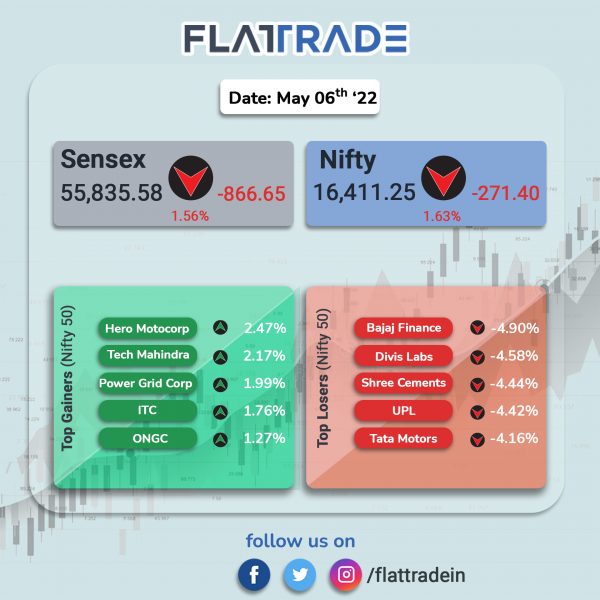

Dalal Street tanked as investors were worried over high inflation levels, lower-than-expected earnings by companies, probable contraction in economic growth and weak global sentiments. The Sensex slumped 1.56% and the Nifty tumbled 1.63%.

The Nifty Midcap 100 declined 1.79% and BSE SmallCap plummeted 2.1%.

Top losers among Nifty sectoral indices were Realty [-3.56%], IT [-2.27%], Financial Services [-2.25%], Private Bank [-2.18%] and Metal [-2.11%].

Indian Rupee nosedived 66 paise to 76.91 against the US Dollar on Friday.

Stock in News Today

Canara Bank: The state-owned lender reported a 65 per cent jump in its standalone net profit at Rs 1,666.22 crore for fourth quarter ended March 2022. It had posted a net profit of Rs 1,010.87 crore in the same quarter a year ago. Total income of the bank in the reported quarter rose to Rs 22,323.11 crore, from Rs 21,040.63 crore in the year-ago period. Net NPA improved to 2.65 per cent in the quarter under review, from 3.82 per cent in the corresponding period last year.

Federal Bank: The lender’s consolidated net profit rose 12.72% to Rs 587.54 crore in Q4FY22 as against Rs 521.24 crore in the same quarter of FY21. Its consolidated total operating income rose 4.85% to Rs 3686.30 crore in the quarter ended March 2022 as against Rs 3515.86 crore during the previous quarter ended March 2021.

Mahindra Group: The conglomerate has begun a restructuring process to split its automobiles business into three separate units, the Economic Times reported. The restructuring is aimed at splitting the auto operations into electric vehicle (EV), tractor and passenger vehicle businesses via a demerger process, the newspaper reported, citing sources.

ITC Ltd: Shares of the company rose 2.6% amid expectations of healthy earnings during the fourth quarter of FY22 and announcement of dividend.

Voltas: Shares of the company fell more than 9.7% in intraday trading after it posted weak earnings. Its consolidated revenue inched up 0.56% to Rs 2,666.58 crore in Q4FY22 compared with Rs 2,651.66 crore in the year-ago period. Its net profit fell 23.15% to Rs 182.7 crore in the reported quarter from Rs 237.73 crore in the same period last year. The company’s board recommended a dividend of Rs 5.5 per share of face value of Rs 1 each.

Zydus Lifesciences: The drug maker has received a tentative approval from the U.S. drug regulator to market Selexipag tablets in specific strengths. The drug is used to treat adult patients with pulmonary arterial hypertension and the tablet will be manufactured at its Ahmedabad facility.

Solar Industries: The company has secured orders worth Rs 1,563 crore from Singareni Collieries Company. The order pertains to the supply of SME explosives, LDC explosives and accessories for blasting of OB, to be delivered over a period of two years.

Happiest Minds Technologies: The IT firm’s consolidated net profit surged to 44.5% YoY to Rs 52.11 crore in Q4FY22 and its net sales increased 36.2% to Rs 300.57 crore in Q4FY22 over Q4FY21. The company’s board recommended a final dividend of Rs 2 of face value of Rs 2 each. Shares of the company ended nealy 2% higher.

SJVN: The company has bagged its first ever 30 MW Wind-Solar Hybrid project through a tender floated by Solar Energy Corporation of India (SECT). The project was bagged @ Rs.2.54/Unit on Build, Own and Operate basis in the Tariff based competitive bidding process.

Ratnamani Metals & Tubes: The company announced that it has received new domestic orders aggregating to Rs 206 crore, expected to be executed within the FY23.