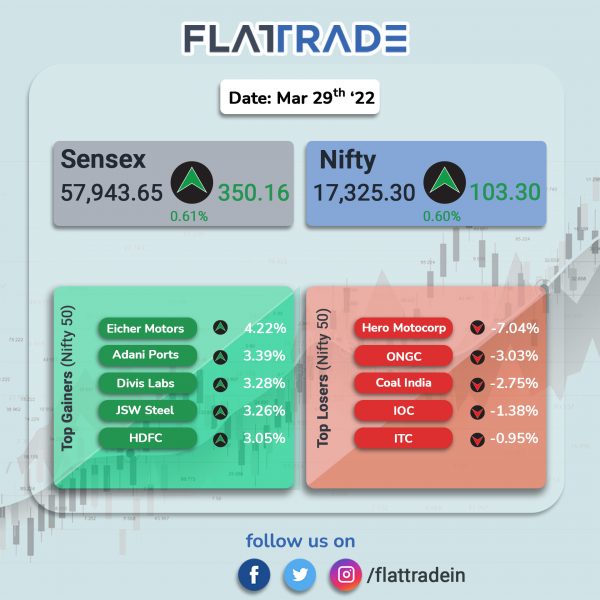

Stock indices closed higher in an extremely volatile session, boosted by gains in pharma and financial services stocks. The Sensex rose 0.61% and the Nifty gained 0.60%.

Broader indices also gained, tracking benchmark indices with the Nifty Midcap 100 advancing 0.41% and BSE Smallcap climbing 0.63%.

Top gainers among Nifty sector indices are Pharma [1.54%], Financial Services [1.01%], Realty [0.98%]. Top losers were Media [-1.22%] and PSU Bank [-0.83%].

Indian rupee rose 17 paise to 75.98 against the US dollar on Tuesday.

Stock in News Today

Hero MotoCorp: The Income Tax Department has found that the company made more than Rs 1,000 crore bogus expenses and over Rs 100- crore cash transactions for a farmhouse in Chhattarpur, Delhi, ANI news reported citing sources. The sources also said that a large number of incriminating evidence in the form of hard copy documents and digital data have been seized during the search operations. Shares of the company plunged 7.04%.

HDFC Bank and Axis Bank: The lender said it has inked an agreement to invest Rs 3 crore in the first tranche to acquire a stake in debt management company IDRCL. HDFC Bank signed a pact to invest in India Debt Resolution Company Ltd (IDRCL) by way of subscription to equity securities, the bank said in a regulatory filing.

Meanwhile, Axis Bank will buy 15% stake in India Debt Resolution Company for Rs 7.5 Crore equity investment which will be made in tranches, with the first investment of Rs 3 crore by March 31.

Alembic Pharmaceuticals: The drug firm has acquired the balance 40 per cent stake in Aleor Dermaceuticals from its joint venture partner Orbicular Pharma for an undisclosed sum. The acquisition is expected to strengthen its skin-related manufacturing and marketing footprint.

IDBI Bank: The board of directors has approved the rupee bond borrowing limit of Rs 8,000 crore for FY23 to be borrowed in one or more tranches comprising of Additional Tier-I bonds up to Rs 3,000 crore and senior/infrastructure bonds up to Rs 1,000 crore by way of private placement during FY23.

Larsen and Tourbro (L&T) and Vodafone Idea Ltd (VIL): L&T’s Smart World & Communication has partnered with Vodafone Idea to establish a use case of Private LTE enterprise network in India. Both the companies will carry out an accelerated Proof of Concept at group business L&T Heavy Engineering’s ‘A M Naik Heavy Engineering Complex’, Hazira.

Paytm: The fintech firm has appointed Anuj Mittal as Vice President, Investor Relations, according to a source close to the developments. Mittal will report to its President and Group CFO Madhur Deora.

PNC Infratech Ltd: The company has won an NHAI project to construct a six-lane, access controlled greenfield highway from Badadal to Maradgi S.Andola in Karnataka worth Rs 1,575 crore. The project is to be constructed in 30 months and operated for 15 years post construction.

Dilip Buildcon Ltd: The infrastructure company has formed a special purpose vehicle to bid for the Raipur-Vishakhapatnam highway project, according to its exchange filing. The project bid cost is Rs 1,255 crore.

Ashoka Buildcon: The company has won the bid for an NHAI project for building a highway from Baswantpur to Singondi in Madhya Pradesh under the Bharatmala Pariyojana. The quoted bid project cost is Rs.1,079 Crore and the construction period is 912 days from the appointed date.

Deep Industries Ltd: The company received an order from Oil and Natural Gas Corporation Ltd. for its gas compression services of 4.5 lakh standard cubic meter capacity per day at Linch GGS for a period of 3 years. The total estimated value of the said award is approximately Rs 71.97 crore.

Engineers India Ltd: the company has been by Bharat Oman Refineries for providing consultancy services for electrolyser-based green hydrogen plant at Bina Refinery, it said in an exchange filing. This will be one of the largest Green Hydrogen Plant in the country with a capacity of about 8.5 TPD.

Embassy Office Parks REIT Ltd: The company’s board has approved a debt financing arrangement between Embassy REIT and its investment entity, Golflinks Software Park Pvt. for up to Rs 950 crore. The funds will be utilised by Golflinks for the acquisition of the real estate business comprising of 356,733 square feet of properties within Embassy Golflinks Business Park, the acquisition of the common area maintenance business covering the entirety of the EGL Campus and for the discharge of certain existing liabilities of GLSP with respect to the above.

Goldiam International: The company has received confirmed additional export orders worth of Rs. 60 crore from its international clients for manufacturing of diamond studded gold and larger carat lab-grown diamonds jewellery.