Market Opening - An Overview

SGX Nifty futures 0.6% higher at 17,030, signalling that Dalal Street was headed for a positive start on Wednesday.

Japanese markets were trading higher, tracking the US markets, which rose on better-than-expected housing starts numbers and earnings. Nikkei 225 was up 0.57% and Topix rose 0.75%. Chinese markets were trading lower on fresh coronavirus challenges. Hang Seng was 0.26% down and CSI 300 fell 0.76%.

Indian rupee fell 25 paise to 76.50 against the US dollar on Tuesday.

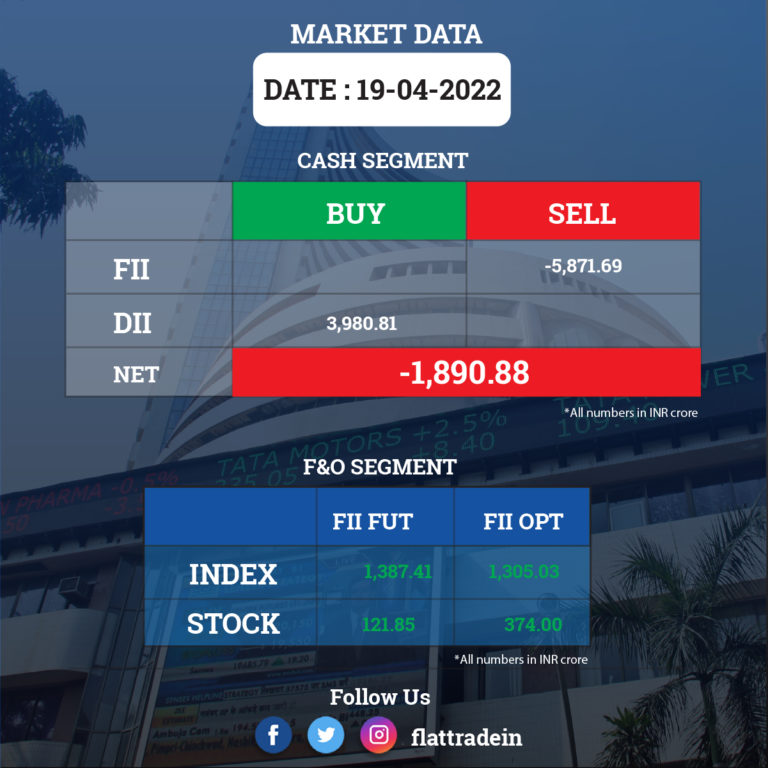

FII/DII Trading Data (19-4-2022)

Upcoming Results

Tata Elxsi, ICICI Securities, Angel One, Glenmark Life Sciences, JTL Infra, Reliance Industrial Infrastructure, Ellora Trading, HCKK Ventures, Indbank Merchant Banking Services, and Ind Bank Housing.

Stocks in News Today

ACC: The company posted a 29.5 percent decline in consolidated net profit to Rs 396.33 crore for the first quarter ended March 2022, mainly due to the rise in fuel cost. It had posted a profit of Rs 562.59 crore a year ago. Its total revenue from operations during the quarter under review increased 3.13 percent to Rs 4,426.54 crore against Rs 4,291.97 crore in the year-ago period. The company follows January-December financial year.

Larsen & Toubro Infotech: The IT services company registered a 4.1 percent sequential growth and 16.8% YoY in consolidated profit at Rs 637.5 crore led by higher other income. Revenue from operations grew by 4 percent QoQ and 31.6 percent YoY to Rs 4,301.6 crore in Q4FY22. The company won 4 large deals with net new total contract value of over $80 million. The dividend for financial year 2021-22 was Rs 30 per share.

Reliance Industries Ltd (RIL): The company’s telecom arm Jio waived entry fee and installation charges for new customers opting for postpaid Jiofiber connections to strengthen its position in the segment. The company has also introduced monthly plans for JioFiber postpaid customers and given an option to subscribers of low-value plans to pay Rs 100 for availing access to six entertainment apps.

Meanwhile, Reliance Jio lost over 3.6 million mobile subscribers and its total customer base stood at 402.7 million. Vodafone Idea lost over 1.5 million subscribers and its customer count slipped to 263.5 million. Airtel added 1.59 million new users and its customer count increased to 358 million.

In other news, Reliance Brands Limited, a subsidiary of Reliance Retail Ventures Ltd, announced it has signed a definitive agreement to invest in couturiers Abu Jani Sandeep Khosla (AJSK) for a 51 per cent majority stake.

Mastek: The company posted 16.5 percent growth in Q4FY22 consolidated net profit at Rs 88.23 crore, as against Rs 75.71 crore in Q4FY21. Total income was up 23.2 percent YoY at Rs 599.46 crore from Rs 486.45 crore in the same period.

Tata Steel Long Products: The company’s Q4 net profit plunged 82.5 percent to Rs 59.62 crore for the quarter ended March 2022 as against Rs 339.85 crore in the year ago period, due to steep rise in input costs. Total income was up 16.7 percent YoY at Rs 1,823.67 crore from Rs 1,562.21 crore.

PCBL: The company reported a 29.1 percent decline in Q4FY22 net profit at Rs 90.27 crore when compared with Rs 127.38 crore in Q4FY21. Total income surged 40.3 per cent to Rs 1,230.52 crore from Rs 877.32 crore.

HDFC: The mortgage lender Tuesday divested 1 per cent stake in real estate company Ansal Housing & Construction Ltd through an open market transaction. HDFC sold 5,74,726 shares of Ansal at an average price of Rs 8.47 apiece, valuing the transaction at Rs 48.67 lakh.

Punjab & Sind Bank: The company in a regulatory filing said that two NPA accounts, SREI Infrastructure Finance with outstanding dues of Rs 510.16 crore and SREI Equipment Finance with outstanding dues of Rs 724.18 crore, have been declared as fraud. The bank has reported the same frauds to the RBI. Further, the accounts have been fully provided for.

Future Enterprises Ltd (FEL): The debt-ridden company said it has defaulted on payment of Rs 29.33 crore as interest on non-convertible debentures (NCDs). The due date for payment was April 18, 2022, it said in a regulatory filing. This is the third default by the Kishore Biyani-led Future group firm this month.

Mahindra Lifespace Developers: The company’s subsidiary, Mahindra World City Developers, has received a Rs 102 crore income tax notice. The amount included interest of Rs 43.1 crore against the return of income filed for the assessment year 2016-17 by Mahindra World.

Kolte-Patil Developers Ltd: The realty firm said its sales bookings rose 45 per cent to a record Rs 1,739 crore during the last fiscal year on higher volumes and average price realisation. Its sales bookings stood at Rs 1,201 crore in the 2020-21 financial year. In terms of sales volumes, the company sold 2.71 million square feet in FY22 from 2.08 million square feet in the previous year.