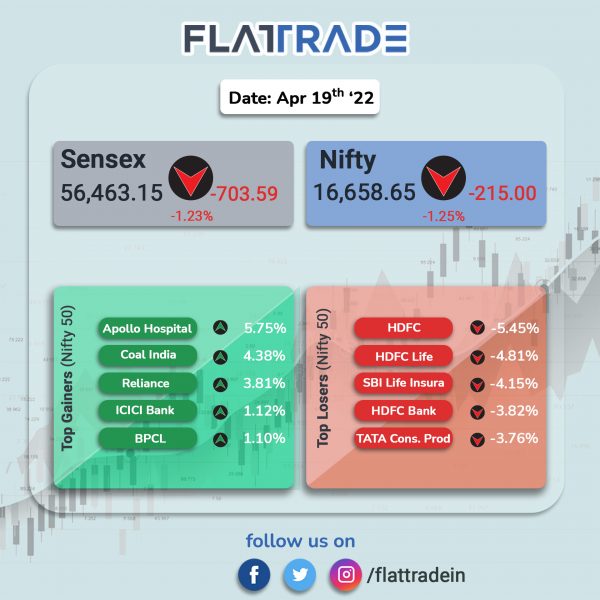

Dalal Street fell in a sudden sell-off amid a volatile session. Domestic and global sentiments were dampened as the war between Russia and Ukraine intensified. Technology, FMCG and financial stocks were the biggest laggards. The Sensex tanked 1.23% and Nifty fell 1.25%. Nifty breached the psychological mark of 17,000 to close at 16,958.65.

In the broader markets, the Nifty Midcap 100 plunged 1.37% and BSE SmallCap fell 1.21%.

Top losers among Nifty sector indices were IT [-2.98%], FMCG [-2.82%], Realty [-2.47%], Media [-1.92%], Financial Services [-1.91%].

Indian rupee fell 25 paise to 76.50 against the US dollar on Tuesday.

Stock in News Today

Coal India Ltd (CIL): The company said it has increased its supplies by 14.2 per cent to coal-based electricity generating plants in the first half of the current month, but soaring power demand due to hotter-than-normal summer seems to have dwarfed the upsurge in supplies. CIL said that it is coordinating with the ministries of coal, power and railways to build up stocks at power plants.

Reliance Industries Ltd (RIL) and Zee Entertainment (ZEEL): Both the companies are among the firms that have signalled an intention to bid for broadcast rights of the IPL between 2023 and 2027, Bloomberg reported. Other companies include Amazon, The Walt Disney Co, Sony Group Corp, and fantasy-sports platform Dream11. BCCI will conduct the online auction starting June 12 to select winner/winners to globally telecast matches of IPL between 2023 and 2027.

Tata Consultancy Services (TCS): The IT company has announced it has expanded its partnership with The IRONMAN Group Oceania in a multi-year deal, for Sun-Herald City2Surf, the world’s largest fun run. TCS will continue to power the official event app, enhancing the fun run experience with live results tracking and leader board data. It will also include custom City2Surf selfie frames and a personalised race-ready checklist.

IndiGo: The budget carrier and Qatar Airways said that they are reactivating their codeshare partnership following India’s decision to resume regular international passenger flights from March 27. IndiGo has codeshare partnerships with Turkish Airlines, Qatar Airways and American Airlines.

State Bank of India (SBI): The largest lender has raised its marginal cost of funds based lending rate (MCLR) by 10 basis points (bps) or 0.1 per cent across all tenures. This will lead to an increase in EMIs for borrowers. The revised MCLR rate is effective from April 15, according to SBI.

ONGC: The public-sector company approved the appointment of Pomila Jaspal as Director (Finance) and Chief Financial Officer of the company with immediate effect. Pomila Jaspal has 36 years experience across varied segments of oil & gas industry.

Nazara Technologies: The company’s subsidiary, Nodwin Gaming, in a board meeting has approved the acquisition of 35% of the paid up share capital of Brandscale Innovations by way of subscription to 567 equity shares having a face value of Rs 100/- each of Brandscale Innovations for a total consideration of Rs 10 crore.

Poonawalla Fincorp: The financial services company has entered digital consumption loans space through a tie up with KrazyBee. Under this partnership, Poonawalla Fincorp will offer small ticket personal loans to individuals. Poonawalla Fincorp focusses on consumer and small business finance as a part of its stated strategy.

AU Small Finance Bank: The lender’s board will consider a bonus share issue on April 26. The board will also consider Q4FY22 results and recommend dividend for the financial year ended 31 March 2022.

Rail Vikas Nigam Ltd (RVNL): The company has entered into an agreement with Mahanadi Coalfields Limited (MCL), a subsidiary of Coal India, for entrusting project management consultancy for rail infrastructure works of MCL to RVNL from concept to commissioning.

Indraprastha Gas (IGL): The company said that it has received an approval from Petroleum and Natural Gas Regulatory Board for setting up city gas distribution network in Banda, Chitrakoot and Mahoba districts in Uttar Pradesh.

Mishtann Foods: The company reported a higher standalone net profit of Rs 13.15 crore in Q4FY22 as against Rs 0.35 crore in Q4FY21. Revenue from operations increased nearly 46% to Rs 153.47 crore in Q4FY22 from Rs 105.18 crore in Q4FY21.

Ajmera Realty & Infra: The company said it plans to launch six projects during the FY23 & FY24, which will have has a revenue potential of about Rs 4,000 crore. The funding for all these new projects to launch will be via a mix of internal accruals, bank funding and sales advances. The developer will be launching 5 new projects in Mumbai and 1 new project in Pune.

Patel Engineering: The company has said that it has bagged a contract worth Rs 419.70 crore from the Municipal Corporation of Greater Mumbai (MCGM). Under the contract, it will construct a tunnel from Powai to Ghatkopar high-level reservoir and further up to Ghatkopar low-level reservoir.

Pennar Industries: The company bagged orders worth Rs 498 crore across its various business verticals, according to its exchange filing. The orders are expected to be executed within the next two quarters.