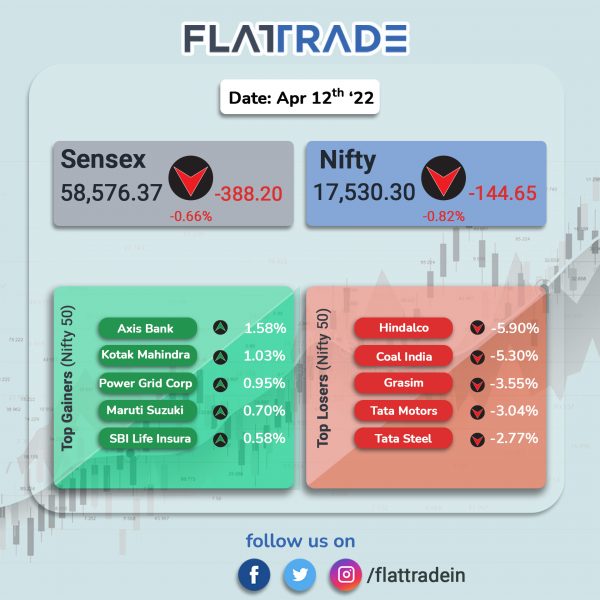

Benchmark stock indices closed lower, dragged by losses in realty, metal and IT stocks. The Sensex fell 0.66% and Nifty lost 0.82%.

The broader markets also witnessed heavy losses. The Nifty Midcap 100 tanked 1.92% and BSE SmallCap plunged 1.47%.

Top losers among Nifty sector indices were Realty [-2.76%], Metal [-2.74%], Media [-1.52%], IT [-1.48%] and PSU Bank [-1.23%]. Top gainer was Private Bank [0.46%].

Indian rupee fell 18 paise to 76.13 against the US dollar on Tuesday.

Stock in News Today

Tata Motors: The company’s global wholesales in Q4FY22, including Jaguar Land Rover (JLR), stood at at 3,34,884, 2% higher as compared to Q4FY21. Global wholesales of all Tata Motors’ commercial vehicles and Tata Daewoo range in Q4 FY22 stood at 1,22, 147, higher by 12%, over Q4 FY21. Global wholesales of all passenger vehicles in Q4 FY22 stood at 2, 12,737, falling 4% as compared to Q4 FY22. Global wholesales for Jaguar Land Rover were at 89,148 vehicles.

Indian Oil Corp (IOC): The company has excluded several high-sulphur crude grades, including Russian Urals, from its latest tender, trade sources said, according to Reuters. IOC imports crude for itself and on behalf of its Chennai Petroleum subsidiary.

Adani Green Energy (AGEL): The company jumped 4.77% after the company said its total operational capacity increased by 56% YoY to 5,410 MW in Q4 of FY2022. AGEL said its sale of energy increased by 84% YoY at 2,971 million units in Q4 FY22 as against 1,614 million units in Q4 FY21. This was backed by robust performance in both solar and wind portfolios.

Coal India Limited: State-owned company said its capital expenditure grew 12% to Rs 14,834 crore in FY22, from Rs 13,284 crore in the year-ago period. The company said its entire capital expenditure was met through internal accruals.

Info Edge (India): The company has invested about Rs 3.70 crore in associate company, Terralytics Analysis. Terralytics is engaged in the business of developing intelligence and analytics in real estate vertical for sale to banks, developers, consulting firms, etc. for diligence, information and other purposes. This investment is expected to strengthen Info Edge’s offering in the real estate segment.

Escorts Ltd: Shares of the company fell as Rakesh Jhunjhunwala pared stake in the tractor manufacturing company. In an exchange filing, Escorts reported that Rakesh Jhunjhunwala sold his 47,19,362 shares, or 3.57% equity, of Escorts in the open offer.

Sunteck Realty: The realty firm’s pre-sales jumped 36% year on year to Rs 503 crore in Q4FY22. On a sequential basis it grew 43% in the reported quarter. On a full‐year basis, the realtor had pre‐sales of Rs 1,303 crore in FY22, up 27% YoY.

Mahindra Lifespace Developers: The realtor has established a new benchmark in the field of sustainable development with the launch of India’s first Net Zero Energy residential project, Mahindra Eden, in Bengaluru. The project is certified by Indian Green Building Council (IGBC).

G M Breweries: The company’s revenue rose 11.15% year-on-year to Rs 141.94 crore in the Q4FY22. Net profit declined 11.60% to Rs 40.08 crore in the quarter ended March 2022 as against Rs 45.34 crore in the year-ago period. For the full year, net profit rose 16.57% YoY to Rs 93.36 crore. Sales rose 34.80% to Rs 458.47 crore in FY22.

Tinplate Company of India: The company’s revenue jumped 59.20% to Rs 1106.08 crore. Net profit rose 103.74% to Rs 114.42 crore in the quarter ended March 2022 as against Rs 56.16 crore in the year-ago period. For the full year, net profit rose 259.56% to Rs 352.91 crore in FY22. Sales rose 83.47% to Rs 3861.48 crore in FY22.