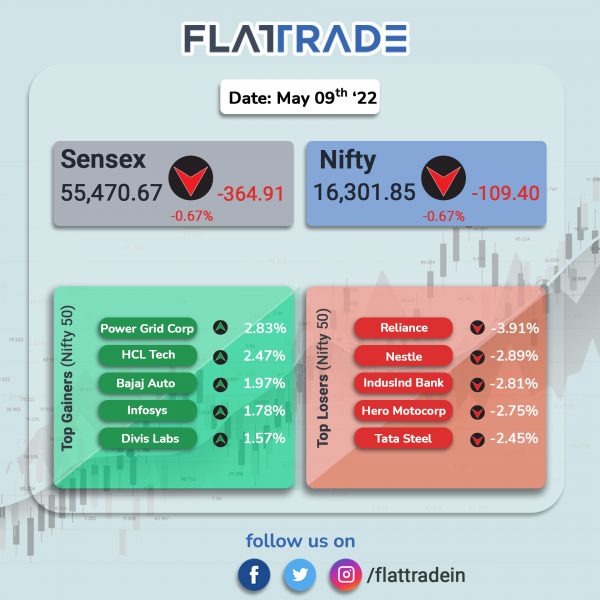

Benchmark stock indices closed lower dragged by losses in RIL, metal and public-sector bank stocks. RIL fell 4.34% during intraday after it posted lower-than-expected results as against various analysts’ estimates. The Sensex and the Nifty fell 0.67%, each.

Broader markets underperformed compared to benchmark indices. The Nifty Midcap 100 declined 1.78% and BSE SmallCap slumped 1.67%.

Top losers among Nifty sector indices were Energy [-2.71%], Media [-2.65%], PSU Bank [-2.34%], Metal [-2.03%] and FMCG [-1.47%].

Indian Rupee fell 55 paise to 77.46 against the US Dollar on Monday.

Stock in News Today

HDFC Bank: The lender has increased its marginal-cost based lending rate (MCLR) by 25 bps across all tenors. The hike across all tenors has become effective from May 7. This will result in rise in cost of house, personal and car loans.

PVR Ltd: The multiplex chain operator reported narrowing of its consolidated loss after tax at Rs 105.49 crore for the fourth quarter of FY22. The company had reported a net loss of Rs 289.12 crore in the year-ago period. Its revenue from operations surged 196.68 per cent to Rs 537.14 crore in the quarter under review as against Rs 181.46 crore in the same quarter last fiscal.

Larsen & Toubro: The company’s construction arm has won significant EPC order worth Rs 1,000 crore – Rs 2,500 crore from Water Resources Department Of Jharkhand. The order pertains to execution of Masalia Ranishwar Megalift irrigation scheme.

UPL Ltd: The speciality chemicals company’s consolidated net profit rose 30% to Rs 1,379 crore in Q4FY22, as against Rs 1,063 crore in the year-ago period. Revenue was up 24% at Rs 15,861 crore in the reported quarter, compared with Rs 12,796 crore in the corresponding quarter of last fiscal. The company has recommended a dividend of Rs 10 per equity share of face value of Rs 2 each, subject to shareholders’ approval.

Sundaram Clayton: The auto ancillary company’s consolidated revenue rose 7.18% at Rs 6,901.63 crore in Q4FY22 from Rs 6,439.57 crore in the year-ago period. The company’s net profit fell 2.19% to Rs 163.5 crore in the aurter under review compared with Rs 167.16 crore in the year-ago period. The company has appointed Lakshmi Venu as the Managing Director with effect from May 6.

Navin Fluorine: The company’s Q4FY22 consolidated net profit rose 3% YoY to Rs 75.16 crore from Rs 73.22 crore in the year-ago period. Revenue was up 22% to Rs 408.94 crore in the reported quarter, compared with Rs 336.42 crore in the corresponding quarter last fiscal.