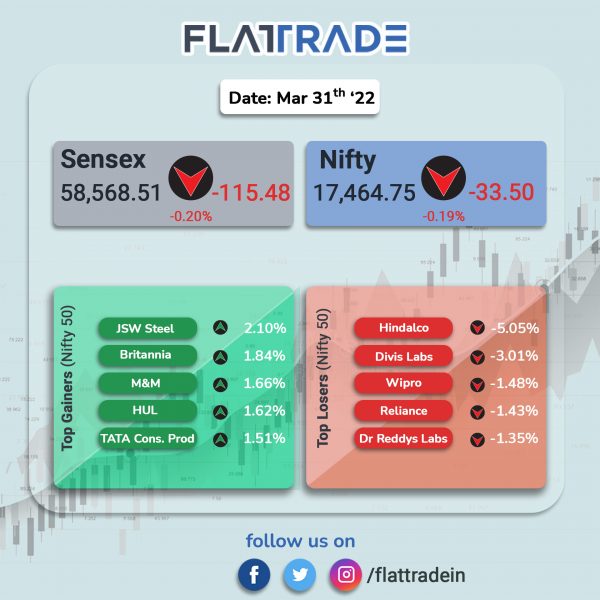

Key stock indices swung between gains and losses, and closed lower due to muted global cues and geopolitical tensions. Investors optimism waned as there was no progress in peace talks between Russia and Ukraine. RIL and pharma stocks weighed on the indices. The Sensex slipped 0.2% and the Nifty fell 0.19%.

Broader indices outperformed benchmark indices. The Nifty Midcap 100 advanced 0.34% and BSE Smallcap rose 0.31%.

Top losers among Nifty sector indices were Pharma [-1.17%], PSU Bank [-0.77%], IT [-0.40%]. Top gainers were FMCG [1.2%], Private Bank [0.29%] and Realty [0.26%].

Indian rupee rose 12 paise to 75.79 against the US dollar on Thursday.

Stock in News Today

Reliance Industries Limited (RIL): The company’s retail arm has privately defended an abrupt takeover of the stores of debt-laden rival Future Retail, saying mounting dues of $634 million compelled it to act beyond expectations, a company letter shows, according to Reuters news report. The company has said that the takeover was significant steps to ensure business continuity at Future and make sure there was no impediment to their deal.

Hindalco Industries Ltd: The company will spend as much as $7.2 billion to expand its aluminium business over the next five years, as global supply shortages and strong demand prospects push prices toward unprecedented levels, Bloomberg reported.

It has set aside about $2.4 billion for its Indian aluminium operations during the five years ending March 2027 as it expects consumption to double in the next decade, it said in an investor presentation. Unit Novelis, its subsidiary, will invest as much as $4.8 billion in the U.S., Brazil, Asia and Germany during the period.

IIFL Wealth Management: America-based private equity firm Bain Capital will acquire a 24.98% equity stake in IIFL Wealth Management from General Atlantic Singapore and FIH Mauritius, which is owned by Indian-Canadian billionaire Prem Watsa’s company Fairfax. Bain will acquire 22.15 million shares at Rs1,666 apiece amounting to nearly Rs 3,700 crore.

Tata Motors: The company’s subsidiary Jaguar Land Rover (JLR) said that it has committed to cut 46% greenhouse gas emissions across its operations by 2030. In addition, JLR will reduce average vehicle emissions across its value chains by 54%, including a 60% reduction throughout the use phase of its vehicles.

Hindustan Zinc: The company has approved a proposal to enter long term group captive Renewable Power development plan to a capacity of 200 Megawatt. It will invest Rs 350 crore for 26% in Green Power SPV. The project will be built under Group Captive norms, under a Special Purpose Vehicle. This SPV is expected to deliver power within 24 months of signing of Power Delivery Agreement (PDA).

SpiceJet: The low-cost domestic carrier and Credit Suisse AG have reached an in-principle commercial settlement of the dispute and the process of documentation is underway.

Meanwhile, the Supreme Court asked Spicejet and Kalanithi Maran to amicably settle the share transfer dispute.

Larsen & Toubro Limited (L&T): The engineering conglomerate has appointed former Chief Executive Officer of Citibank India Pramit Jhaveri as independent director. He has been appointed for a period of five years with effect from April 1, 2022, L&T said.

Dhanlaxmi Bank: Shares of the bank closed 4.2% higher after the lender received ‘in-principle’ approval from Reserve Bank of India for opening 20 new branches and one administrative office. The bank plans to open the 20 branches in Kerala (7), Tamil Nadu (4), Karnataka (3), Andhra Pradesh (3), Telangana (2) and Pondicherry (1), during FY23.

Mahindra & Mahindra Ltd: The company has increased its stake in ReNew Sunlight Energy from 31.2% to 37.2%, according to its exchange filing. The company acquired the shares for a total amount of Rs 16.07 crore. ReNew Sunlight will build, own and operate captive solar power plant with capacity of 58 Megawatt (peak) to generate 100 million units and supply it to Mahindra & Mahindra.

Hindustan Aeronautics Ltd: Shares of the company rose 5.72% a day after the Indian government approved the procurement of 15 Light Combat Helicopters from the company for Rs 3,887 crore.

Bharti Airtel and Tech Mahindra: Airtel has announced strategic partnership with Tech Mahindra to co-develop and market 5G use cases in India.The two companies will set up a joint 5G innovation lab for developing ‘Make in India’ use cases for Indian and global markets. The companies will also offer secure Cloud and Content Delivery Network solution for businesses.

GAIL India: Shares of the company closed higher after the company approved buyback of about 5.7 crore shares of face value of Rs 10, representing 1.28%, at Rs 190 per share, for an aggregate value of Rs 1,082.72 crore. GAIL has sets April 22 as the record date for eligibility of shareholders for buyback.

Ashoka Buildcon: The infrastructure company has received a Letter of Award from National Highways Authority of India for development of lane access controlled greenfield highway under Bharatmala programme. The bid project cost stood at is Rs 1,079 crore. The construction is expected to be completed within 912 days from the appointed date. The operation period is 15 years from the commercial operation date.